“It is our task, both in science and in society at large, to prove the conventional wisdom wrong and to make our unpredictable dreams come true”

– Freeman Dyson (theoretical physicist and mathematician)

Blockchain or distributed ledger technology[i] and its application in financial services has generated huge ripples in recent times. After ‘China slowdown’ and the ‘Repeat of 2008 financial crisis’, possibly it appears as the most frequently published term in financial headlines in the last few months. Promising to bring disruptive transformation in an industry – hitherto burdened with process complexities, increasing regulatory requirements, unfavourable operational costs and lack of harmonized standards, curiosity about the untested potential of innovative blockchain technology has generated huge interest with increased level of expectations.[ii]

While few occasional discussions and whitepapers regarding suitability of the technology underlying cryptocurrency (bitcoin) were considered usual seminar affairs till recent period, a new frenzy has started since Sep 2015 when Innotribe hosed a panel discussion in SIBOS 2015 – ‘New kids on the Block (chain) platform’. Curiosity (or an increased hysteria) of the SIBOS participants around the subject was so intense that it caused a huge overcrowding in the room hosting the panel discussion. Some news reports suggest that to accommodate large number of unexpected delegates, Innotribe had to organize live streaming of panel discussion in an adjacent room at the last moment.[iii]

Industry Consortiums

Around the same time R3 Cev partnered with nine leading global banks to form a consortium to explore distributed ledger technologies and its suitability for global financial markets. Not to be left behind in a potential gold rush, number of banks joining the consortium has reached to 42 towards end 2015. In the intervening period, market has also witnessed almost daily announcements regarding potential blockchain based solutions from startups and new partnership/consortium being formed by financial firms. In a similar development, Linux Foundation in partnership with few startups, banks and IT firms has announced charter for ‘Hyperledger project’– an open-source project to advance the blockchain digital technology for recording and verifying transactions.[iv]

Startup Ventures

The developments taking place on startups front appear more intense and exciting. A series of new solution ideas covering different segments of financial markets remained hitting the headlines in recent months. While many of these announcements were about preliminary ideas or proof of concept and trials, these kept market bubbling with a sense of feverish anticipation. Notable amongst these startups ideas are:

- Nasdaq Linq for Private Securities Issuance

- Overstock’s T0 platform – issuance of financial securities through blockchain-based technology

- Digital Asset Holdings to build a distributed ledger based settlement solution for ASX

- ConsenSys in partnership of Microsoft launches Ethereum Total Return Swap (eTRS)

- Earthport and Ripples Lab launching cross-border real-time payments network /gateway

- ItBit Bankchain for DVP ledger for Gold settlement

Financial Markets Infrastructure Initiatives

The raging discussion has reached to a next level, when some of the key market infrastructure providers and regulators, leaving aside their initial sense of scepticism, have joined the bandwagon to understand the nuances of this unproven technology and its future potential for financial markets. Going beyond preliminary curiosity about how blockchain technology would affect their present business, some of these institutions have gone ahead with closer evaluation of possibilities in specific functional domains and feasible implementation ideas.

LSE, LCH, Euroclear and CME have recently formed ‘Trade Distributed Ledger Working Group’, to explore how blockchain technology can transform post-trade processes. DTCC[v] and Euroclear[vi] have come up with whitepaper/analysis report in the last few weeks to assess potential of technology, adoption feasibility and present hurdles. Maintaining a cautious sense, these reports do not overtly exhibit higher level of confidence about disruptive adoption scenario. At the same time, these support leveraging blockchain technology for possible transformation opportunities – to modernize present market infrastructure capabilities and enhance post-trade processes. To flourish at the industry level, an increased level of market collaboration, development of common standards and legal/regulatory framework are identified as common minimum requisites. [Please also read recent speech by Greg Medcraft, Chairman, ASIC on ‘Capital Markets and digital disruption’[vii]]

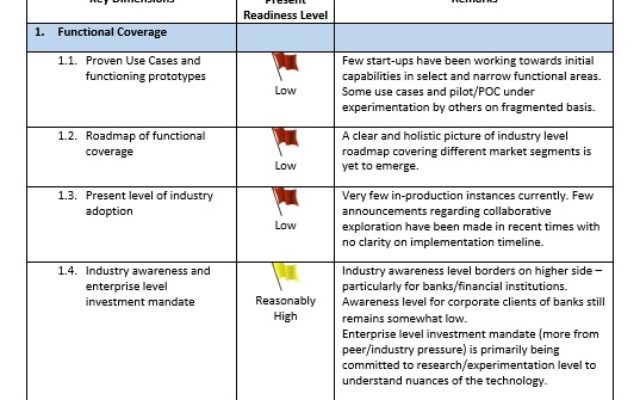

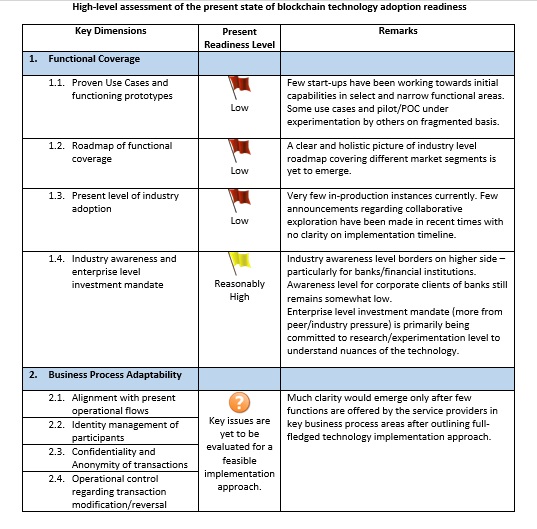

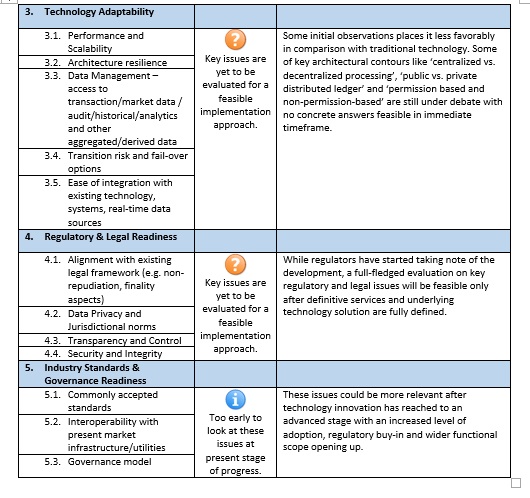

Assessment of Present State of Adoption Readiness

With increasing hype and many facets of innovation yet to be explored, a balanced and definitive perspective on potential of the technology and its market adoption outlook at present stage are quite hard to outline. Historically, path of any technology innovation and its adoption have always remained unpredictable – dependent on a complex web of factors, beyond linear technical, financial, operational and legal issues alone. If we attempt to oversimplify this situation to draw a basic hypothesis, one fundamental thought could be outlined – how an innovation changes present scheme of things (ecosystem) towards intended improvement / efficiency and finally settles in a relatively stable state of the changed ecosystem? This element of change or transformation can have two facets:

- Scale and intensity of disruption or influence from technological innovation on the existing market structure, business model, process and practices.

- Level of adaptability of technological innovation to fit into the complex grid of processes in the ecosystem – not to radically unsettle many intricate and interrelated cogs of the wheel just for the sake of transformation (in a sense of reinventing the wheel altogether without commensurating benefits).[viii]

Against this unprecedented background, a preliminary and high-level assessment of the present state of blockchain technology adoption readiness in capital markets ecosystem has been summarized below. These are based on present available information about different solution ideas, exploratory initiatives and on-going experimentations.

Possible Adoption Scenario and Outlook

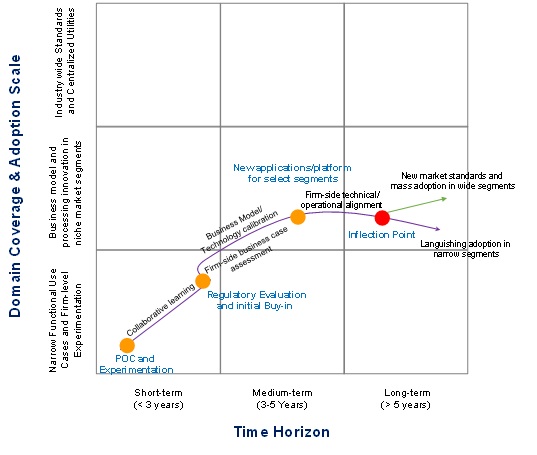

Reckoning inferences from above readiness/adaptability assessment, we can draw possible adoption scenario under varying levels of functional domain coverage and scale of adoption (highlighted in below diagram). While deriving these conclusions, it will not be out of place to ponder over some basic insights from the past relating with extremely optimistic view about adoption level of a radical technology innovation during its early stages.[ix]

At a high-level, it can be concluded that in an immediate timeframe various forms of POC and experimentation by different firms/consortiums relating with technology options would continue. This period will also witness a steady growth of technology spending commitments being made by the firms[x]. Much of the focus during this period would remain on intra-firm (inside enterprise) applications. Building on the collaborative learning of initial phases, and after regulatory buy-in and refinement on technology/architecture models, few applications in narrow market segments would emerge in medium term. These would essentially introduce new level of innovation in existing business model and processing structure in niche and narrow market segments. Depending on the feasibility and ease of integration/alignment of firm-side technology/operational platforms, firms would have reasonable level of implementation insights about the advantages, opportunities and constraints. This would help them to make a clear evaluation about taking the technology adoption to the next level or otherwise, and committing further resources accordingly.

Coming closer to an inflection point in next 5 years or so, it would open up long-term adoption options for banks as:

- Aggressive adoption of the technology based on successful implementation experience and visible advantages of prior stages

- Limit resources to maintain at present level of adoption within enterprise or intra-firm level applications in narrow segments or in an extreme scenario scale down the resource commitment altogether – based on less encouraging experience of earlier phase.

While time span is too long to make any reasonable prediction about implementable solution options in such a horizon, broad pointers about likely direction can certainly be outlined. The former option would lead towards a wide and accelerated industry level adoption, which in turn would push for more radical market structure and business model transformation. Within a short gestation window, active formulation of industry level standards and possible emergence of few centralized utilities in different segments would a vital development anticipated during this phase. In other situation of low momentum path, market will witness a languishing growth of blockchain technology with an eventual scenario of returning to post-partum stage carrying the feeble trails of innovation- i.e. continue dealing with complexities and challenges of legacy technology as a part of BAU.

[i] Both the terms are used in an equivalent/interchangeable sense in this article, without making any technical distinction.

[ii] A paper published by Santander Innoventures in partnership with Oliver Wyman and Anthemis Group predicts that Distributed ledger technology could reduce bank’s infrastructure cost relating to cross border payments, securities trading and regulatory compliance by between $15-20 billion per annum by 2022.

[iii] http://letstalkpayments.com/sibos-2015-day-one-highlights-blockchain-discussion-room-overpacked/

[iv] As per recent update, R3 has announced about successful completion of distributed ledger experiment involving eleven participating firms, who were able to execute financial transactions instantaneously across the global private network. Also, the Hyperledger Project has ramped up fast and has received proposed code and technology contributions from several partnering companies.

[v] http://www.dtcc.com/news/2016/january/25/new-dtcc-white-paper-calls-for-leveraging-distributed-ledger-technology

[vi] https://www.euroclear.com/dam/Brochures/BlockchainInCapitalMarkets-ThePrizeAndTheJourney.pdf

[vii] http://download.asic.gov.au/media/3544461/greg-medcraft-speech-to-omfif-roundtable-published-24-february-2016.pdf

[viii] If we think about much discussed scenario of shortened settlement cycle/near real-time settlement using innovative technology, we would realize settlement window of T+2 or T+3 currently followed in different markets is not caused due to present generation technology system constraints per se, rather for other attributing factors such as operational business process, market practices and regulatory issues.

[ix] Concorde passenger airliner jointly developed by British and French Consortium based on supersonic jet technology with a maximum speed of 2.04 Mach (twice the speed of sound) was considered as a triumph of modern engineering in its times (1960s). At the early stages of sales, order for more than 100 long-range version aircrafts was placed by major airlines of the time – a significant feat in itself. After launch of its commercial operations in 1976, day-to-day operational and technology issues (including heating, structural and maintenance) started cropping up and gradual depletion of order book had already begun. Facing increased operational challenges and competition from other airliners (like Boeing 747), when British Airways and Air France retired Concorde services in 2003 there was hardly anyone to shade tear on untimely death of a marvelous technology invention.

[x] Aite Group projects that blockchain technology spending would witness a steady increase in next 5 years and expected to reach to level of $400 m by 2019.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured