Recently I had the pleasure of speaking at the Loss Prevention Research Council (LPRC) Impact 2019 conference. Over 430 people made their way to the University of Florida’s Gainesville campus for the three-day event.

The symposium “focused heavily on learning and collaboration, as well as an overview of the LPRC’s research on evidence-based tactics and strategies to reduce crime and loss in the retail space”.

As part of a senior retail executive session, I contributed this excerpt of my continuously updated “Disruptive Future of Retail” presentation.

What is the state of the global retail industry? Is USA retail a dying industry? What’s in the mind of the new omnichannel shopper and how is it changing? What’s the impact on the loss prevention function? What’s driving disruption? Why is LPRC positioned to lead at the speed of NEW retail?

The groovy retail industry

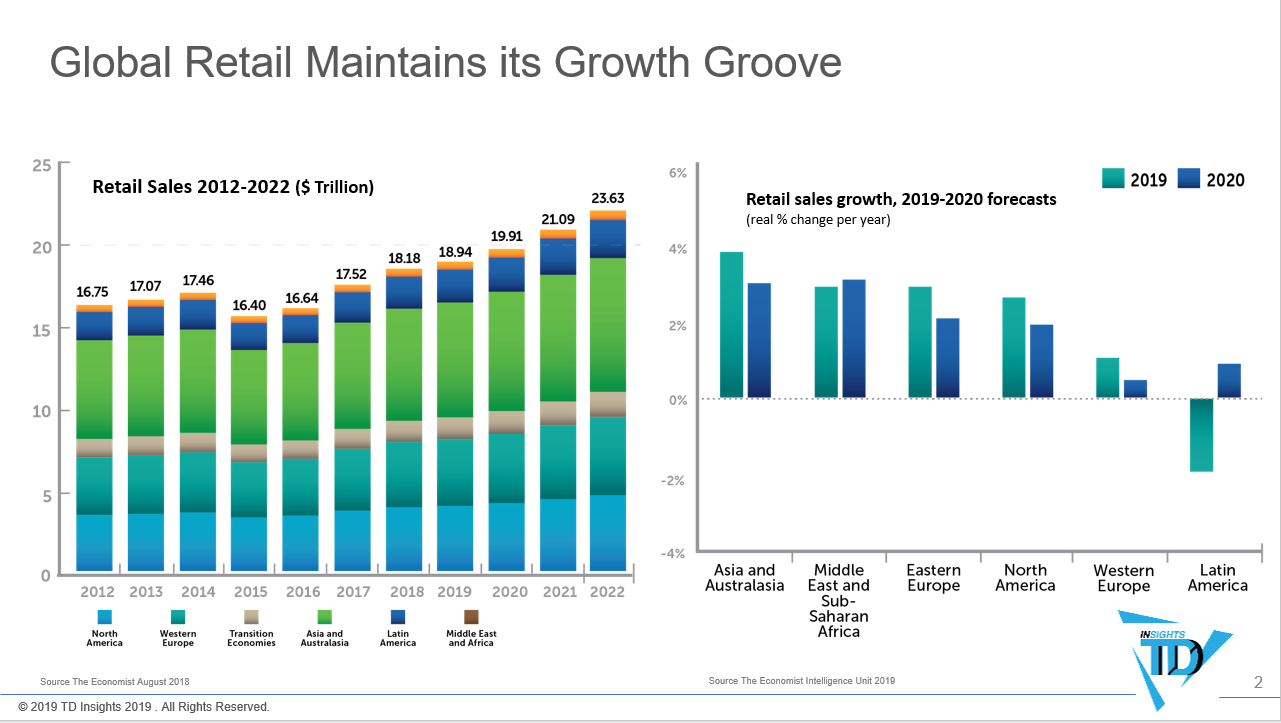

Globally Retail is a vibrant growing industry with Asia leading the world in retail growth. China is a key barometer to watch for disruption and future industry potential. By next year, China will surpass the United States as the largest retail market.

Latin America is the only challenged retail region for 2019 and Western Europe has the lowest growth. Forecasts for 2020 are positive in all regions.

The doom and gloom of USA retail

The opening image of this article includes fictional newspapers, but the retail headlines presented are real;

- ‘Retail apocalypse’ now: Analysts say 75,000 more U.S. stores could be doomed, Washington Post

- Gloomy Labor Statistics Show that Retail Apocalypse was Worse than we Thought, NY Daily

- Who will Survive the Retail Apocalypse?, Yahoo Finance

- An Avalanche of Store Closings ‘bigger than anything we’ve Seen’ is Sweeping Across the US, Business Insider

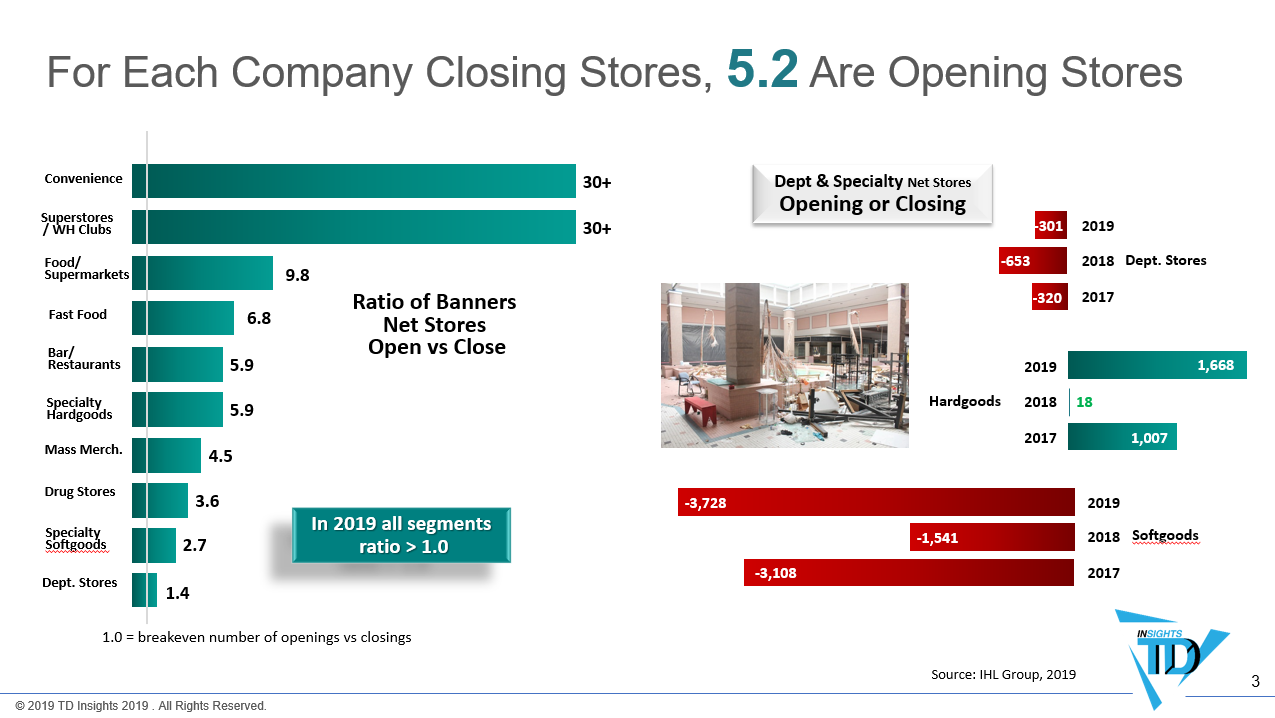

Reading all these and many more headlines, you would think that the USA retail industry was going out of business. The opposite is true. As the latest IHL Report indicates, USA retail is still vibrant and growing.

For every chain closing stores, 5.2 chains are opening them. The two sectors contributing heavily to store closures are department stores and specialty soft-goods. Between 2017 and June 2019 when the study was completed, 42,563 stores closed, but 51,138 opened for a net positive of 8,575 new stores.

Social shopping is just getting started

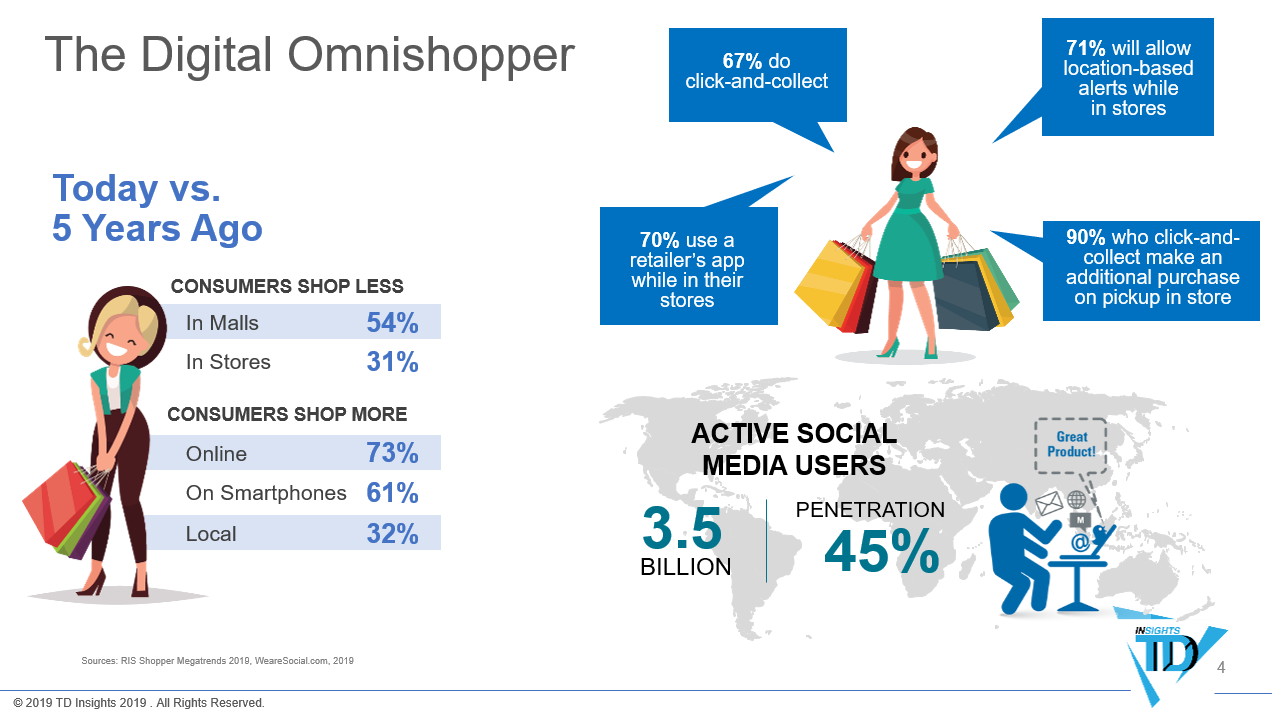

Digital transformation is driving disruptive changes in the global retail industry. We are shopping less in malls and physical stores, and more online and on smartphones. New services such as ‘click and collect’ are being positively received by consumers in the ever changing omnichannel shopping journey.

Shopping is a social activity. Worldwide 3.5 billion people are using social media platforms with a 45% total global population penetration. This almost instant level of communication will continue to disrupt retail.

Top 5 technologies and top 3 services shoppers want

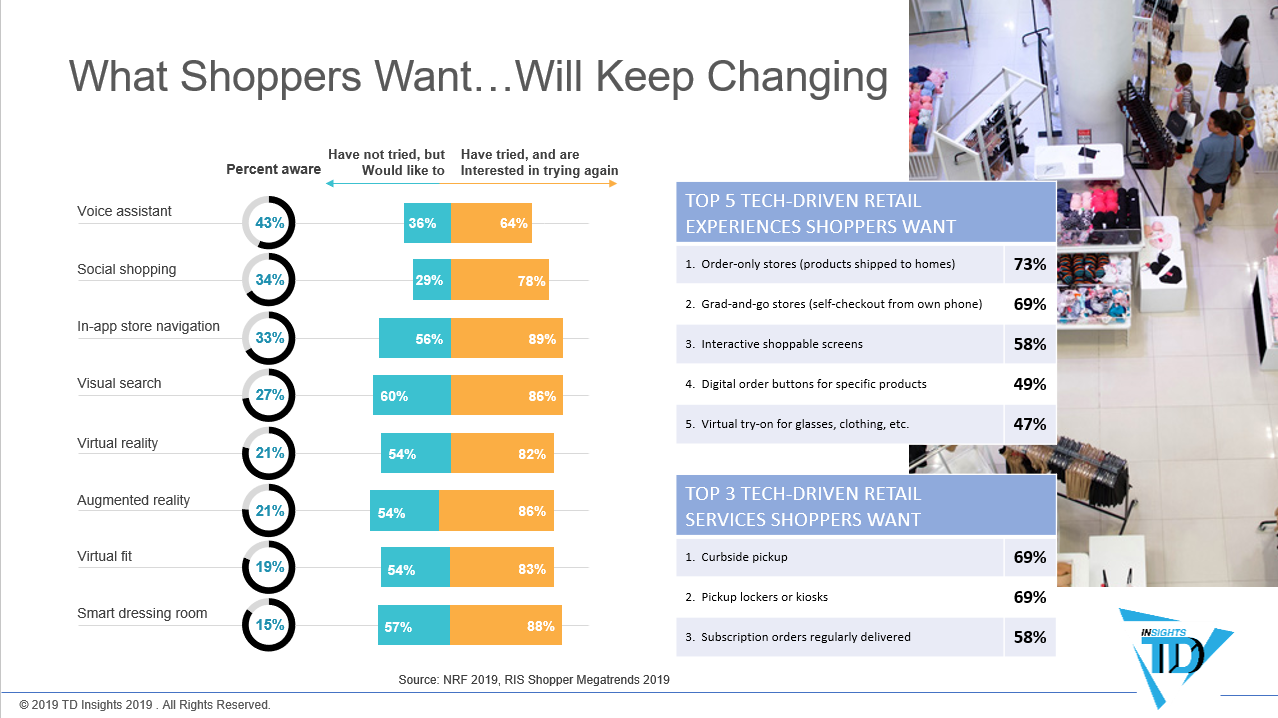

At the crossroads of new technology platforms and next generations of consumers, continuously expanded shopping opportunities will emerge.

A majority of consumers want order-only stores, grab & go from smartphones, interactive shopping screens, curbside pickup, pickup lockers or kiosks, and subscription orders.

The loss prevention digital collision

For the Loss Prevention Research Council audience, I pointed out that current digital trends are leading to a collision between the smartphone empowered consumer and retail theft opportunities. The CXX functions of progressive retail companies are focused on strategies to dramatically reduce friction in the shopping experience. Increasing friction to deter theft has been the primary historical strategy for the loss prevention.

Truly believe that with the correct execution of strategies and emerging mix of technologies this is a critical moment for Loss Prevention to achieve value differentiation and elevate their function to the CXX leadership table.

The need more innovation speed

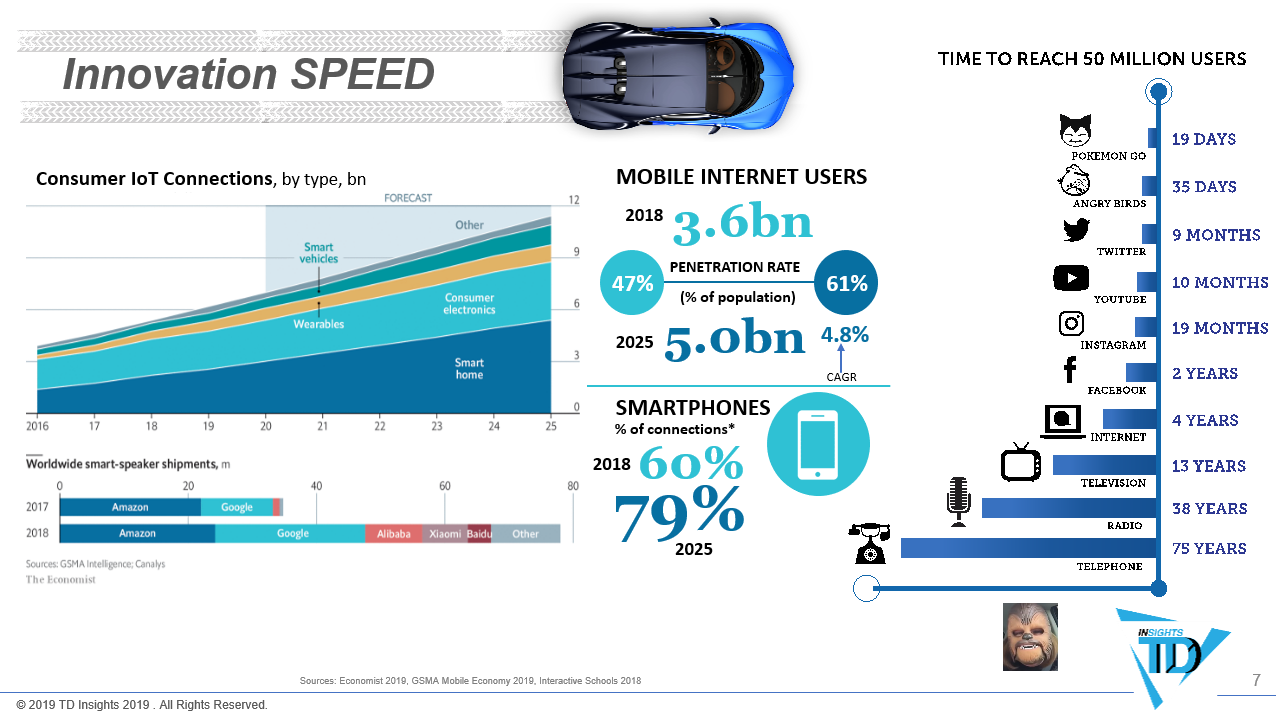

By 2025, five billion people will be connected to the internet via mobile. Seventy-nine percent of those connections will be on smartphones.

Mobility and Internet-of-Things (IoT) connected devices are accelerating the pace of change and will dramatically transform the retail industry. Note the technology adoption difference in electricity versus Pokémon in reaching 50 million users. The Chewbacca Mom reached 50 million views in 24 hours.

Execute at the speed of new retail

“In today’s rapidly changing landscape, retailers must deliver a next-generation consumer experience while simultaneously preventing theft and ensuring the safety of their associates and customers.

The LPRC has responded to this challenge by launching LPRC Innovate, bringing together key people, places, and processes to solve problems in this new retail environment.”

Recently I joined the Board of Advisors (BOA) of the Loss Prevention Research Council (LPRC). This industry group is comprised of 70 major retailers ($2 Trillion in retail revenue) and 75 solution providers. My BOA focus will be on LPRC Innovate and helping retailers and solutions providers execute new ideas at the speed and renaissance of new retail.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured, Omnichannel, Retail