In part 2 of this series of 3 articles, we explored the key seller considerations when disposing of a portfolio / book of business. This culminated in an action / consideration list, including the following:

- Create the ‘Sale Story’

- Establish a Minimum Valuation

- Identify Potential Buyers

- Conduct Vendor Due Diligence

- Establish Deal Structure & Process

- Plan for Separation and Integration

We now turn to the key buyer considerations which have become increasingly important in the current environment as financial institutions look to achieve balance sheet equilibrium by inorganic means.

Whilst a number of the seller considerations above can apply equally to the buyer, specific considerations for those looking to buy a portfolio / book of business include:

- Rationale for the Acquisition

- Integration Planning

- Quality of / Access to Due Diligence Information

- Valuation Methodology

We will now look at each of these in more detail.

1. Rationale for the Acquisition

What are the reasons for acquiring the portfolio? What are the business objectives? How does it fit with the overall strategy of the organisation? Will the acquisition build additional complexity into the strategic growth plans?

Buyers must be very clear on both the commercial and strategic benefits and drawbacks of buying a book of business / portfolio. Sometimes there is simply a cheap deal to do but mostly businesses are looking to acquire to achieve:

- Increased scale

- Access to new customers and markets

- Cross-selling opportunities

- Cost of capital advantages (particularly if the buyer’s cost of funds is lower than the seller’s)

2. Integration Planning

Key questions include:

- How will we integrate the acquisition into our business?

- Should we integrate it?

- How will we on-board the book?

- Do we want the book to be held at arms-length or become a core proposition component?

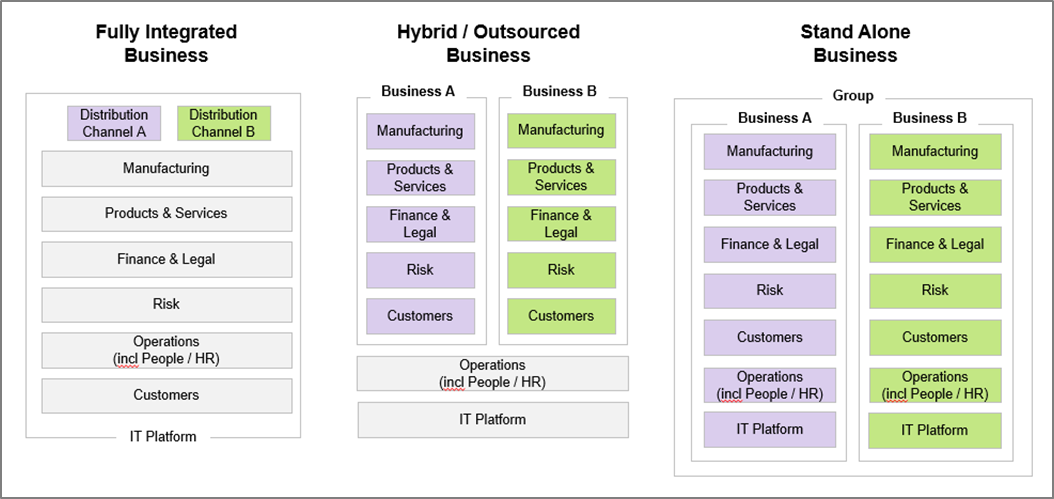

The rationale for the acquisition (point 1 above) predominately informs the answers to these integration planning questions. If it was simply a cheap revenue purchase then the book will probably be held at arms-length. However, if it fits with the strategic direction of the organisation then full or hybrid integration is more likely (see our example diagram below). This will require the business to consider their operating model design and more complex integration requirements surrounding IT, servicing and proposition/product maintenance.

The buyer needs to factor operational as well financial due diligence considerations into the acquisition price and plan if they are to avoid incurring unexpected additional costs and adding unnecessary complexity into the operation.

3. Quality of / Access to Due Diligence Information

As an example, Data Protection Act regulations can have a significant impact on the due diligence process, notably for consumer portfolio acquisitions, as customer files will often contain sensitive items such as names, addresses, bank statements, pay slips etc. This is particularly relevant in light of GDPR, which came into force in May 2018.

In order to reduce the risk of infringing Data Protection laws, a seller may redact customer files to the point where the buyer cannot perform any meaningful due diligence.

It is, therefore, essential that both the buyer and seller agree the approach in terms of access to information at the start of any due diligence process (e.g. via controlled electronic data rooms, supervised access to the seller’s systems and site visits) in order to ensure that the due diligence process runs smoothly whilst complying with any regulatory obligations.

4. Valuation Methodology

We have already stated that valuations are a key consideration for both buyers and sellers, but how is the valuation of a portfolio calculated?

Whilst valuation is a subtle mix of art and science, portfolios are typically valued on a percentage of book value. The percentage applied to a portfolio varies from case-to-case but common factors that influence the valuation include:

- Originations (e.g. loan size, type, term)

- Historic portfolio performance (e.g. collection, profitability, arrears, defaults)

- Underlying asset (including LTV levels) and borrower profile

- Forecast portfolio performance

- Portfolio profile (e.g. underlying security, impairments, cohort analysis)

- Funding (e.g. rating and facilities, if applicable)

- Servicing platform (e.g. systems, outsourcer, data quality, disaster recovery)

- Regulatory compliance and approach to forbearance

- Approach to underwriting and collections

- Level of guarantees (if applicable)

The more a portfolio satisfies the above criteria, the higher the percentage figure usually applied to it.

In terms of deal structure, it is common practice that all consideration is paid in cash at completion with no deferred or contingent ‘earn-out’ payments linked to the portfolio’s future performance.

Estimated valuations

As portfolio valuations are typically made on a percentage of book value and not an absolute number, for practical and timing reasons the purchase price paid at completion is often based on the seller’s estimated value of the loan book at the completion date. Where the book value at completion is an estimate, the actual value may subsequently be agreed via a buyer’s formal post-completion review. Any agreed variance between the estimated and actual completion value, and therefore the purchase price already paid, is then settled (upwards or downwards) between the buyer and seller.

Locked box’ valuations

However, some acquisitions are undertaken on a ‘locked box’ basis where the purchase price is essentially fixed in advance based on an agreed historic position as opposed to the one at completion. This approach provides both the buyer and seller with certainty on the purchase price at completion and also eliminates the need for any formal post-completion review or settlement. The ‘locked box’ approach is often seen when an acquirer is owned by a fund and does not wish to make a further draw down post-completion for what may only be a nominal amount if there is no significant variance between the estimated and actual loan book value at completion.

Equally, a ‘locked box’ mechanic can create different practical deal issues such as agreeing the ‘locked box’ date itself, the treatment of items such as interest receipts and redemptions between the ‘locked box’ and completion dates plus the conduct of business and approach to writing new loans between the two dates. This last point is particularly relevant if the portfolio is not in run-off.

Conclusion

As we pointed out in our first article, there is a clear movement towards organisations buying portfolios in order to achieve balance sheet equilibrium, particularly as business-as-usual lending activities are failing to achieve this business objective.

For those financial institutions looking to buy a portfolio or book of business, they must consider very carefully the motivations and implications of doing so. This in turn leads the level of financial and operational due diligence required as well as how comprehensive the post deal plan needs to be. Failure to complete suitably thorough due diligence and integration planning could increase the risk associated with the acquisition and lead to a significant increase in organisational complexity from integrating the book into your operation.

If you would like to discuss your balance sheet strategy in more detail, please feel free to contact us at: ewen.a.fleming@uk.gt.com or our corporate finance specialist antony.watkins@uk.gt.com.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Business Model, Featured