Six of the ten most valuable companies in the world are platform companies. None of the six is a bank. Admittedly, banks are late to the platform party.

Nonetheless, banks are set on — what would have been considered impossible until a few years ago — transforming themselves from impassable monoliths to nimbler organisations, open to new kinds of partnerships.

“Why it’s simply impassible!

Alice: Why, don’t you mean impossible?

Door: No, I do mean impassible. (chuckles) Nothing’s impossible!”

― Lewis Carroll, Alice’s Adventures in Wonderland & Through the Looking-Glass

Regulations such as PSD2 and Open Banking that mandate banks open their data vaults to third parties play an important role in this transformation. Banks have started to build public APIs with the aim to create and nurture an ecosystem of external partners (service providers, technology companies and independent developers).

But as we would soon see, Banking-as-a-Service (BaaS) rather than Banking-as-a-Platform (BaaP) more aptly describes banks’ strategy of providing public APIs and development portals. Even though the distinction between BaaS and BaaP is not always clear with the terms often used interchangeably, the two key differences between BaaS and BaaP are –

1. The target end users and

2. Extent of integration with banks’ product stacks

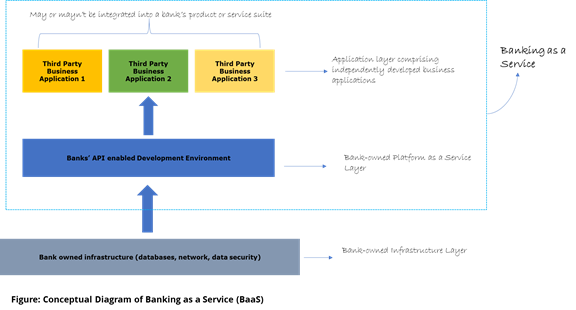

In the case of BaaS, the target audience is largely confined to third parties and independent developers with a good understanding of using technologies such as APIs to create new solutions. In that sense, the development environment provided by banks act as a Platform-as-a-Service (PaaS) layer to help third parties develop business applications which may or mayn’t be integrated into the banks’ product suites.

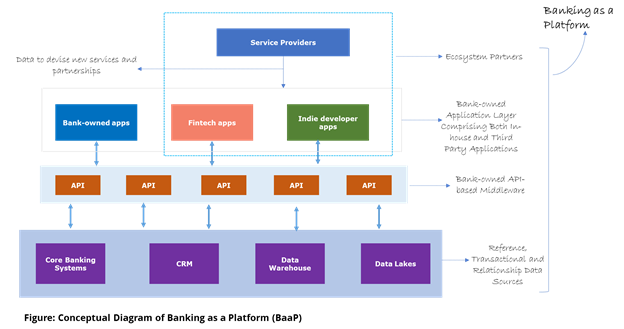

BaaP, on the other hand, is far more comprehensive in that it encompasses banks’ offerings for not just technology partners but also for banking customers.

For instance, BBVA’s acquisitions of Simple, a digital-only US bank and Holvi, a Finnish online-only bank for small businesses and entrepreneurs, define BBVA’s attempt to reach customer groups not serviced well by traditional banks.

BBVA, through these acquisitions, plans to derive synergies in areas such as customer experience, products and technology that its smaller additions excel in; synergies that’ll be complemented by access to a larger customer base, regulatory compliance and established brand name that the traditional bank possesses.

Nonetheless, for banks, to embark on a BaaS strategy is a precursor to a full-fledged BaaP strategy, in the long run.

Take Monzo, a UK based challenger bank, that clearly states its mission is to build the ‘best current account in the world’. But with a banking license it can sell many more products and services. In 2016, less than a year after its inception, Monzo started to provide APIs to third parties to build applications that can access Monzo’s customer data.

Through APIs, Monzo plans to build a banking marketplace, where its customers will access, in addition to its specialised current account product, banking solutions from different providers — all on Monzo’s platform. Similarly, Starling Bank, early this year, launched its app store along with a developer platform to give access to customer data to external participants to build products and solutions for its customers.

No longer independently blue*

It’s not just the digital banks but even traditional banks that think banking of the future would be modular, where banks would provide only a subset of products and services, while the rest of the offerings would be from an assortment of ecosystem partners. The quest for modularity has also stemmed from constraints beyond regulations.

Not too long ago, mobile first strategy emerged as a dominant theme in banking. Applications were reimagined to be delivered through mobile, adapting to newer, smaller form factors. Mobile enabled banking on the go – hugely convenient for customers. But the backend infrastructure complexity remained, which meant business challenges, such as lack of personalized products, slower innovation, delayed go to market persisted? Could APIs be the solution?

APIs, upending industries such as retail, transportation, travel and technology, have gradually gained traction within the financial services industry. Considered an enabler of innovation, APIs are software programs that allow disparate applications to communicate and share information with one another. An API strategy could result in not just enhanced customer experience and competitiveness but also operational efficiency.

Leading banks such as BBVA, Capital One, HSBC, RBS, all have developer portals — offering APIs, software development kits and support to external developers and tech firms to build new solutions. The API based middleware connecting banking assets and third-party applications has led to the rise of Banking-as-a-Service or BaaS.

To understand BaaS, let’s take a simple example – Bank B has a cumbersome paper-based mortgage process. Fintech F has just the solution – a fully digitised product spanning the entire mortgage process from application to approval, complete with a super easy to use interface.

F needs customers – a banking license would be good but customers are essential. B’s API gives F access to B’s customer data. Soon, B’s customers have a hassle-free experience applying for mortgages and F has access to a well-established customer base. BaaS can often result in point solutions such as personal finance management tool, accounting software, interest calculators or ATM locators being developed by third parties.

These solutions can be sold as standalone applications, be part of an app store, or integrated into a product suite, all of which may or may not be owned by the banks.

In contrast, Banking-as-a-Platform or BaaP is all encompassing. To understand why, we’ll first take a quick look at what defines a platform.

*The colour of the logos of most prominent financial brands such as RBS, Barclays, BBVA and Visa is blue.

Back to Basics: So, what exactly is a Platform?

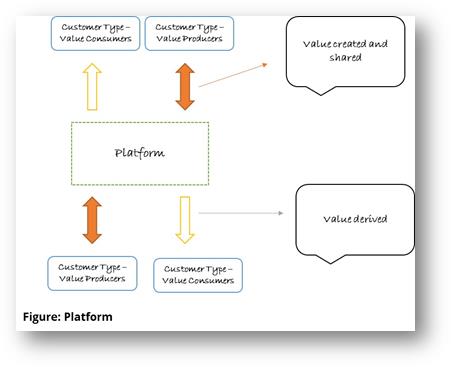

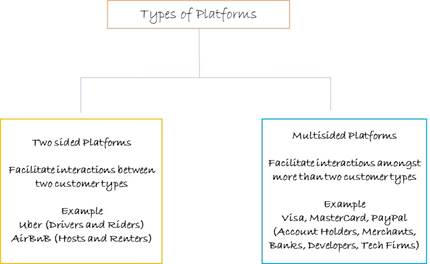

A platform is a business that creates value by facilitating direct interactions between two or more distinct types of customers. Value creation is a persistent theme and together with interactions forms the basis for network effects, without which a platform is ineffective. Customer types can be further divided into value creators and value consumers.

For instance, Facebook facilitates direct interactions between content generators (value creators) and users (value consumers). Facebook itself is a platform owner or facilitator providing the infrastructure for the interactions, among the different customer types, to originate and sustain.

Though the most commonly thought of platform businesses are Uber and AirBnB, I’ve deliberately omitted the two because the companies’ focus is largely confined to their respective industries, namely transportation and short-term rentals.

To truly understand the potential of platforms, one must look at companies that have used a platform strategy to springboard into areas that might have traditionally been perceived as outside their areas of competency.

Some of the best-known examples of companies considered pioneers of platform strategy are Apple, Amazon, Facebook, Google and more recently, Tesla.

In 2006, Apple was a nonentity in the mobile phones industry, which was dominated by the likes of Nokia, Motorola, Samsung, Sony and LG which together controlled 90% of the market share. By 2015, Apple had turned the market share on its head, generating 92% of global profits while the former incumbents except for Samsung struggled to stay afloat. What did Apple do differently?

Apple, known for being obsessive about owning its products stack across hardware and software, took a leap of faith when it decided to enter the mobile industry. It adopted a platform-as-a-service strategy, opening its operating system to external application developers.

Application consumers formed the other side of Apple’s two-sided platform and together the two built the foundation for the success of Apple’s App Store, hugely responsible for Apple’s unforeseen growth in an industry it had no experience in.

Since then, Apple’s platform strategy has led to its growth as a formidable platform company. It has ventured into healthcare through wearables, financial services through mobile wallets, contextual commerce through AI-powered virtual assistants and even autonomous cars – industry adjacencies possible due to Apple’s platform strategy of partnering with external parties, be it developers or partners such as banks and retailers.

The approach helped Apple not just reduce its time-to-market but iteratively improve products based on constant feedback, unlikely if the company had remained closed to external influences.

Over two decades ago, Amazon started life as an online book store. Today Amazon’s ecommerce site is a thriving marketplace where thousands of retailers can set up virtual shops and start transacting with customers. Had Amazon continued with its original narrow business model, focusing on the sourcing and selling of books, it would have offered limited options to its customers.

In fact, Amazon’s story is largely about turning its limitations into new business models. But the going was hardly smooth. Amazon started to face scalability challenges when like any typical company, it faced delayed projects because project teams built custom infrastructure, costing a great deal of time and effort and resulting in duplicated infrastructure.

To bring in standardisation and shorter project delivery time, Amazon decided to have common infrastructure services, which eventually took the shape of its next business idea – Amazon Web Services. Owning the front to back end infrastructure demonstrates Amazon’s need to be as self-sufficient as possible.

Take its recent foray into drone technology and dedicated logistics infrastructure (it now owns cargo planes and has reduced dependence on transportation companies such as Blue Dart and DHL).

This independence has resulted in ensuring quality of services such as free two-day shipping for Amazon Prime subscribers.

Amazon’s shape shifting strategy becomes apparent in the way it has entered the entertainment industry through steaming media and video on demand, hardware manufacturing from tablets to smart speakers, to financial services – debuting with payments (Amazon Pay) and progressing to lending to SMB retailers (with Amazon Lending).

Amazon loves Customer Infidelity!

“Our customers are loyal to us right up until the second somebody offers them a better service. And I love that. It’s super-motivating for us.” Jeff Bezos, Amazon CEO

Tesla known for autonomous cars has launched its own ride sharing platform called Tesla Network. The inspiration behind the network is addressing a major customer pain point. On an average, car owners use their cars just 5-10% in a day which doesn’t justify their investment in terms of the large car loans they must repay.

Tesla decided to capitalize on this issue of owning expensive assets which remain heavily underutilised. Creation and sharing of value with customers are what powers the network. Tesla car owners can monetise their cars by renting them out to other users on the network.

What’s in it for Tesla? Through its platform strategy, Tesla gains exclusive control of continuously streaming customer data which it can then use to enhance its services.

With a robust platform strategy, each of these companies has expanded the breadth and depth of its reach. Had Amazon thought of itself as just an ecommerce provider, had Apple restricted itself to the business of selling mobile phones or had Tesla focused on producing and selling electric cars, none of them would’ve managed to be dominant forces in their industries.

Instead, Amazon thinks of itself in the business of selling and enabling sales – that explains its strategy behind embedding itself along the entire value chain from contextual commerce through smart speakers that lets users instinctively search, parse, and place orders from a wide products repository, to offering financial services to its merchants to easily do business using its online marketplace.

Even AWS is designed around minimising friction in customers’ end to end purchase journey. By controlling the customer journey, Amazon has continuous access to data generated by its customers, helping it constantly refine its value proposition.

Tesla likewise has focused on building an ecosystem around customers who buy its cars — right from owning a car, having access to convenient charging docks to monetizing their cars through rentals — customers can avail all these services, that are so conveniently provided on Tesla’s network. Like Amazon, Tesla is a one-stop destination.

And that brings to the fore, certain characteristics shared by the platform leaders.

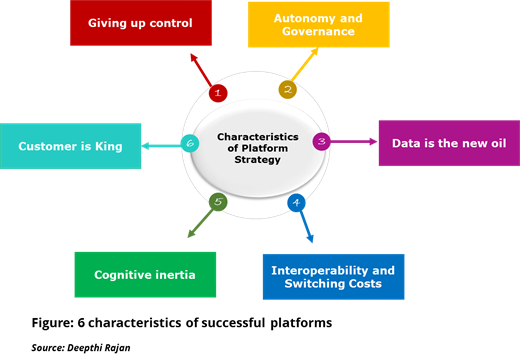

Giving up absolute control

Early on, these companies realized that zealously guarding their entire product and services stack would hinder their ability to cater to increasingly diverse and demanding customer base. External partners, dabbling in numerous niches, enable the companies to serve the oft overlooked but highly profitable long tail of customer needs.

Autonomy and Governance

While product development is largely autonomous, third parties are held to high standards when it comes to product or service delivery. By putting in strong governance mechanisms, platform owners ensure partners are accountable for quality.

Data is the new oil

And platform owners know it best. While they co-create with their partners to build customer facing applications, the platform companies still control the infrastructure layer through which customer, product and service data flow.

A modular middleware layer, which connects the back-end infrastructure to the customer facing applications, enables seamless interoperability and thereby, data and information sharing, among their own applications and those of their external partners.

Interoperability and Switching Costs

Tesla’s cars, Amazon’s products or Apple’s apps can be bought and used on only their platforms. By limiting interoperability with competitors’ products, these companies pursue a customer lock-in strategy.

Network effects on the platform get amplified because customers generate value through greater number of interactions with one another.

Cognitive Inertia

According to Hick’s law, the more choices people are given, the less they choose anything. Successful platforms ensure customers don’t have to do any heavy thinking. Back-end complexity is masked from customers.

Be it search, comparisons, recommendations, or payments, these platforms reduce customers’ efforts by simplifying the end to end processes of making purchases or availing services.

Customer is King

Companies, in general, focus on achieving product leadership, operational efficiency and customer intimacy. But the magnitude of focus on each of the three dimensions should vary depending on the maturity of the products and services the companies offer.

The overarching objective driving platform strategy is customer intimacy. Even product leadership and operational efficiency are informed by customer intimacy goals. It’s customer intimacy which yields sustainable profitability. It’s also the hardest to replicate.

Throw in network effects and its gets harder still to imitate. For instance, Amazon’s decision to control its logistics from transporting to delivery is informed by its customers’ need for real time tracking of their orders.

The success of platform strategy in other industries is a strong indicator of its potential in the banking and financial services space. And that brings us back to API driven services and BaaP.

Curated Marketplace

With BaaP, banks can curate the best applications that complement its customer and product strategies. BaaP will help banks create marketplaces that meet customers’ banking needs through a wide mix of in-house and externally developed products and services, all provided on bank owned platforms.

The solutions can be built either using tools such as banks’ developer portals or created independently.

But can BaaP prevent the banks’ existential crisis due to disintermediation or will it deepen it further?

Disintermediation due to ‘Unbundling’ –Threat or Opportunity for Banks?

Today, as banks face declining interest income from their existing business models, the tactics adopted by most banks, in a bid to retain customers, lack differentiation.

It’s not uncommon to see banks following up with similar products or services as those launched by competition. If a bank launches a new voice based authentication, mobile wallet or even a mobile app, other banks soon follow suit with similar offerings.

Undeniably, it’s great that banks are constantly innovating with new technologies, be it biometrics, virtual assistants, augmented or virtual reality, but in addition to these solutions, customers seek relevant financial products or services, be it deposits, loans or financial advice, customised to individual needs.

So, when nimble fintech companies deliver personalized experience through a deep and focused understanding of the pain points in customers’ banking journey, what does it mean for customers and banks?

For customers, it’s a great deal – access to better products, elegant user interfaces and enhanced services. But the downside is, customers must deal with a fragmented set of service providers for different services – loans from one company, investment advice from another, deposits from a third and so on.

For banks, fintechs with their narrow offerings, minimal regulatory obligations and zero legacy technology infrastructure, are an uncomfortable reality.

Unless of course, they acquire a fintech (BBVA’s acquisition of Simple) or partner with one (HSBC with Tradeshift). But many such relationships are largely driven by a zero-sum mentality, where one party wins often at the expense of the other smaller player.

But it doesn’t have to be this way. With BaaP, banks can design a win-win strategy for themselves, their partners and most importantly, for their customers.

But as we’ve seen with successful platform companies, access to internal data, transactional and relationship, are provided through APIs to allow third parties to participate in building ecosystems. As banks plan their platform journey, they must look at the kind of APIs that would help their partners devise new uses for their existing offerings.

It could be a new product, service or even bringing banking to customer groups such as the unbanked. Though it’s often difficult at the outset to predict the innovativeness of the use cases devised by external participants and the ways such use cases could translate into tangible benefits for the banks, yet providing APIs is a crucial first step.

Starting small with BaaS

Not just banks, even financial service providers such as Visa and MasterCard are facing disintermediation from the likes of PayPal, Dwolla and Square.

Like BBVA and Capital One, if one were to look at the product roadmaps of Visa and MasterCard, it quickly becomes apparent that a robust platform-as-a-service strategy is necessary to help them pivot from their traditional business models, increasingly under threat from upstarts.

In recent years, both have introduced developer platforms, that support external developers, technology companies and financial institutions develop innovative application prototypes. The card processors have turned catalysts for spurring ingenious use cases, leveraging their years of expertise and data.

For instance, Smooth Commerce, a Canada-based mobile commerce and engagement platform, integrated Visa’s Checkout API to streamline customer onboarding, loyalty and payment processes. For Smooth Commerce, the clients are retail businesses who on one hand, use its platform to offer a seamless payment experience to their customers and on the other hand, derive actionable insights from analytics offered by Smooth Commerce’s platform.

Now imagine, if Visa had decided not to provide APIs such as Visa Checkout to third parties such as Smooth Commerce. Of Visa’s customer base of merchants or retailers, only a subset would have integrated Visa Checkout on their websites or mobile apps.

But companies such as Smooth Commerce that greatly expand the reach of Visa by not just offering retailers Visa’s seamless checkout process but also providing information on their customers, their shopping behaviours and ways to engage them effectively, thus driving more traffic back to Visa.

For banks, providing APIs is a great way to encourage product development. While partners can leverage bank owned assets such as data and customer relationships, banks can acquire fresh data, through the new offerings, on different customer behaviours and journeys.

Beyond BaaS to BaaP

Consider peer-to-peer payment or ecommerce providers that largely deal with micropayments, transactions that are small in value but high in overall volume. Most of these companies don’t have the technology infrastructure to process the high volume of transactions daily.

And because financial transactions must also follow compliance and legal procedures, together the two play a key role in determining the scalability of such companies’ operations.

And precisely these challenges of scalability and regulatory compliance are what makes the idea of BaaP, strongly appealing to those who can’t otherwise afford to set up financial services on their own.

But will BaaP render banks simply as infrastructure facilitators that enable third parties to build applications and control customer interactions?

On the contrary, with BaaP can lead to new monetization opportunities.

New Revenue Models for Banks

White labelling

solarisBank, a Germany-based fully licensed digital bank, is on a mission. It wants to help companies, any company, become financial services providers. solarisBank, using its regulatory and technology infrastructure, has developed a modular banking kit that includes APIs for account and transaction services, compliance, loans, working capital and more.

And who would be the likely customers of solarisBank? Any company, from fintechs, telcos, ecommerce providers to internet companies that want to offer financial services but lack banking licenses or the technological know-how to do so.

Fidor Bank, another German digital-only bank, follows a similar model of serving customers through its open source platform and easy to implement set of APIs. It has already helped a leading German telco and a UAE-based bank set up digital banks using its platform. IN 2015, six years after it was founded, Fidor attributed 30% of its revenues to its platform based technology offerings.

More recently, BBVA has released eight APIs for commercial use by third parties. The APIs, applicable for a host of use cases from cards, payments, accounts, loans to notifications, can be bought for a fee and integrated by companies, start-ups and developers into their products.

Alliances and Partnerships – All about Relationship Management

Changing customer and competitor dynamics should compel banks to explore new sets of services that don’t necessarily fall within the ambit of conventional offerings.

A 2017 report by Accenture states how banks are well positioned to offer non-bank and add-on services such as home security, roadside support – peripheral yet essential services associated with traditional banking products like mortgages and vehicle loans.

A BaaP strategy is fundamentally about building an ecosystem of partners who could effectively serve a bank’s customers. While BaaS and modular banking platforms are essential for BaaP, establishing and leveraging relationships with service providers could become a strategic and difficult to imitate advantage for banks. For BaaP to reach its full potential, banks should look at three types of customers/ partners –

- Technology companies/developers/ fintechs

- Service Providers (retailers, property firms, educational institutions and so on – ranging from small businesses to established firms)

- End users

While the first and third types are well understood, it’s the second set of customer/ partner relationships that banks should start focusing on.

For instance, in the mortgage space, banks can build a network of property firms that it can use to recommend best fit solutions based on customers’ location, budget and property preferences.

With banks providing the validation layer, in terms of verifying and onboarding only credible partners, customers are assured of dealing with trustworthy parties. The property verification service can be either offered by banks directly or through their fintech partners.

Such a B2B2B2C model can be another avenue for generating revenues for the banks.

Winner takes it all

With regulations such as PSD2 and Open Banking compounded by surging demand for better products and services, banks will look to partner with upcoming firms that serve niche customer needs well.

Exclusive agreements could become a favoured integration option for banks curating the ecosystem for superior solutions. Fierce competition to partner with the best of breed fintechs and other service providers could mean only the most aggressive, persistent and astute banks will succeed in onboarding the most competent partners.

Such alliances will result in greater value generation for all the ecosystem participants, leading to strong network effects.

Challenges in implementing a platform strategy

Technology changes for the better

Technology infrastructure that allows easy integration of applications and functionality, both internal and external, is crucial for BaaP.

But traditional banks have been in existence far longer than the new age companies covered here which means that banks must overcome legacy technology infrastructure challenges not faced by its younger competitors.

Additionally, all leading platform providers have modular architectures that permit easy interoperability. The platforms are also built on open source technologies, such as Linux, Ruby on Rails, Apache, MySQL, PHP and so on.

Banks on the contrary, have legacy banking applications built on proprietary technologies, lending a high degree of non-homogeneity and making interoperability a major challenge. Furthermore, banks typically have multiple core banking systems for the different geographies they operate in. The multivendor nature of these applications means that interoperability is possible only through manually intensive customization.

Without a flexible middleware to connect all such disparate applications, banks have resorted to building additional layers, a short-term fix that only serves to increase the complexity – a situation not designed to scale for innovation, faster time to market, customer experience and efficiency.

However, a growing positive trend in the financial services space is the move away from building custom solutions to using open source tools and components. Financial institutions are increasingly embracing the idea of contributing to the open source community as opposed to the earlier practice of building everything by themselves.

Doing so has helped the companies improve their systems at a much faster pace by leveraging the power of collective wisdom of the open source community.

This is an important step in building the right infrastructure that would allow easy integrations among the bank and its various ecosystem partners. The other step, a longer-term approach would be to look at overhauling complex core banking systems that prevent banks from attaining ‘single view of customer’, a critical factor for banks to succeed at forging and sustaining profitable customer relationships.

Culture Maketh a Bank

Like digital, can BaaP be regarded as a new channel or distribution medium? Or is it something much more? BaaP, if implemented right, can change the way banking has always been done. It’s a paradigm shift but one that at some point, I believe will be adopted by most large banks.

But success of BaaP relies heavily on the ecosystem partners that a bank would chooses to associate with. Technology, though hugely important, could still be replicated. Relationships not so much. With BaaP, banks would have to encourage collaboration and healthy competition among its internal workforce and those of its ecosystem partners.

Changes, product or service related, will require coordinating and communicating among multiple sets of stakeholders such as financial technology companies, service providers and independent developers. Mediating and negotiating would be important aspects of managing relationships. For banks used to absolute ownership of their product and service stacks, such a change might be difficult to adapt to.

The good news is that banks have started to, in small ways, engage with fintechs and start-ups through accelerators, incubators and hackathons. But rather than limited or one-off interactions afforded by the current practices, BaaP should make the internal-external partnerships, the very foundation of the banking experience.

Humanizing banking interactions

“I think what’s going on is a commoditization of linear intelligence. Robots will almost definitely be better than we are at number crunching and linear processes. But I think humans are really good at being human, we’ve just lost the time and inclination to do that. As we seek to be relevant in a world that’s being taken over by robots, these unfocus techniques will place us at an advantage.”

– Srini Pillay, Associate Professor, Harvard Medical School and Author of Life Unlocked

For banks used to absolute ownership of their product and service stacks, such a change might be difficult to adapt to. The good news is that banks have started to, in small ways, engage with fintechs and start-ups through accelerators, incubators and hackathons.

But rather than limited or one-off interactions afforded by the current practices, BaaP should make the internal-external partnerships, the very foundation of the banking experience.

Summing it up

It has increasingly become clear that banks are unlikely to be a one-stop destination for their customers banking needs given banks’ legacy technology systems and siloed operating ways. Banks will find it difficult to flexibly meet growing customer expectations.

And if we were to look at the customer groups across the wealth pyramid, it’s clear that banks in their current avatar cannot scale to serve the different groups, each with their own complex requirements for banking products and services.

BaaP is crucial for banks to stay relevant or else banks’ run the risk of obsolescence due to fragmentation of its offerings by fintechs and non-financial services providers.

With BaaP, banks should look at overhauling their infrastructure to enable easy interfacing with external partners. Banks should let their partners take lead in product and service development. At the same time, banks should be in control of all the customer data that flows across the multitude of applications offered by their partners.

Focusing on operational efficiency and customer data analytics would allow banks to strategically design customer experience journeys with apt offerings by leveraging the expertise of their partners in product development.

In a BaaP-like set up, it’ll be unlikely that banks are reduced to an infrastructure provider role. Instead, managing relationships among the many players that make up its ecosystem, a bank would be the only entity to have a holistic view of how all the different moving parts will work together to serve customers efficiently.

Now that’s a role that can’t be imitated easily by competition or upstarts.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Business Model, Featured