Portfolio management is a fundamental innovation capability used to dynamically plan, align, and optimize innovation investments. It serves as the primary link between innovation strategy and project execution, providing corporate and business unit leaders with the insight, analytics, and visibility to improve decision making for funding the right mix of projects across all growth horizons.

When performing well, portfolio management discipline:

- Ensures alignment between strategy and funded projects in the innovation pipeline

- Optimizes resource loading for priority projects to maximum value creation

- Explores alternative scenarios to optimize investment within and across opportunity areas

- Establishes clear project priorities for maximum development throughput

- Ensures appropriate balance of projects by innovation type, strategic bucket, geography, and risk profile

Portfolio review – dynamic decisions, not status

The portfolio review, when operating effectively, is a decision-making forum designed to confirm adherence to portfolio objectives while making periodic corrections or adjustments based on changing market conditions, project variances, strategic pivots, or other significant new information gained between annual planning cycles. In other words, portfolio management is a dynamic process.

Unfortunately, in most companies, portfolio reviews more closely resemble project status meetings where project teams are paraded in front of senior leaders, providing schedule updates and presenting red/yellow/green issue logs while executives pepper project teams with questions and tinker with tactical project details.

To make matters worse, these same companies use their annual budgeting process as the sole mechanism to fund and prioritize development projects. Annual planning is not a substitute for portfolio management.

Markets, technologies, customer buying behaviors, and competitors change too quickly. In most industries, a quarterly review cycle is needed to revisit investment priorities and reallocate resources.

How do you avoid these common traps? Here are four practical and easy to implement tips:

1. Separate analysis from decision making

Establish a business-minded portfolio analysis team to separate data capture and analysis “pre-work” from the decision-making forum. The portfolio analysis team’s responsibilities include:

- Validating project data submitted by project teams

- Conducting portfolio analysis and resource “what if” scenarios

- Recommending project priorities to the decision-making team

- Communicating portfolio review decisions to the organization

- Tracking market and industry developments to validate portfolio planning assumptions

When reliable data is analyzed, summarized clearly in agreed-upon set of charts, and proposed recommendations are formulated in advance, the portfolio governance team can utilize the portfolio review to focus on decision-making. The portfolio governance team is the small group of leaders ultimately responsible for the business unit P&L. Their responsibilities include:

- Defining strategic investment buckets and allocating budgets across growth horizons

- Aligning the portfolio to innovation strategy and confirming project priorities accordingly

- Tracking progress of the portfolio versus defined portfolio objectives

- Determining top-priority projects and their key investment milestones

- Addressing longer-term capability and resourcing needs

2. Take a pause to reinforce review objectives

Start the portfolio review with a discussion of the meeting objectives before jumping into the analysis. If leaders feel uncomfortable or out of touch with project specifics, remind them that there are other forums more appropriate for staying current on project status, namely functional meetings, project dashboards, phase gate reviews (core business), and new growth project funding reviews.

The gated development process, used to manage core business projects, was originally designed to give senior management a window into projects at key investment milestones while empowering accountable project teams to execute between the gates. If you feel a need for more frequent status updates, then this is likely the symptom of a larger problem.

In this case, ask yourself why, as an executive, you feel the need to tinker in project details. Is there a skill set issue on the team? Are there cultural challenges around empowerment and accountability?

Do you need to provide teams with escalation guidelines (guard rails or variance limits that trigger interim reviews when agreed-upon project performance parameters like schedule, budget, and product cost are exceeded)?

3. Separate portfolio reviews from phase reviews and new growth project funding reviews:

The objective of a phase or stage gate review in the core business is different from a portfolio review. The objective of a phase review is to make an individual project go/no-go business decision at a predefined investment milestone.

These reviews are conducted from a business perspective and provide the governance team with the appropriate information to determine if the project should continue to the next phase, get redirected, or cancelled. When making the go/no-go project decision, it is important that portfolio objectives and relative project priorities are well understood.

Funding and staffing a project for its next phase may mean something else in the portfolio gets cancelled or outsourced to free up resources needed to ensure the success of a higher value project.

New growth project funding also happens outside of the portfolio review occurring at the completion of evidence-based learning cycles. The focus is on the individual initiative. A separate forum is recommended when managing the entire portfolio.

4. Separate portfolio reviews from annual planning

While annual planning is not a substitute for portfolio reviews, it plays a valuable role in connecting “top-down” business unit and functional strategies and budgets to “bottom-up” portfolio plans and objectives.

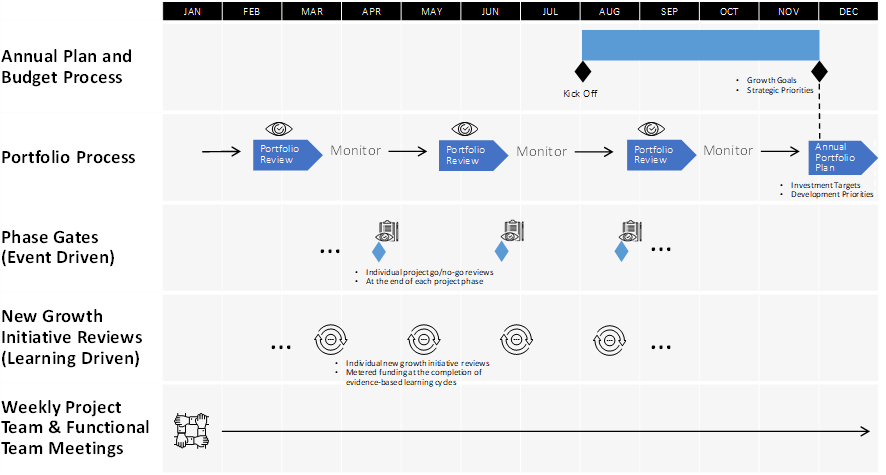

Outcomes from the annual planning process include alignment around and confirmation of the innovation strategy, investment targets, portfolio objectives, and development priorities. The calendar graphic below shows a typical cadence that ties annual operations planning to quarterly portfolio reviews and project-level decision-making.

Questions to address at your next portfolio review

Once your decision team is aligned on portfolio review objectives, your analysis team has crunched the numbers and prepared proposed recommendations for course correction, and you are up to speed on product line plans, you are ready for the portfolio review.

The following list will give you an idea of types of questions that are appropriate for a portfolio review. These questions are designed to trigger the right discussions and, ultimately, actionable decisions to adjust investment allocation, to confirm project priorities, and to enable execution activity needed to achieve growth goals.

Whether you choose from this list or come up with your own, the agenda topics and questions should be tailored to fit your unique portfolio review objectives and desired outcomes.

Strategy Alignment:

- Does the portfolio align to our corporate and business unit innovation strategy?

- How much technical and market risk is there in the portfolio? Are we comfortable with this?

Investment allocation:

- Does our current portfolio represent the desired mix across derivative, new, and platform projects? Across growth horizons (H1, H2, H3)? Across business units and/or product lines?

- Are we making sufficient investment in feasibility/exploratory work (new sources of growth)?

Financial Reward:

- Does the portfolio’s expected revenue (risk adjusted) match our near-term and long-term revenue plans?

- Does the portfolio provide a rate of return consistent with our goals and corporate thresholds?

Customer and Market Needs:

- How does the portfolio address critical, unmet customer needs in our target opportunity areas? Are there any major gaps that can be addressed with existing, improved, or altogether new product and service offerings?

- Are there any new disruptive threats or “weak signals” coming from our target markets? Are there white space opportunities that are not being addressed?

Execution:

- Are there sufficient resources to deliver the current list of approved projects?

- Are there any major development project pipeline gaps that could lead to a disruption of the flow of new products entering the market?

- Are there opportunities we should accelerate/decelerate/kill or reassign resources?

- Are our new growth initiatives progressing toward product/market fit with sufficient evidence-based learning? Are we taking the necessary steps to de-risk these initiatives? Are there opportunity areas where we should accelerate funding for lean experimentation?

- What is the impact on the overall portfolio if we load new proposed projects? What are the implications on resources and available competences?

- Have we clearly defined and communicated core and new growth innovation priorities?

The output from the portfolio review includes documented, actionable decisions that clarify linkages between innovation investment allocation and the execution activity needed to produce results. Once these decisions are captured, they are communicated to project teams and the broader organization.

Portfolio hierarchy in large corporations

In global, multi-billion-dollar companies, some with business units that would make the Fortune 500 list, it is important to distinguish between corporate portfolios (collections of business units), business unit portfolios (collections of new growth initiatives and core business projects), and product lines (platform, brand, or franchise derivatives or line extensions).

Each tier in this corporate hierarchy has its own unique governance mechanisms with different decision objectives and decision-makers. When operating at this scale, I advise my clients to manage the project portfolio at the level in which project resource allocation decisions are made. This is most likely going to be at the business unit level.

While this “rule of thumb” works for most large corporations, it is important to understand the role corporate portfolio management plays in the layer “above” the business unit and the role product line management plays in the layer “below”.

Corporate portfolio management

At the corporate level, executives are responsible for managing innovation across a portfolio of business units and, for those with a centralized, corporate-funded innovation model, overseeing new growth initiatives and acquisitions.

The corporate governance team establishes company-wide business strategy, tracks and monitors aggregate portfolio performance, and ensures that each business unit is playing its proper role in the execution of business strategy.

Performance metrics reflect company-wide effectiveness of core and new growth innovation efforts with broad-based measures like return on R&D spending, new product revenue contribution, progress toward new growth sources, and ultimately, growth from innovation.

Corporate leaders must also monitor the life cycle cadence of the aggregate core business to ensure replenishment as core platforms and product lines reach the end of their life cycles and need to be replaced with new growth sources while, at the same time, avoiding portfolio gaps that leave them exposed.

For those with a centralized new growth innovation model, the corporate governance team establishes areas of focus, sets opportunity size guidelines, sets customer development guard rails to protect core assets, and provides a “safe space” for innovation teams.

Funding for new growth initiatives more closely resembles a venture-model, occurring in metered tranches based on the achievement of evidence-based learning objectives.

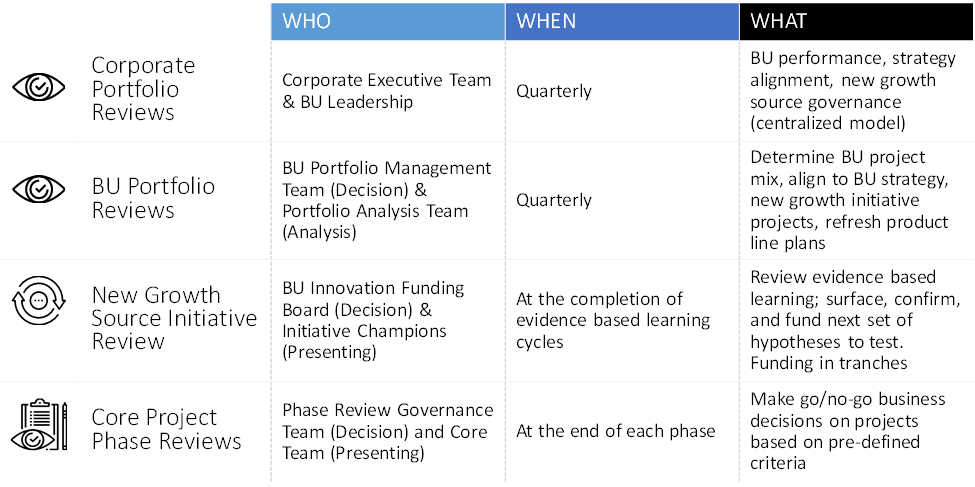

The following chart summarizes the differences between corporate and business unit portfolio reviews, new growth initiative reviews, and project phase reviews.

Product line management

Product line management addresses the type and sequence of products necessary to optimize positioning and value creation in a target market. Successful product lines are built off a platform with a defensible basis for differentiation such as a proprietary technology or unique, hard-to-replicate business model.

One of the primary roles of the product line manager is to determine the priority, sequence, and timing of product releases. These decisions are best captured in a product line roadmap, a time-phased plan that links market-need windows to successive product generations or releases, which in turn are linked to enabling technologies.

It is not uncommon to have multiple product lines within a business unit portfolio. In this case, you should consider incorporating product line strategy refresh decisions into your portfolio review.

Conclusion

C.R. Bard, a $3.7 billion, global, medical device company, listed by Forbes in 2017 as one of the “world’s most innovative companies” before being acquired by Becton Dickinson last December, has successfully implemented portfolio management discipline across a large, geographically dispersed corporate structure. John DeFord, CR Bard’s senior vice president of science, technology & clinical affairs (now BD’s CTO) throughout the transformation, describes the benefits this way:

“Five years ago, we set out to improve our portfolio management discipline throughout the Bard organization. Our primary goal was to arm each business unit with the processes and tools to manage and shape their R&D portfolios while also giving corporate leadership the visibility necessary to ensure ongoing alignment with our corporate goals and growth objectives.”

C.R. Bard’s results over this period speak for themselves with market cap growth of over 4X.

Gated development processes have been around for over 25 years and have proven effective in managing core business new product development. Over the last several years, design thinking and lean startup have emerged as the predominant approaches for new growth innovation.

Companies now have a methodology and growing toolset appropriate for discovering, incubating, and scaling new, disruptive sources of growth. However, they are also realizing that they cannot simply train the masses and roll out stage gate and lean innovation approaches alone.

Leading companies are realizing that embedding these approaches in a large enterprise requires careful integration within a broader innovation system that links strategy to funded projects, optimizes resource loading across multiple growth horizons, and balances short term safe investment with longer-term, high risk, high reward investments—governed effectively and enacted with decision-oriented portfolio reviews.

About the author:

Noel Sobelman is a researcher, writer, and corporate advisor on innovation effectiveness. His experience includes senior-level corporate roles, new venture creation, and executive advisory. He is widely recognized for bringing a practical and applicable approach to companies looking to accelerate growth from innovation.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured, Innovation, Strategy