Digital Business Transformation describes the use of Next Generation Enterprise (NGE) Digital Business Models and other resources – such as SMACT/4D Digital Technologies – to radically disrupt existing business models through creation of emerging digital economies with novel methods of production, distribution and communication.

Digital Business Transformation promises to unleash an unprecedented level of economic capability and capacity to create new business opportunities in both digital and physical economies through the convergence of the enhanced digital competencies and qualities of people, processes and technologies.

There will always be both winners and losers during any period of rapid and radically disruptive change. Change favours those individuals who are most agile and best-prepared. Some members of society will benefit and profit from these changes, whilst others may be adversely affected – perhaps for the rest of their lives. As demand for education, training, skill-sets and experience changes, then some individuals may find themselves propelled forward in both their careers and personal lives – and at the same time others will become increasingly disadvantaged, vulnerable, isolated and disconnected citizens living in a strange and challenging new Digital World – ultimately feeling abandoned and left behind by a digital global society.

The purpose of the Digital Strategy Manager role is to provide future analysis / strategic direction to key stakeholders who are challenged to integrate the multiple, divergent Future Narratives in Digital Business Transformation and Digital Asset Management Programmes from cross-silo digital stakeholders across the Enterprise – Strategy and Planning, Finance and Accounting, Budgeting and Forecasting, Human Resources, Sales and Marketing, Data and Process Owners, Stewards, Administrators and Operatives, Information Providers and Consumers, Profit Centre and Cost Centre Budget Holders and Responsible Managers – all with different viewpoints, drivers, issues, concerns, interests and needs.

This is overcome by developing, in a collaborative environment, a shared, common Global Vision of the future state of the Digital Enterprise where we plan, design, deliver and realise the Digital Vision – including Digital Strategy, Business Operating Model, Business and Technology Roadmaps. This is achieved by organising Digital Discovery Workshops to design a shared, common Vision of current / future states of the Enterprise documented by Enterprise Architecture Models and Road-maps, Lean / Agile Scenarios and Use Cases, Epics and Stories along with Programme / Project Planning diagrams and architecture models – deliverables which help guide us to realise the achievement of that Vision through Organisational Change and Digital Business Transformation in a collaborative environment.

Digital Business Transformation – client engagement is achieved through Advisory Consulting / Strategy Studies / Programme Management assignments across multiple and diverse industry sectors – beginning with Digital Strategy envisioning, planning and execution, deploying Next Generation Enterprise (NGE) Digital Business Models which inform, enable and direct Digital Business Transformation, Organisational Change and Technology Refreshment Programmes. Digital Business Transformation exploits the impact of radically disruptive novel, emerging SMACT/4D Digital Technologies – Social | Mobile | Analytics | Cloud – through Technology and Platform Refreshment Programmes driving success in both Physical and Digital Economies.

SMACT/4D Digital Technologies describes the use of digital resources to discover, analyse, create, exploit, communicate and consume useful information within a geospatial context. Client engagement is driven by Advisory Consulting / Strategy Studies / Programme Management assignments deploying Next Generation Enterprise (NGE) Digital Business Models which in turn drive the Digital Strategy, Business Transformation, Organisational Change, Digital Technology Platform Refreshment and Product Launch Programmes that drive competitive advantage through exploiting the radically disruptive SMACT/4D Digital Technology Stack.

SMACT/4D Digital Technology Stack: –

• Social Media / User Curated Content

• Mobile Platforms / Smart Devices / Smart Apps

• Analytics / Data Science / Big Data – Hadoop, Spark / Fast Data – GPGPUs, SSDs

• Cloud Services Platforms – AWS, Azure, NetSuite, Salesforce, Workday

• Telematics / Telemetry – Machine-generated / Automatic Data Streams / IoT

• 4D Geo-Spatial Data Science / Geo-demographics / GIS Mapping and Spatial Analysis

A geographic information system (GIS) is a synthesis of computer hardware and software which captures and stores geospatial data types for mapping, analysing, layering, combining, communicating and displaying geographically referenced information – geographic data (mapping), geospatial data (topology) and geology (sub-surface data) – which may be overlain with Human (population and demographics), Asset Location (property and infrastructure) and Land Use (agriculture, forestry, industry, town and urban) Gazetteers.

• ECONOMIC MODELLING and LONG-RANGE FORECASTING • SMACT/4D Digital Technology Stack was used to envision, architect and design Forecast Demand, Supply and Cost / Price Models based on Physical (Commodity / Reservoir Exploitation) and Economic (Forecast Demand, Supply and Cost / Price) Models – using large scale GIS Mapping and Spatial Analysis (including sub-surface modelling) and Structured Financial Data to explore both Historic and Future values (+/- 50 years forecast / actual closing prices for all grades of crude + LNG) overlain by periodic wave-form trends from Schumpeter Business and Economic Cycles.

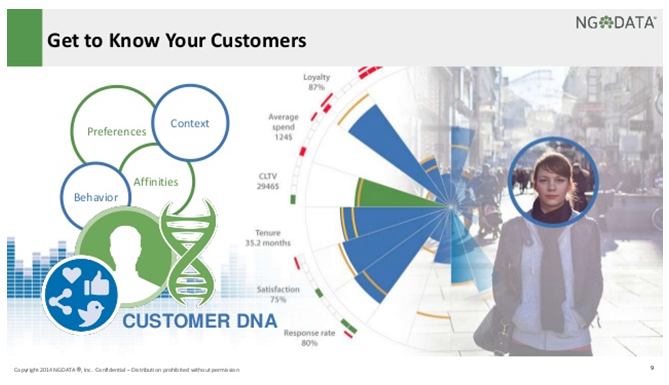

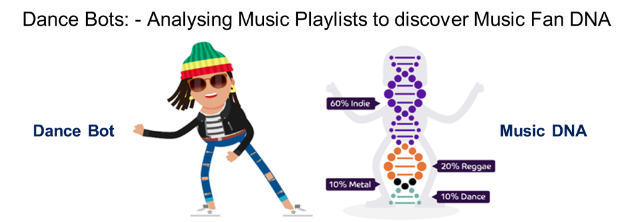

Social Intelligence delivers intimate personal insights from Social Media analytics data streams. Lifestyle Analytics and Consumer DNA insights allow us to segment our customers by their propensity to engage – fanatics, enthusiasts, casuals, indifferent and unconnected – through analysis of their on-line and mobile Social Media postings and Audio-visual streaming listening and viewing playlists. We are thus able to understand consumer Lifestyles through discovering which people, products, brands, ideas and trends our customers are following and connecting with. Lifestyle Analytics explains the role that peoples’ personal interests – Sport, Music and Fashion – play in their lives. Consumer DNA is exploited through converting data streams into revenue streams – whilst maintaining the highest levels of brand messaging and integrity.

• CONVERTING DATA STREAMS INTO REVENUE STREAMS • Lifestyle Analytics and Consumer DNA data feeds inform Social Intelligence and Digital Marketing which in turn drives Retail Sales Acceleration for Luxury Goods, Designer and Fast Fashion Retailers, Sports Equipment, Apparel and Footwear companies, Telco, Media, Entertainment, Communications and Financial Services organisations – exploiting the radically disruptive SMACT/4D Digital Technology Stack to convert Social Data Streams into Sales Revenue Streams.

Consumer DNA is a 360-degree view of each customer’s unique consumer psyche – personality, motivation and behaviour – their interests, needs, desires, aspirations, lifestyle. Derived from a consolidated single view of every customer data-point, Consumer DNA provides a holistic customer picture – allowing customer-centric enterprises to peer deep into their customers psyche to gain an intimate understanding of their motivation and lifestyle. Consumer DNA is the essence of the customer’s own unique set of purchasing behaviour and personality – interests, needs, desires, aspirations, taste and lifestyle. Consumer DNA gives a 360-degree customer view, enabling organisations to exploit micro-marketing – uniquely personalised, relevant customer offers, experiences, journeys – optimised to meet every customer’s individual needs.

CASE STUDY – Radio One

25 years ago, Radio 1 audience figures had slumped to 8 million and the channel was in danger of losing its charter. The Radio 1 charter stated that the minimum audience level for continued support was 6 million listeners. The Controller of Radio 1 engaged with marketing guru Matt Hartto try and understand why core target audiences had abandoned the channel targeted at Youth segments.

The Radio 1 formula was based on repeat broadcasting of classic Chart standards – like Radio 2 does today. Audience surveys, metrics and analysis discovered that what individuals in Youth segments really wanted was to listen to New and Emerging Music. DJ’s and Producers were given a monthly Audience Analytics pack containing detailed feed-back on their shows from Audience Surveys. Radio 1 channel content was re-focussed on New and Emerging Music – and the rest is now history…..

Today, instead of sampling just a few thousand listeners in Audience Surveys – the BBC uses Social Media Analytics (Social Intelligence) from Crimson Hexagon to discover intimate personal insights from millions of listeners – from the people and trends that their target audience are connecting with, what Music Genres they are interested in and which Artists and Bands they are following (Music DNA) – to understand the role that Music, Fashion and Sport plays out in the lives of those individuals in their target Youth segments. Radio 1’s target audience is 15-29 year olds. About 9.5 million adults a week tuned in to Radio 1 between April and June 2016 compared with 10.4 million during the same period in 2015 (audience figures: Rajar) – discounting audience growth on Digital Platforms, with social media platform audiences of over 8.5 million and increased audience figures across both the Radio 1 YouTube channel and the BBC Red Button service.

CASE STUDY – Dunnhumby and Tesco plc

Dunnhumby is a UK-based consumer data science company formed by husband and wife team Edwina Dunn and Clive Humby. The couple had both worked at CACI – providing Integrated Consultancy, Marketing, Location Planning, Network Services and Technology Solutions based on CACI Acorn geodemographic matrix which was designed by Richard Webber – combining geography, population, social factors and consumer behaviour. Clive Humby resigned from CACI so that he could start up his own business. Together the couple founded Dunnhumby in the kitchen of their West London home in Chiswick – to begin working with a diverse portfolio of customer-facing clients including BMW and Cable & Wireless.

After a successful period as Managing Director, in 1982 Sir Ian MacLaurin became Chairman of Tesco – the third-largest food retailer in the UK. In 1992 the first Tesco Metro store opened in Covent Garden. In 1994 the first two Tesco Express stores opened in London and Tesco, which were now second after Sainsbury’s in the UK retail food market, wanted to create a new customer loyalty card. Dunnhumby gained prominence for their role in helping establish the Tesco Clubcard and Loyalty System. The Tesco Clubcard / Dunnhumby Loyalty system was unique in storing every item in every basket purchased by loyalty card holders – driving Consumer Analytics, Marketing, Offers and Promotions applications hosted on a huge 40-terabyte Teradata Appliance. This helped propel Tesco to the number one UK food retailer slot, overtaking Sainsburys in 1995.

In 1994 Terry Leahy took over as chief executive and in 1997 Tesco opened its first Tesco Extra 24-hour hypermarket in Pitsea, Essex – followed by the first two Tesco Express stores in London; Tesco Bank was founded in alliance with RBS. In 1999 Tesco Mobile was formed and in 2000 Tesco.com was launched. Tesco acquired a 53% stake in Dunnhumby in 2001 for a reported £30m, increasing this stake to 84% in 2006.

Tesco Bengaluru was set up with Infosys in May 2004 “to enable standardisation and build centralised capabilities and competencies which can be leveraged across the Tesco Group” – outsourcing mission-critical technology and retail operations to India and replacing Tesco plc corporate functions in Welwyn Garden City. The scope of work supported by the new offshore / outsourced company covered the entire spectrum of retail operations – technology, business, finance, commercial and supply chain and property services. This offshore / outsourced technology and retail operations centre fell short of the retail skills and business agility lost by closing the UK HQ facilities in Welwyn Garden City, failed to maintain Tesco’s shared service core business functions, failed to support Tesco’s growth and profitability targets and eroded the Tesco Customer Offer, Experience and Journey – tarnishing a global presence serving millions of customers worldwide.

Philip Clarke took over as Group CEO in March 2011 – beginning a catastrophic reign that saw Tesco lurch towards both financial and retail disaster. BzzAgent, a Boston-based social marketing and advocacy start-up, was also acquired by Dunnhumby in 2011. The Berlin-based global advertising digital technology firm Sociomantic was acquired by Dunnhumby in 2014. Given the increasing trading difficulties at Tesco, it was suggested in autumn 2014 that Dunnhumby might be on offer for sale at £2 billion. The BBC reported in January 2015 that Tesco was seeking a buyer for the company. In April 2015, The US-based Kroger Company announced it would buy much of Dunnhumby USA and create a new consumer insights subsidiary.

Today, Tesco uses Social Media Analytics (Social Intelligence) from Dunnhumby to discover intimate consumer insights in combination with the Tesco Clubcard / Dunnhumby Loyalty system – hosted on a 40-terabyte Teradata (Atomic Data Warehouse) Appliance and a Nettezza (Aggregated / Summarised Data Marts) Appliance – driving Accelerated Omni-channel Retail Sales through Digital Marketing which creates targeted Digital Campaigns, Offers and Promotions – thus converting Data Streams into Revenue Streams.

IN CONCLUSION

Digital Business Transformation can unlock both tangible and intangible benefits streams to create new business opportunities in both digital and physical economies – through the convergence of enhanced digital competencies and qualities across people, processes and technologies.

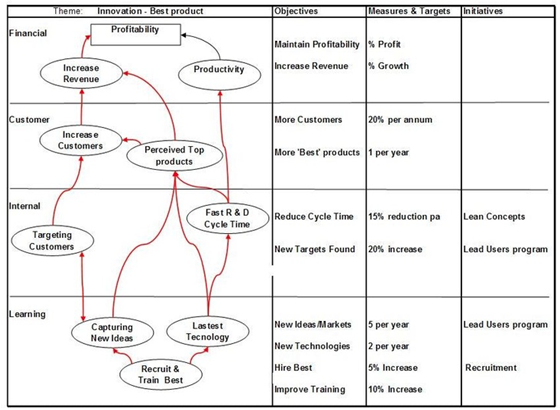

Successful programme delivery and benefits realisation depends ultimately on human as much as technical critical success factors. If we get Human Factors wrong – Strategy, Recruitment, Training and Leadership Programmes – so that we miss out on the achievement of target Key Performance Indicators, if we fail to optimise and manage Lean Process Models, Use Cases and Scenarios and the Requirements Backlog so that our Agile Delivery is compromised – then our Digital Business Transformation Programme will fall short of our Mission, Vision, desired Outcomes, Goals and Objectives.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Digital Disruption, Featured