I’m always fascinated by the incredible organizations that this interview series has introduced me to. Organizations achieving incredible things, often under the most pressing and difficult circumstances, and finding novel ways to push through with resilience and humility. I’m even more impressed when I see the subsequent impact they’re able to have on the customers and communities they serve. Time and again, the organizations that have placed an emphasis on building a cohesive culture are able to turn that energy into a true customer-centric operation. In recent weeks I’ve been introduced to some fantastic community banking leaders who intuitively understand the relationship between a community, the banks that serve them and the possibility to thrive together. Jill Castilla, President and CEO of Citizens Bank of Edmond, is one of those leaders.

During her tenure, Jill has been able to turn a community bank in Oklahoma into a cornerstone of Oklahoma City, build a relationship with one of America’s most energetic billionaires and, in the midst of COVID, create a product and service that has literally impacted millions of Americans. It was a delight to chat with one of the most passionate and humble leaders in community banking to discuss culture, leadership transformation and how Mark Cuban became one of her biggest advocates.

HB: Jill, always a delight chatting with you. Particularly with so much on your plate at the moment, thanks for taking the time.

JC: My pleasure Hilton. There is certainly a lot going on here at Citizens and at community banks across the country. This pandemic has really created a moment for many of us to re-evaluate how we can best serve the communities we’re in and deepen that unique connection we have. The pandemic may be global, but I firmly believe that we’re going to get through this local community by local community. That’s certainly where we’re focusing our energy.

HB: I can absolutely see that “local focus” in many of the businesses and leaders I speak with. Take a moment and give me your background and your role at Citizens?

JC: I’ve been at Citizens Bank of Edmond for just over 11 years and am currently the President and CEO, a role I’ve held for the past five years. Citizens is almost a 120-year-old bank and we have been at this very same intersection for that entire time, which I think is a great testimony to how much we’re part of this community. I joined Citizens after serving at a bank in Northern Minnesota for several years. Prior to that, I spent almost a decade with the Federal Reserve Bank in Kansas City. I’m proud to say that I come from an Army family and both my husband and I are Army veterans. He’s just retired after 26 years in the Army and Army Reserves, and our children are currently serving in one branch of the military or another and we have one still at home. I’m also incredibly honoured to serve as the Civilian Aide to the Secretary of the Army and in several board roles that are focused on generating opportunities for the people and businesses here in Oklahoma.

HB: You’re a passionately outspoken advocate for community banking and how, unlike the large national retail banks, community banks like Citizens have got to think, lead and operate differently. Can you talk about that through your experiences at Citizens?

JC: Absolutely. Case in point, Citizens Bank is a single location, $320 million asset bank that has been part of this community for nearly 120 years. We are naturally operating with a different set of realities to the national banks, but that’s where I believe our ingenuity and resilience comes from.

I think of us as the “MacGyvers of Banking” because we have to be creative in how we use technology, where we dedicate resources, the opportunities we double-down on, and the manner in which we operate as a team. All of those elements come into sharp focus when you’re the size we are but have the responsibility to the community we have.

For example, the deep relationships we’ve built in the FinTech community, and with other progressive Financial Service leaders, is because we see those partners as a force multiplier for what we’re trying to unlock for our customers, and it definitely allows us to punch above our weight. We’re a group of 55 team members at Citizens Bank of Edmond, but I’m regularly amazed at what our group has been able to achieve because of our courageous and adaptable mindset.

HB: I adore the “MacGyvers of Banking” metaphor which brilliantly sums up what so many leaders want from their teams and their partners which is ingenuity and passion. That is the stuff of legendary cultures so how have you built that into the Citizens Bank environment?

JC: Thank you <Laughs> but it has been a journey since I first joined the bank. A journey for the culture I inherited but also a journey for my own leadership style. Fortunately, I come from one of the best leadership training environments in the world – the US Army – where you learn first-hand some great lessons about how to build world-class teams and you learn a lot about your own leadership abilities and opportunities.

When I first joined Citizens, the bank was not in great shape at all. By many of the ratios and indexes that banks are measured on, we had significant issues that needed to be addressed immediately. Regulators had written us off, but I wasn’t willing to accept that we couldn’t turn this bank around. I really did come at this with a “failure is not an option” mindset, but I wasn’t naïve enough to think that we didn’t have to drastically change how we conducted ourselves internally and how we were going to operate as a team. A critical aspect of our structure is that the employees of Citizens are the largest shareholders through the employee stock ownership program, and I wasn’t prepared to let them down and see all that hard work and commitment evaporate. It’s also hard to describe the tremendous sense of responsibility and accountability that comes with running the oldest bank in this community. So much legacy, history and community impact are tied up in this bank and none of us were prepared to let that go.

The hard truth was that the bank, its staff, its culture and the way we operated needed a critical re-set. And, as the lead at the bank, I felt responsible to execute that re-set. I put in significant more rules, restrictions and a real no-nonsense fiduciary approach to turning the bank around. Eighteen months later we’d executed the fastest turn around in national banking history without adding any further capital, but it had taken a toll. I tell this story to emphasize just how woven a community bank is into the fabric of the town or city they operate in. I was getting my hair cut across the road from the bank and the stylist asked me where I worked, and I replied “Citizens”. She stopped and said, “be careful I hear there’s a really terrible lady over there running the place.” I said, “I’m that terrible lady” to which she replied, “No way, you seem so lovely.” When you’re executing a culture and business transformation in a community bank, there really is no place to hide because your decisions and leadership style are genuinely out in the open. That took some getting used to, but it was an important lesson for me as a leader.

Community Impact – The annual “Heard on Hurd” Street Festival initiated by Citizen’s Bank of Edmond is credited with bringing $30 million into the downtown core.

We were absolutely committed to ensuring Citizens was going to be around for another hundred years and that required some very direct, even dictatorial, leadership at the outset. Of course, once we were out of the woods that leadership needed to evolve so we could develop a more collaborative environment and culture. I tell you, turning around a bank is hard. But transforming a culture…that takes a lot of energy, time and commitment. Give me a bank turnaround any day <Laughs>

HB: Kudos on the turnaround, that’s amazing. Also, on the recognition that your leadership style needed to evolve as the environment within the bank was changing and evolving too. Talk to me about the culture and leadership lessons you picked up on this transformation?

JC: Sure. Much is written about how a culture is defined by the attitudes and behaviours of the leaders, and I think there’s a lot of truth in that.

For me, one critical aspect of culture transformation is about setting clear expectations between the people you work with and developing the resulting expectations the team has of each other.

I inherited a culture where some of the expectations that we held team members to were incongruous with running a successful and disciplined business.

There was no expectation set about questioning decisions or directives from management. No-one wanted to be the bad guy or the person who said no to a customer and that caused many of the debt problems the Bank was suffering from. Re-establishing an environment – and a subsequent set of expectations amongst the team – became a cornerstone of our efforts. The hard part for some was the perception that we were changing the “nice and warm” culture at Citizens into something more direct and more confrontational. That required numerous discussions to highlight we weren’t, but we had to change the expectations internally. Expectations around discipline, around diligence and around how we could still create opportunities for our clients and customers but do it in a more responsible and sustainable way.

HB: That’s a fantastic story and, from all I’ve read, very similar to the NetFlix attitude to culture and performance. NetFlix have famously said they don’t want a “family” culture because, and I’m paraphrasing here, we let some bad behaviours slide with our family. They emphasize team and performance in their culture. That sounds similar to your perspective Jill.

JC: I would wholeheartedly agree. As recently as this morning, we had a team member meeting and talked about that.

We want to have a talent-based culture, a strong performance focus, but it really is about this expectation for incremental improvement and how we all get better every single day.

That requires that we all have radical candour, a candour that allows each of us to tell each other when we’re doing great and where we’re not.

For us it’s critical that attitude permeates through the entire bank, no matter what your level.

I do want to make a little bit of correction. We have not arrived yet when it comes to the culture that we want to achieve for Citizens. And that’s the one thing I’ve learned as a leader. It’s very humbling for me as a leader, and the culture that you strive to have, that you’re always working to be better and to be more relevant, to increase the expectations of yourself and your team. Culture, I’ve come to find, is an every single day effort of setting those expectations for yourself and your team.

Business Impact – Vault is a co-working space created by Citizen’s Bank to help their small business owners.

HB: I adore that perspective and the acknowledgement that culture is not a “one and done” effort. Can you point to any milestones where you began to sense the culture transformation, and your leadership transformation, was taking root?

JC: Sure. A few stick out but there was a moment in 2012, around the time that Gangnam-style video was so popular, that stands out. I had this moment when I decided we were going to do a Gangnam-style parody video at the bank and that it would be a whole fun team exercise. Remember this was around the time local hair stylists were hearing about the terrible lady over at Citizens. <Laughs> And so, the fact that I was orchestrating this, the Citizens team probably thought it was some weird Jill-style initiation, like getting voted off the island. I love looking at that video because I can see us really starting to trust each other and a renewed feeling that we’re going to have fun. The team may not have fully trusted me yet, but there’s this moment when you can sense new bonds, new sense of camaraderie forming. That moment is one where there was a culture jumpstart and a new chapter starting. I can’t get through that video without shedding a tear, and I’m not a crier.

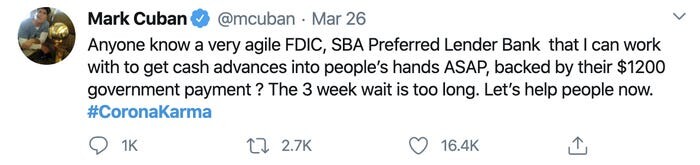

More recently was this remarkable moment when we got involved with Mark Cuban and got took part in this remarkable initiative that has gone on to help so many people across the country. It was a real moment when the whole leadership team had to get in a room and make a high-risk decision in a matter of hours. I was floored by how our team rose to the occasion and, unlike times in the past where I’d have been making the decisions single-handedly, this was an amazing moment of collaboration and courage. I was so proud of the team, how they stepped into this, and ultimately what we were able to achieve. It was another great milestone for us.

HB: Mark Cuban? Dallas Mavericks owner and Shark Tank host Mark Cuban? You gotta tell me more about that?

JC: Yup, that Mark Cuban. First, I have to give a shout out to Bryan Clagett who had seen a tweet Mark Cuban had put out looking for a community bank that was FDIC insured and Bryan immediately called to say, “Jill, you and Citizens should get involved in this initiative.” In short, this was related to the government stimulus checks that were being sent out at the start of COVID and the problem being how long it was taking to get those stimulus checks to the people who desperately needed them. Mark Cuban was looking for partners in the banking community to accelerate that process. I must admit I was overwhelmed by the number of colleagues in the banking community who reached out and said, like Bryan, that Citizens was exactly the type of bank to get involved with Mark and make this happen.

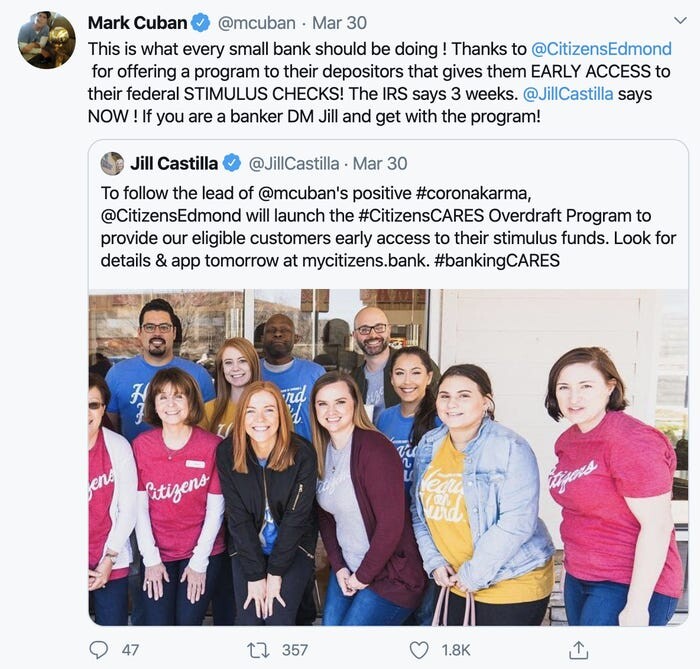

From that moment, things moved incredibly quickly. There was a series of calls with Mark – it really felt like “Shark Tank” on steroids but I was glad I’d watched the show so had some sense of his style – where we were pitching each other a series of ideas. Somewhere between a Friday morning and the following Monday afternoon, we’d hammered out this unique overdraft program that was going to provide real relief for so many people relying on those stimulus checks. Mark Cuban was this incredibly generous partner who never stopped calling out Citizens and connecting us with other banks across the country – over 400 in the end – and telling everyone “connect with Jill, connect with Citizens, they’ve got this solved.” It really was an amazing fairy tale moment where we really saw our bank and our team shine.

For me it was particularly poignant to watch how our team jumped into this opportunity. There was this moment when we were looking at the opportunity and the complexity and speed with which we needed to act, and I saw our entire team exhibit this remarkable confidence in each other. A confidence that we could do this in the time and that, no matter how complex it was, we’d find a way. To me that was another watershed culture moment. A moment when those expectations and belief in each other was crystal clear for everyone.

From that initial interaction with Mark, things really began to snowball. Pretty soon I found that we (Citizens) were playing matchmaker between small businesses and progressive banks across the USA particularly around the PVP rules and forgiveness which were initially these super complex application forms that were impossible to make sense of. Again, Citizens was thrown into this situation where we were creating this amazing online application with a number of ODU students to simplify the entire process. In a matter of days we’d built this application, found a way to meet all the regulatory requirements, and entirely streamlined the forgiveness application for thousands of small businesses nationwide. It was one of the most exhilarating experiences of my life. The opportunity to be able to help so many people at such a critical time was an amazing reminder and recognition of the role that community banks can have.

Importantly, it highlighted a really important culture and leadership lesson for me. We were able to achieve so much, as a bank and as a team, because we didn’t set a ceiling for ourselves.

There wasn’t a moment that I think any of us said “we can’t do this, we’re just this small bank in Edmond.”

I think too often we set ceilings for our organizations and for ourselves when, without those unnecessary ceilings, you’d be able to achieve so much more.

This entire experience has reinforced that for me.

HB: That’s a fantastic perspective. From all our conversations I’ve gotten a real sense that you’re looking to create a different perspective around banking, and bankers, in the way you operate Citizens. Is that accurate?

JC: There’s definitely a Renegade streak that we’re trying to instill inside Citizens because, back to that MacGyver reference earlier, there are things we’re able to get done here that the enormous national banks would not be able to achieve. Strangely there’s something liberating about having capital and resource constraints. One thing that I don’t feel constrained by is the talent we have here, the culture we’re building, and from these recent initiatives the reputation and recognition we’re getting. A growing confidence in what we’re able to deliver and how we perform as a team that is quite remarkable when you consider the journey and transformation we’ve been on.

There’s genuinely a unique attitude that community banks and community bankers have. We have excelled historically when we have had the feel, the heartbeat, of our community because we’re walking beside them. How do you then become the 2020 version of that sentiment? Where you’re walking beside them all the time, then accelerating the innovation needed to deliver that in modern and relevant ways?

HB: We spoke briefly about your time in the military and I have to imagine some of your perspectives about leadership and team building come from that experience. Could you comment on that background and how it’s helped with your time at Citizens?

JC: It’s inevitable that what I’ve experienced and learned in the military has helped me with this journey at Citizens. You learn how to assess various high-pressure situations and determine the leadership styles and methods needed to navigate those. Some situations require strict command-and-control styles but, the military shows you, that when you’ve got a well-functioning team that understands their roles, the team expectations and what the goals and outcomes are, more decentralized leadership is the best way forward. I’m eternally grateful to the leadership experiences I’ve gained from the military because they gave me a richer set of tools to draw on.

At the core of all the leadership lessons I’ve learned, none is more crucial than building an environment of trust across a team. Trust in each other and often trust in themselves individually to know they have the skills and competencies to tackle any situation.

I’ve also been inspired by another pretty unusual leadership mantra. That of Anna in the Disney movie “Frozen 2” which I watched a fair few times through COVID. There’s a moment in the movie where she’s confronted by a moment where she could stop and give up or she could power through and, as she sings in the movie, focus on “the next right thing”. It’s like that classic metaphor “how do eat an enormous elephant? One bite at a time” which is often what leadership requires. Taking one step at a time, doing the next right thing. That’s how you lead, and I think that’s how you build great teams and great cultures.

HB: C’mon now, the US Army and Anna from Frozen in one reference. That’s fantastic. I always ask interviewees for some tips or advice for the folks reading this. What advice do you have Jill?

JC: Inspiration can come from anywhere Hilton. <Laughs> The number one thing that I would say is to create a network that is entirely different from you. Go out and seek friends that, whatever your political affiliations, your social affiliations, your geographic affiliations are, find folks that are completely different from you, so your perspective is constantly stretched.

That means you’re able to look at problems from many different perspectives and have empathy that you wouldn’t have had without those interactions. It doesn’t mean you have to agree with everybody but expose yourself to everyone and create authentic networks.

Sure, social media has so many biases about it, but there’s so many blessings from it too. Let’s be honest, there’s no way the CEO of a single bank in Oklahoma could have connected with Mark Cuban, but for social media.

The other thing I earnestly believe is that if you are blessed beyond measure, if your bank is running and humming and doing great, go out and support those people that are facing some type of crisis or challenge. If your buddy down the street has been your rival, your entire career and their bank is in trouble, send a little note and say, “Hey, we’re thinking of you. I’m lifting you up. I’m praying for you” Whatever it is that you can do, then send some good vibes out. We should really all be lifting one another up. Particularly right now. We have this incredible opportunity to raise all boats by making genuine and authentic connections and helping each other wherever and whenever we can.

HB: Jill, I can’t think of a more eloquent “community” attitude from a community banker. What a great uplifting attitude. Appreciate the time you’ve spent today, and I wish you and your renegade MacGyvers every success.

JC: Thank you Hilton. It was fun chatting.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox