This book focuses on one question: How can large companies generate business impact from non-incremental innovation?

An Introduction by the authors Frank Mattes and Dr Ralph-Christian Ohr

“The situation seems paradox. Winning in non-incremental innovation should be the domain of large companies, not of greenfield startups. Yet, 7 out of 8 corporate startups do not generate business impact. And the media is full of stories that greenfield startups are ‘disrupting’ incumbents.

To stack the odds for success, large companies have tried to emulate the methods and approaches of greenfield startups. They set up explorative innovation units (called Innovation Centers, Incubators, Accelerators, Digital Labs, Innovation Outposts, Fab Labs, Maker Spaces, etc.). Around the globe there are more than 600 of these. But returns on innovation are decreasing – despite increasing investments into innovation.

We think that the root cause – and hence the Archimedean point for solving the problem – lies in one part of the end-to-end innovation process. Companies need to think one step further, beyond their explorative innovation units. They need to actively shape the phase that comes after a promising innovation concept has been found and validated.

We call this phase Scaling-Up.

In this phase, business impact is generated. Success in this phase requires an orchestrated interplay between the corporate startup and the core organization, built on a solid methodology.

With excellence in Scaling-Up, a corporate startup has the entrepreneurial momentum of a small company and (by leveraging the assets of its parent company) an ‘unfair advantage’ in the innovation race. With every successful corporate scaleup, the company not only increases growth, EBIT and market cap – it also actively reshapes its core business for tomorrow.

Without excellence in Scaling-Up, validated innovation concepts will not generate business impact. In other words, if a company is not good in Scaling-Up, all work done in the Ideation and Validation phases is just a costly hobby.

The book is written for Top Managers and members of the Board who are concerned about the business impact that their innovation investments create. It is also written for corporate practitioners working in explorative innovation units, in Corporate Innovation Management, Corporate Research, Group Technology, Corporate Strategy, Corporate In-house Consulting or in comparable functions. And we also had Senior Management from Business Units in mind when we wrote this book.

This book draws on our extensive consulting experience in this space and is co-written with our clients. We assembled a cross-industry ‘Peer Group’ of well-known, large European companies – all of them widely seen as good innovators or even innovation leaders. In the process, the group members analyzed relevant research, shared their Good Practices, developed and validated methodological frameworks and helped each other in Peer Coaching.

The reader of this book can benefit from the Peer Group’s work and findings. Some readers might be more interested in ‘how-to’ methods, others more in practical experiences. This book contains both.”

Inside this Executive Summary

- Understand: What is scaling-up?

- Prepare: Work to do before scaling-up

- Scaling-Up: the process outlined

- Lessons learned from the real world (Telefonica, Orange, Bosch, TŰV, SIX, TRUMPF)

Summary of the summary

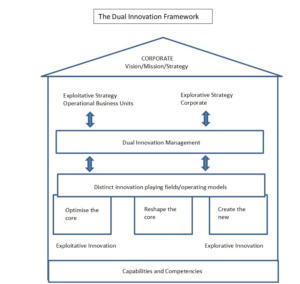

- There are three innovation playing fields to run concurrently: The Innovation “Playing Fields are “Optimise the Core” – exploit existing business. “Reshape the Core” -adapting “new but proven” technologies. “Create the New” – non-incremental innovation, exploring new business models, technologies. Each of the innovation Playing Fields needs a dedicated and distinct operating model. 6% of organisations manage to run all three well concurrently (Accenture research).

- Successful innovation requires an innovation management framework: comprising a Comprehensive overarching corporate vision, mission and strategy, senior leadership alignment and engagement, dual innovation management (running exploitative and explorative innovation in the way best for each)

- End to End innovation process stages are: Ideation, Validation, Scaling-Up, Growth. In the 4-stage process, most organisations can manage items 1,2 and 4. It is the scaling up part that Organisations find hard.

- Scale up success rate is low: converting non-incremental innovations into substantial businesses has been disappointing. Corporate scale ups stand 1,700 times more chance of success than a greenfield start up, yet 7 out of 8 fail (C. Zook: HBR 2016

- Scale up issues: Commitment missing post the Ideation phase (which is the cheap to do part). Scale ups are complex, it is not easy work. Organisations lack scale-up-supportive formal managerial. Cultural barriers hinder scale-up

- Dual leadership is an enabler of Scale up success: core business units have a paradigm of mid-term time frames, risk minimising, value maximising. New business (non-incremental) has a lean start up, long term to impact, explorative, fail fast paradigm. Senior leaders, particularly the CEO and direct reports always need have a bilingual approach and be able to lead in the natural tension that arises. Sounds simple but few can do it, leaders need to be strategist, visionary, communicator and active sponsor

- Elements to complete in pre-scale-up: validation of the product/service is crucial to being ready to scale up (Desirability, Viability, Feasibility). The aim is to get to Minimum Viable product and achieve Product Market Fit (product satisfying target market).

- Common errors made in Scaling up: Product market fit is for Pioneers who do not represent the mainstream. Validation is of the product only, testing the business model viability and feasibility of industrialising the product is often not done. Finally, feasibility is often not fully validated: – show stoppers such as privacy concerns are not tested.

- Good Pre-scale steps: Validate 4 dimensions concurrently: (Desirability, Viability, Feasibility and Contextuality) in a managed swim-lane type project management process. Build evaluation points “Value Inflection Points”: that connect the swim lanes and give you jumping off points to check on progress. Value inflection points include: Problem-solution fit (PSF), Minimum Viable Product (MVP), Minimum Marketable product (MMP), Minimum scalable venture (MSF).

- Good Pre-scale test questions: Desirability: is the sale pipeline filling? Do we have a first paying customer? Viability: do we have a clear pathway to profit? A roadmap from “must have” pioneers to mainstream customers? Feasibility: do we have partners established? Is there a clear and committed budget? Contextuality: is the governance defined and the scale-up been embedded into parent company roadmaps, portfolio management and budgets?

- Funding is often unreliable: Corporate scale-ups often need to shift priorities in the fight for funding. The scale-up decision should be taken at the same time as a commitment to fund the whole scaling-up process.

- Corporate enthusiasm and funding vanish at scale up: Top management sees the Minimum Viable Product as “job done” and moves onto other things, leaving the business to carry on with the integration. Business Unit SME’s head back to their day jobs.

- To Scale up successfully: set up workstreams: Value chain build: building up the validated product into a robust industrial product (reliability, customer care, cyber security etc). Market making build the go-to-market approach to cater for the mainstream. Grow the organisation: in scaling up that we move from 2-5 FTE to 50-150 FTE. Transition the management system: the organisation/management system in the scale-up must start to look like the parent. Set up Governance/funding: that fits with the way the parent works. KPI’s/Metrics: move to those that are suitable to the established business. Ensure you have milestones. These can be revenue goals or valuation goals. HR items: this includes the pay and conditions and incentive schemes of the start-up being harmonised with the parent.

- Scale up collaboration killers: Areas of tension that block collaboration with the core business are basically about being different. Blockers include differing paradigms, the scale up Business model, the partner Ecosystem, Governance processes, Metrics, KPI’s, Organisational complexity, IT systems, Reward systems, Brand, Culture, People capabilities and Leadership/Ownership.

- Building for successful collaboration: Actively design for collaboration: have a relationship launch day. Measure collaboration, find common ground, foster collaborative behaviours have one process for formal resource allocations, pay in full for core business services, have contingency plans, prioritise the long term, set special targets/bonuses: e.g. selling a new concept/product is a tougher sales cycle than usual. Understand the value equation together, define the value contribution: ensure each side understands what each brings to the table. Operationalise collaboration via shared protocols to manage differences, processes for everyday work.

1) Understand: What is scaling-up?

Modern Innovation Management

Innovation is played out in three “Playing Fields. Organisations can manage each in isolation, few have an overarching framework that consciously recognises all the playing fields and manages them well concurrently. This means that organisations struggle to run each playing field with a relevant management process for each.

The “playing fields” are:

- Optimise the Core: this is where we exploit existing business and move product through the S curve of development. The process uses existing business models (linear stage gate) using an existing technology. It is incremental innovation, exploiting what already exists. An example in the Automotive industry would be the ongoing year on year development of a model of car. Time to business impact will be short time frame (1 to 2 years).

- Reshape the Core: this is about adapting “new but proven” technologies and/or making changes to the business model and then scaling up. This will be incremental innovation, exploiting new but known concepts. An example in the Telecommunications industry would be 5G mobile technology. Time to business impact will be mid time frame (2 to 5 years).

- Create the New: finds and validates new businesses. The concept will be new to company or industry or world. It is about the exploration of new business models, technologies and typically will use Design Thinking, Agile or Lean start up methods. This is explorative, non- incremental innovation. Time to business impact will be mid time frame (2 to 5 years).

Optimize existing, reshape Tomorrow, create the New

Doing all three of these well at the same time is a real challenge. Each is dealt with in its own silo. Optimising is usually held in Business units. Reshaping is a mix of Business unit and some form of Corporate central group. Creating the new is usually run in a central function (incubator, innovation lab or similar).

Integration of Non-Incremental Innovation needs to be designed

The success rate of converting Non-incremental innovation into substantial businesses has been disappointing. Doing integration well will lead to three great outcomes:

- Success in scaling up a validated innovation concept into a material business.

- Adaptation of existing business (e.g. via Digital Transformation)

- Establishment of modern corporate innovation management.

The results are in – we are not ambidextrous

Accenture conducted a survey of over 1,400 companies on the topic of innovation. They found that less than 6% are doing well at Optimising, Reshaping and Creating the New concurrently. Companies that can “reshape the core” excellently show consistently better earnings results than the rest. In those companies who are great at “reshaping the core”, 60% see this innovation playing field as important. Of those who are not so good at “reshaping the core” only 28% see that activity as important. Top players achieve and know what enables success.

Connecting Exploitative and Explorative innovation is important

Ability to execute both types of innovation concurrently means scaling up of innovation will be possible. Elements seen today missing in many organisations (remember 94% cannot do this) are:

- Focus is on scaling up an individual project rather than providing a systemic process allowing all innovations to scale up.

- Scale up is based on Green Field thinking rather than Brown field reality. “Green Field” is fine during ideation, but as we move to scaling up the business an integrated approach is needed, and corporate assets must be leveraged to succeed. This move to brown field cannot be an afterthought or one-off, it needs to be in the process design of innovation from the start.

- Today there is a lack of flexibility in thinking about the different pathways for scale up. These include spin in, spin out, internal development, external development.

Playing Field management

In companies, the Central corporate units and the Business units operate on different paradigms. Corporate is mid/long term focus, Business Units shorter-term focus. Corporate is dealing with uncertainty whilst Business units are about minimising risk. These differing perspectives create a natural tension.

Each of the innovation Playing Fields needs a dedicated and distinct operating model. Playing Field 1 (Optimising the core) and Playing Field 3 (Creating the New) are more obvious and have distinct management structures in most organisations. They have their own distinctive governance, funding, process, culture and leadership structures. “Optimising the core” falls naturally into a Business unit management – development, exploit the known – model. “Create the new” fits into a Corporate – non-incremental innovation, explore the unknown – model.

Playing Field 2 (Reshaping the core) is mandatory in modern corporate innovation management and the hardest to manage. It is in Reshaping the core that we find the most tension: who “owns” this playing field? The options are a Corporate unit, a Business unit or a well-defined joint ownership. To be successful Playing Field 2 needs a distinctive operating model.

Scale up successfully

To succeed in scaling up, an innovation management framework is required, comprising of:

- Comprehensive overarching corporate vision, mission and strategy

- Senior leadership alignment and engagement

- Dual Innovation management (running exploitative and explorative innovation in the way best for each)

- Comprehensive management of competencies and capabilities

Nespresso is a great example of an explorative innovation that made the scaling up journey to become a huge success.

A Scale up success story

Think about “Nespresso”. This started as an innovation within Nestle. The Nespresso business model is different from that of its parent; there is a club to which customers belong, different target market, a distinct group of key partners. It scaled up from a small-scale innovation to a multi-billion-dollar business. This is though, the exception. Accenture has estimated (from a survey of the largest 1,000 companies in the world) that the chance of a corporate start up to mature into a substantial business was 1 in 8. The bridge that has proven tough is the middle part, taking a proven idea from the lab and integrating it into the mainstream business to scale up/industrialise.

Defining “Scaling up”

The end to end innovation process broken into 4 steps:

- Ideation: Based on meaningful insights, promising value propositions are developed and ideas as to how to capture value via new products, services, business models and processes.

- Validation: Concepts are developed, tested, reworked, refined, tested via an agile Build Measure Learn approach.

- Scaling-Up: Validated innovation concepts are scaled up to the point that they are a material business that can be transitioned and integrated into an operating Business unit.

- Growth: Using existing corporate assets (brand, channel) and proven approaches the business unit drives growth of the business.

In the 4-stage process, most organisations can manage items 1,2 and 4. It is the scaling up part that they find hard. Think about your own organisation and do an honest check:

- What is the current Return on Investment on Innovation investments made 3-5 years ago?

- What % of revenue is made up of products less than 3 years old?

- How are corporate scale ups resourced and funded?

- What % of Scale up management time is spent on convincing the main company of the need for the product and building compliance vs industrialising the innovation and making a market?

Scaling up comes up against barriers of culture, managerial design and commitment.

Common problems encountered in scale up

- Shaky foundations: Scale up decision is too hasty, and product/service is not ready.

- Commitment missing: Ideation is cheap. When you get into productisation a real level of resourcing (people, equipment, money) are required on a less than certain financial return. Senior Executive attention will go elsewhere as their own motivation is driven by KPI’s to more certainty and speed to market. This lack of commitment will lead to understaffing for the new concept.

- Scale up Complexity: it is not easy, and it is not routine. Driving a scale up of innovation is the road less travelled and there are not many managers around with the experience to successfully navigate the organisation and drive through the complexity.

- Inadequate formal managerial design: during scaling up investment starts to get to serious money. Putting in place formal governance, KPI’s and other managerial design processes proves difficult at this point for many organisations. Suddenly that greenfield idea that needed little control during its explorative ideation stages now moves to requiring close attention. This transition proves hard.

- Cultural barriers – the tension described earlier between the Business unit and Corporate paradigms really come true at scale up. The grey areas of control and transition/integration into mainstream can kill many ideas.

Why are Corporate Scale ups not winning hands down?

What follows is not theory, it is based on what has really been happening in the Corporate Scale up business. The reality is most fail and they should not. The words and aspirations and desires of Corporations are to spawn new high value business. The reality is that they fail at this most of the time. There are 3 main contrasts between them, and their Greenfield start up equivalent:

- They lack flexibility: Corporate start-up/scale ups are usually the outcome of an overall Corporate innovation strategy. This limits them compared to a greenfield start up. There will be borders or scope within which the corporate scale up is expected to work. The independent greenfield is not limited and can pivot to a new business completely if the original idea is flawed. You Tube for example was originally an online dating site allowing users to upload videos of themselves. Success was limited and so the founders pivoted the business to allow any user to upload any video. This massive scope change would be unlikely to make it through any corporate governance.

- They face a collaboration drought: A Corporate scale up has a massive theoretical unfair advantage over an independent greenfield start up. Research by Chris Zook published in Harvard Business Review in 2016 found that a Corporate scale up theoretically stands 1,700 times more chance of success than a greenfield start up. The unfair advantages of having a corporate parent include funding, brand, reputation, channels to market and industry, existing value chains and supply chains with trusted partners, in house expertise in specialist technical, legal product and other disciplines. Yet 7 out of 8 fail due to a lack of effective collaboration between the corporate scale up and the mainstream organisation. The scale up in its early stages is built on Build Measure Learn techniques and as such is not industrial in scale or reliability. When the scale up tries to work with the mainstream which is built on strong industrial scale repeatable processes, risk mitigation and error minimisation, the clash is often just too much. In a Greenfield start up there is no parent organisation to fold back into and so this lack of collaboration just does not exist.

- They must fight a two-front war: A Corporate scale up is fighting to make its place in the market. At the same time, it is fighting a rear-guard action against “corporate antibodies”. In addition, they must keep an eye on the fortunes of the parent. A bad quarter may lead the CEO to reprioritise the organisations investments to placate shareholders and that can impact innovation activities. Watching the rear-view mirror dilutes effort from the main game which is to win in the market. The independent greenfield start-up has a singular focus and that is to win in the market. This builds up an obsessive zeal in many start-ups that gives them a chance when in theory they should stand no chance.

Dual Leadership: being able to lead explorative and exploitative innovation will help your organisation stay ahead of the competition.

Dual leadership is an enabler of Scale up success

We noted earlier the ambidextrous nature of the business model to enable success for both Exploitative and Explorative innovation. So, core business units need to ensure they have a paradigm of mid-term time frames, risk minimising, value maximising. New business (non-incremental) must exist simultaneously with a lean, long term to impact, explorative, fail fast paradigm. Senior leaders, particularly the CEO and direct reports always need to have this bilingual approach and be able to lead in the natural tension that arises. Sounds simple but few can do it. There are three main tasks of leaders to create an environment where a dual innovation strategy can work:

- Be a strategist: new non-incremental innovation has the threat of disrupting existing value streams. The leader needs to be the advisor and sometimes the sparring partner of the new business. Above all though the leadership need to formulate overarching strategy into which innovation fits and be prepared to manage the tensions that will arise from the current revenue generating business and new potential business. This means being prepared to adapt the strategy to circumstance. Without strategy encompassing innovation the organisation is driving blind, unaware of whether disruption is ultimately of value.

- Be visionary and communicate painting a picture of where the company will be is vital to the teams executing on strategy. This needs to be done often, repeatedly in differing situations and contexts. Acceptance of new realities and real engagement into the actions needed is a slow process. It can only be achieved through communication and leadership display of the behaviours asked of others. Leaders will not implement the Core business and the New Business. They will not execute the integration and scale up. What they will do is create the environment for others to do it by communicating and painting the picture, often.

- Be a sponsor and manager: leaders must be prepared to devote time and resources to both Explorative and Exploitative innovation. It is their role to be involved when asked. Delegating when asked to make a key commitment or decision is not innovation leadership. It is the role of the leader to ensure good cultural fit for the various innovation types and pay attention to when confluence occurs, and integration is required between Core and New. This confluence point is where leaders are needed more than ever to support and help the success of Scale ups. Leaders are likely to have evolved from either one area (Exploit leadership – likely to have Operations skills) or the other (Explore leadership – likely to have Corporate i.e. Chief Technology Officer skills). The skill in leadership is to understand and value both leadership types and to really understand when each is required. For a two-sided Exploit and Explore model both leadership types are needed.

To be ready for scale up a product must be desirable, viable, feasible to build and have a supportive corporate environment.

2) Prepare: Work to do before scaling-up

Elements to complete in pre-scale-up validation

Validation of the product/service is crucial to being ready to scale up. Validation elements in preparation for successfully scale up:

- Desirability: investigate and understand the desirability of a product to a market. Being clear on the market need.

- Viability: the appropriateness of the product or service as a response to the customer need identified.

- Feasibility: assessment of the risks (damage caused when things go wrong with the product) and uncertainty. Uncertainty is the unknown unknowns. Examples include regulatory barriers, blockage to market by competitors, potential of patents being held by others.

- Corporate context: this element is irrelevant for independent greenfield start ups and very relevant for corporate scale ups. It is to understand the provisions to be made to enable the product to be successful in the Corporate environment. This includes alignment with management, governance, processes to follow, KPI’s to be adopted and others.

The objective of Validation

Once Validation has occurred, we can scale up. In Validation the aim is to:

- Get to Minimum Viable product: the version of a new product which allows a team to collect the maximum amount of validated learning about customers with the least effort.

- Achieve Product Market Fit: to pass the threshold where we are in a market with a product that can satisfy that market.

Validation Techniques

There are many techniques and most follow the Build-Measure-Learn approach. All deal with the Desirability and Viability elements of validation but only the last technique really deals thoroughly with Feasibility.

- Design Thinking: a 6-phase process that puts customer needs at the centre of everything that is built into the product. It is the opposite of a “build it and they will come” approach.

- Sprints: a development by Google which is a time boxed version of Design thinking.

There are several techniques to validate a product. They are all based on the Build-Measure-Learn approach.

- Outcome Driven Innovation: works on the idea that people buy products to get jobs done. And that there is usually more than one way to get a job done. A range of solutions or products may result.

- Lean Start-up: combines concepts from Lean Manufacturing with Design Thinking. It puts the customer interaction at front and centre and emphasises the importance of “rapid prototypes”.

- Lean Stack: adds additional tools to the Lean start-up methodology. Particularly the concept of Traction which is the rate at which a business model captures monitisable value from its users. In this way it starts to deal with industrialisation of a product.

- Growth Hacking: is an approach that re-validates Desirability and looks at how to make the market for the product.

- Traction Gap framework: like the other techniques it is based on a Build-Measure-Learn approach. In addition, it ensures the product has a solid understanding of the market, understanding of channels to market, process repeatability, some reference customers and implementation success repeatability.

Traps to avoid in Scaling up

The work to validate a product/service to Minimum Viable Product (MVP) and Product Market Fit (PMF) can be where some errors are made that doom the product at later stages and prevent scaling up. Common errors are:

- Product market fit is for Pioneers: those prepared to take an early version of a product are Pioneers. They may be those who are willing to accept imperfection, work harder to make a product work and not represent the mainstream. So, assuming you have a solid PMF may be illusory.

- Validation is of the product only: a frequent error is to assume MVP has been achieved because the product meets requirement. In fact, testing the business model and the business model being fit for purpose is every bit as important. A great product with untested supporting processes, channels and support is not a sustainable product. The Traction Gap Framework technique deals well with this.

- Corporate context has not been established: ensuring the business model viability and feasibility of industrialising the product and making the market are all vital to scaling up. Often this is not done.

- Feasibility is not fully validated: product risks are evaluated as part of validation but often risks not related to product are not. Show stoppers may exist in the regulatory environment (think privacy concerns for example), patents or market access.

Running a Validation framework

To manage and measure Pre-scaling a process is needed with measurable jumping off points:

- Validate the 4 dimensions concurrently: (Desirability, Viability, Feasibility and Contextuality) in a managed swim-lane type project management process.

- Build evaluation points “Value Inflection Points”: that connect the swim lanes and give you jumping off points to check on progress. These are Problem-solution fit (PSF), Minimum Viable Product (MVP), Minimum Marketable product (MMP), Minimum scalable venture (MSF). PSF and MVP are met easily with light resources. It is the later stages that are more resource and commitment intensive. Easy to have ideas but the real cost is in implementing them!

Value inflection points are vital milestones to be achieved during Validation.

Value Inflection points during Validation – the questions to ask

At Value inflection points we are measuring (by element):

- Desirability: is the sale pipeline filling? Do we have a first paying customer?

- Viability: do we have a clear pathway to profit? A roadmap from “must have” pioneers to mainstream customers?

- Feasibility: do we have partners established? Is there a clear and committed budget?

- Contextuality: is the governance defined and the scale-up been embedded into parent company roadmaps, portfolio management and budgets?

Practical measures that define each Value Inflection point

- Problem Solution Fit – PSF:

- Desirability – we have identified a customer problem worth solving. We have worked out willingness to pay and scoped market size. Customers have confirmed the mock up solution we have developed will fit their context and are willing to pay.

- Viability – we have developed an outline pricing and business model. We have a positive back of the envelope business case.

- Contextuality – general strategic fit with the overall business has been established. A small team has been assigned (1-2 FTE).

- Minimum Viable Product – MVP:

- Desirability – we have a rapid prototype, a version of the intended solution which allows to collect the maximum amount of validated learning with least amount of effort. We have validated with customers in a protected environment.

- Viability – the Value proposition, go-to-market, support, customer segments and pricing have been validated and put into the business plan. More detailed business case is still positive.

- Feasibility – major show stopper risks have been identified and assessed as not show stopping for the product. There is a proven supportive ecosystem/value chain for the product. New to company or new to industry supporting technologies are at technical readiness level.

- Contextuality – the Top management sponsor validates strategic fit to company and resources (1-3 FTE) are assigned.

Practical and measurable Value Inflection points are: Problem Solution Fit (PSF), Minimum Viable Product (MVP), Minimum Marketable Product (MMP) and Minimum Scalable Venture (MSV)

- Minimum Marketable Product – MMP:

- Desirability – a version of the solution with the smallest feature set that solves the problem has been developed and delivered via the go-to-market channels identified in the business plan. A significant number of customers are using the product and are supported and there are sales being generated.

- Viability – business plan items from MVP have been validated and now are baked in. Traction metrics are positive, and the business case is still positive.

- Feasibility – major relevant show stopper risks have mitigation plans. Ecosystem partners have been established and are scalable and are supportive. New to company or new to industry supporting technologies are at technical readiness level.

- Contextuality – there is an agreed pathway for scaling up and a target business unit to take on the product identified. A collaboration model between the corporation and the scaleup has been established, key personnel allocated, and key internal stakeholders are aware and at best supportive of the scale up.

- Minimum Scalable Venture – MSV

- Desirability – sales funnel has filled and first paying customers with no subsidies/early adopter discounts are onboard.

- Viability – Traction and scalability for the business plan items from MVP have been validated. The detailed business case with scale up budget and expected margins of the scaled up venture show viability and a solid path to profit.

- Feasibility – the scaling-up concept (particularly the plans to obtain mainstream customers and the industrialisation plans) are defined and validated. The value delivery and innovation Ecosystem are defined and validated.

- Contextuality – the initial core team and governance of the scale-up are defined, budget is allocated and scale-up has been baked into strategy, roadmaps and portfolio management.

Special notes re “show me the money” and gaining alignment

Funding: Corporate scale-ups often need to shift priorities in the fight for funding. The scale-up decision should be taken at the same time as a commitment to fund the whole scaling-up process.

Gaining alignment: initial corporate enthusiasm and funding vanishes during scale up. Top management sees the Minimum Viable Product as “job done” and moves onto other things, leaving the business to carry on with the integration. Also, the Business Unit Subject Matter Experts (SME’s), head back to their day jobs. To mitigate these issues, we need to:

- Promote the scale-up internally

- Work hard to embed the scale up into the Corporations long term plans including middle management’s KPI’s. Having KPI’s, portfolio roadmaps, innovation roadmaps include the scale up are vital.

- Provide support and mentoring to the scale-up

- Work the organisation, especially the natural tension between corporate and business units (created by the differing paradigms). Remember, middle management are driven by their own goals and the requirements of the core organisation and departments are driven to run the business optimally not focus on innovation.

3) Scaling up: the process outlined

In Scaling up ensure you have milestones and workstreams. Everyone needs to see progress and be able to measure success.

Tip to make scaling up work

Ensure you have milestones. These can be revenue goals met or valuation goals. Choose your milestones carefully and they will help you remove uncertainty from the start-ups staff, allows the parent to explain to the market how a start-up is progressing and allows comparison statistics on how the start-up is doing against averages (e.g. 80% of our scaleups at milestone 3 made it to market and generated 60% of projected revenues in the first 3 years). Keep in mind the type of customer the Scale-up is selling to in setting milestones. Types are B2B (a few customers), B2C (many customers in segments), OEM type markets (a few, big customers), Internal market (intra the parent company), Heavy-asset investment markets, regulated markets (e.g. pharma).

Workstreams for the Scale up phase

- Industrialisation, Value chain building: this is about building up the validated product into a robust industrial product. That means building reliability (uptime), 24/7 customer care, cybersecurity. For physical products, it means tooling production lines and building the supply chain (suppliers/materials)

- Market making initial customers are early adopters or pioneers. The go-to-market approach now needs to shift to cater to the mainstream.

- Grow the organisation: it is in scaling up that we move from 2-5 FTE to 50-150 FTE. This needs to be done right, your early recruits must be the right people with broader skill sets than in mature organisations.

- Transition the management system: the organisation and management system in the scale-up must start to look like that of the parent and fit in. This includes the management system itself (KPI’s, reporting etc) and the way the entity is organised. If it is being transitioned to a parent BU, then it must fit the way that BU operates.

Formal items to be organised

- Governance/funding: that fits with the way the parent works. The Top management sponsor of the scale-up is ideal to run the governance group.

- KPI’s/Metrics: move to those that are suitable for the established business.

- HR items: this includes the pay and conditions and incentive schemes of the start-up being harmonised with the parent and a “return ticket” for those who are seconded. It may be a conscious decision not to give return tickets in order to attract the right type of people.

Get the collaboration model right between the scale-up and the parent.

Establishing the right Collaboration model with the parent

As noted, in theory a scale-up has a set of “unfair” advantages over a green field start up that do not materialise. The block is a lack of collaboration with the parent company. Areas of tension that block collaboration:

- Differing paradigms – the scale-up is in Playing Field 3, characterised by Build-Measure-Learn, exploring, fail fast. The core has an operating environment that aims for predictability, risk mitigation and exploiting advantage.

- Business model: the core is there to execute on a defined business model with controls and management. Scale-ups business model may not even be defined yet.

- Ecosystem: the core has an ecosystem of suppliers and partners enabling the supply chain. The scale-up does not and may have a differing set of partners acquired and acting without the process rigour of the core.

- Governance: the core has committees and assigned accountabilities and formality. In scale-ups the team-based approach prevails with much less structure and formality.

- Metrics: the core will have short term KPI’s that are quantitative. Scale-up KPI’s will be both qualitative and quantitative and longer term.

- Organisational complexity: the core has many layers and silos. The scale-up is small, informal and without layers.

- IT systems: the core has legacy IT with many hard-wired components and well structured. The scale-up will have fewer, simpler systems, most cloud based and has much more flexibility (e.g. for upgrades or integration)

- Reward systems: in the core this is likely to be annual and formal (pay review and bonus). In the scale-up people trade the employment risk for greater potential reward.

- Brand: the core protects the brand zealously. The scale-up has the room to play with their brand and wreak less damage if a mistake is made. So, concerns with brand play less in the mind of scale-up personnel.

- Culture: typically scale-ups have a higher level of urgency and less formality than the core organisation.

- People: scale-ups generally have people who can collaborate and undertake a wide range of activities to a medium/low level of depth (“T-Shaped” people). The core has those who are less broad but deeper on a skill area (“I” shaped people).

- Leadership/Ownership: in scale-ups we see a higher level of ownership, identifying with the organisation. The core aims to have more managers than leaders, people who can run things well and minimise risk.

Building for successful collaboration (people and decisions)

- Actively design for collaboration: have a relationship launch day, map out decisions and decision makers.

- Measure collaboration: leading indicators include speed of decision making, number of items escalated, information sharing – volume, methods of sharing et al.

- Find common ground: ask how we can create value for both the scale-up and the core business.

- Foster collaborative behaviours: establish working rules and principles.

You can plan and build for successful scale-up to parent collaboration. It won’t just happen.

Building for successful collaboration (mitigating natural tensions)

To mitigate the tension from competition for scarce resources, management time and the fact that scale-up and core people do not work well together:

- One process: for formal resource allocations to a scale-up

- Pay in full: scale-up should pay for resources it uses.

- Scorecards for the core: ensure scale-up is separable from BU scorecard. Diluted results will demotivate.

- Contingency plans: have them, discuss them.

- Prioritise the long term: leaders must do this or the unimportant and urgent will dominate.

- Set special targets/bonuses:g. selling a new concept/product is a tougher sales cycle than usual.

- Reinforce collaborative behaviours: leaders need to show collaborative behaviours and stamp out any “us and them”

- Use insiders: for roles needing strong collaboration with core.

- Enhance differences in skill sets: do not seek to homogenise. Difference is what creates the local identity.

- Clarify strategic common ground and areas of expertise: explicitly for all to see in both the core and scale up.

- Design the integration together: by sharing resources.

Building for successful collaboration (principles for transition)

- Have a dedicated transition team: conduct a readiness assessment, a transition plan, set up an oversight board.

- Conduct training: the core organisation should provide training and facilitating personnel transfer pre-transition.

- Grant discretionary powers: the core organisation to grant discretionary power to managers active throughout transition

- Assess the transition timing: both the receiving core BU and scale-up personnel should agree the timing.

- Open direct reporting lines: for scale-up personnel during the transition to enable swift decision making.

- Align performance measurement systems early: so that post transition the scale-up is using the receiving BU system.

Building for successful collaboration (three must do’s)

- Understand the value equation together: expressly understand what the value of collaboration is. This covers the value to customers (competitive advantage, access to new and complementary expertise, strengthening the customers innovation position)

- Define the value contribution: ensure each side understands what each brings to the table. Typically, this includes business impact, long term growth, the BU as the scale-ups first customer, market access via the BU, leveraging capabilities, assets, HR, funding, talent.

To build collaboration: Understanding what success looks like, what each brings to the table and put collaboration logistics in place.

- Operationalise collaboration: how to run it and monitor its success. This includes shared protocols to manage differences, processes for everyday work, contingency plans, information sharing processes and content, joint escalation processes, cadence of meetings. Often this is helped by a 2 day kick off workshop covering the vision for the future of the scaled-up product, demonstration of the MMP, run through of validation work done, plan for the first 3 weeks of scaling up, lifecycle funding, milestones, KPI’s and work rules, contingency plans.

4) Lessons learned from the real world (Telefonica, Orange, Bosch, TÜV, SIX, TRUMPF)

Telefonica are a Spanish Telecommunications company. Revenues of over 52Bn Euros (2017) and operate in 17 countries with 127,000 staff. To create a framework of innovation Telefonica needed to build capability for continuous innovation and empower staff. To help with this, 6 years ago they started the “Lean Elephants” transformation initiative. Lean Elephants is a framework to take ideas from Pre-Ideation up to and including scaling up. Results have been 2.6 increase in the speed of innovation cycles, 45% increase in the number of innovation projects, 48% reduction of the budget per project and 52% reduction of budget spent on “big bets”. Telefonica’s learnings:

- Start small/aim high: ambition can be high, but resources burn need not be. Allocate resources frugally.

- Iterate fast and be consequent: kill ideas or scale up early. Delay does not help traction. Fail fast, fail cheap and learn. Killing projects enables another team to get on with another prospective idea.

- Decrease upfront risk with prototyping: get to prototype quickly and out of theory.

- Avoid internal milestones: link to achieving market validation, this matters more than internal milestones.

- Encourage multidisciplinary teams: broader range of perspectives will benefit the project and prevent “innovators bias” – (not being able to see limitations).

- Provide training and a mentoring program: Lean start up and customer development training for those involved in the projects is mandatory. In addition, a mentoring program run by internal or external staff is vital for the project team. Mentors must have start up experience, a good network, deep understanding of entrepreneurial ecosystems and a good knowledge of customer development methodology

Telefonica are in an industry that is being digitised and they need to move rapidly to stay ahead.

- Create a team of catalysts: this is a small group of managers who can take care of the whole innovation cycle.

- Build a learning culture: a change in the culture to one of experimentation, learning and prototyping is needed to create the environment for innovation to succeed.

- Find and build a team of intrapreneurs: this will take time and again helps augment the learning culture.

- Funding: this was and is a challenge for Telefonica when the innovation hits scale up.

- Preparing for corporate process and policies needs to be done during scale-up and is challenging. Having top management committed and frequent communication on progress, activity and results of innovation helped.

- Involve the Corporate Branding team: they need to know what the innovation is doing and how they intend to brand the solution. Telefonica created a “Telefonica Lab” and using “White brands” meant the Corporate brand did not get tainted by the experimental nature of the innovations.

- Manage customer expectations, especially in the B2B market: the tension that arises is the sales channel want to use the innovation dialogue to lead to a sale, the project team want to use dialogue to understand customer needs.

- Use non-traditional KPI’s for the scale ups: scale ups will have more qualitative goals than quantitative.

- Scaling up projects compete for space in go-to-market: again, this creates a tension with existing portfolios. In addition, the core business prefers innovation that is incremental to current business rather than disruptive. To mitigate place innovation teams accountable for innovations that help the core business, into the core business.

BP’s existing business will be mostly gone in 50 years. Now that is a catalyst for action!

BP (formerly British Petroleum) are a British based global Oil, fuel, petrochemicals and alternative energy company. Revenues are $240Bn US (2017). This is a business that will disappear over the next 50 years as alternative energies rise and fossil fuels decline; a real catalyst to innovate! BP created BP Group Technology to lead the innovations that will transform their business. They do not expect innovations to deliver fast profits and they have over 50 projects underway using an array of approaches: partnering, acquisitions, investing in technology ventures, joint ventures, internal projects. The BP innovation strategy has seen 3 significant things happen:

- Investment pool has grown larger

- There has been greater emphasis on Scaling-up.

- Scope has broadened beyond the core into alternative energies development

- Bio fuels:g. low carbon ethanol production (Brazil)

- Wind: one of the largest wind farm owners in the US

- Solar: through its subsidiary Lightsource BP has commissioned 1.3GW of solar capacity

- Bio and low carbon products: producing bio variants of core products e.g. Castrol lubricants.

- Carbon management:g. investing in changes in the chemistry of cement production to reduce carbon emissions during cement production.

- Power and storage, Advanced mobility and Digital.

BP Group Technology Internal projects often die during scale up

BP found that Internal projects faced the “valley of death”. BP dug into root causes and found that every industry/company faces this scaling up challenge. 6 root causes that kill ventures:

- Assumptions of maturity: Treating ventures as established predictable business (which they are not) and imposing processes on them that are designed for mature businesses.

- Top Leadership support falters: continuous effective senior leadership support is not guaranteed during scaling up.

- Those who matter (in terms of execution) are not aligned: Middle management is not aligned as the venture is not built into long term planning elements that drive thinking and behaviour.

- Corporation help is ad hoc: Providing ventures with expertise and HR for their organisational growth is ad hoc.

- Pre scale up work and scale up processes are inadequate: this means that the scaling up is done too early and the processes of scale up are ad hoc and done on a case by case basis rather than via a standardised toolkit of processes.

- Disruptive innovation is homeless: Non incremental innovation does not have and end to end environment that is suitable yet. So, the chances of success are slim.

BP have built a scaling up capability based on 3 cornerstones

- Defined lean processes: every venture during scale up has the same set of generic milestones. Milestones trigger funding, incentive schemes, management systems, portfolio management.

- Provide a suitable environment: BP have implemented venture suitable governance structures employing Private Equity methodologies.

- Utilising Agile build up: they are working on the standard Ideate-Validate-Build-Measure-Learn-Scale approach for ventures as well as the wider organisation. This helps ensure C suite buy in.

Bosch are a vast company with high yielding products. This is a challenge when driving new products as it takes time and resources away from what is already profitable.

Bosch employ 402,000 people and turnover 78.1Bn Euros (2017). Their four divisions are mobility solutions, industrial technology, consumer goods and building technology. Bosch face the common challenge of shaping tomorrows business whilst not neglecting todays core. Bosch have learned driving non incremental innovation needs:

- Top management commitment: to enable new approaches and release appropriate resources.

- Patience: radical changes take 5-10 years to take root.

- Freedom: radical innovation needs different processes from the core, a different location and a different culture. The freedom to implement these differences is essential.

Bosch invest heavily in research

Bosch have 1,800 people involved in research and spend 300 million Euros pa. They found that growing/scaling ideas in existing structures is ineffective. Therefore, Bosch created their “Grow” platform, this develops new business for Bosch in new markets with internal resources based on Bosch technology innovation. Grow started in 2013 (Germany) and 2015 (USA) and has 135 staff.

Features of the Bosch Grow initiative

A small shared service team gives HR, communication, marketing, lean start up subject matter expert advice to Grow projects. Grow has HR people who specialise in start-ups. They have been careful to recruit people who flourish in a start-up environment and have put in place incentives that suit start-ups not the core area. Staff can make a year’s pay in bonus if the start is successful. No IPO billionaires here but a very handy pay day nonetheless! In building Grow Bosch focussed on people, places, tools, principles and regulations.

- People: focus on people/culture very strongly, there is an HR function in Grow even though it is so small.

- Places: Grow has its own location with its own characteristics that is not far from Bosch main buildings.

- Tools: use simple, stripped down version of systems to allow for flexibility.

- Principles/regulations: within legal and regulatory boundaries, they have defined their own set of processes and rules. This means they are not overburdened with major processes and regulations built for a far larger organisation.

Measures of success for Grow

Success is measured by immediate impact of innovation (financial and other) and by secondary impacts on the business. Scale-ups must make double digit millions of Euro. Ultimately the aim is to transfer the scale up to the core and this has occurred with one successful scale up that was started in 2013/14 as an innovation idea.

TRUMPF’s growth rate of 15% pa demands innovative products and ideas to fill the pipeline.

TRUMPF are a leader in machine tools and lasers for Industry. They provide products and services which pave the way for their customers to a Smart Factory. They employ 13,400 people in 77 countries and turnover 3.6Bn Euros (2017) growing at 15% pa. They have a flexible process for building adjacent businesses. The latest are a business that uses extreme ultraviolet light in photolithography partnering with Carl Zeiss and ASML and a laser metal fusion business (3D printing with metal). They wanted to drive more innovation to compliment the efforts they already drive in building adjacent businesses. They accelerated M&A activities, corporate venturing and built an “intrapreneur” program.

TRUMPF Intrapreneur program

Employees are encouraged to submit ideas that are about new technology in new markets leveraging existing core competencies. The successful candidates, post a jury selection process, can spend 50% on the idea in a team of 2 people. They are given support with internal and external coaches. They are provided with a bank account with 100% of the funding requested to get to Product Solution Fit and Product Market Fit via Minimum Viable Product. The teams are freed from traditional process and are given support via agile processes and control systems and a physical location away from Headquarters.

At the end of 3 months a committee of the Chief Technology Office decide whether to kill or continue the project. If they decide to continue, they can go one of two ways:

- Move to 100% of their time on the project and continue in the Intrapreneur facility. They will receive a significant uplift in funding and more resources will be applied to the project.

- Spin off the project as a business, a legally separated entity. The employee leading the project becomes the managing director of the new business and an advisory board from the core business is appointed.

Lessons learned/challenges from the Intrapreneur program

TRUMPF feel that they have set off successfully in the direction of scale up and see a clear road to business impact. Lessons learned:

- Acceptance: of the Intrapreneur program from middle management has been tough. The program competes for resources and sometimes revenue with the core.

- Time allocation: the employee struggles with 50% of their time in two organisations. These are usually top talent and make it happen, but it is not an easy balance to achieve.

- Funding: needs to be aligned. Start ups focus on cash burn, the core focusses on revenue and cost (P&L). P&L and budgets are on an annual cadence, cash burn is as needed. Aligning funding rounds to the timing of the core organisation is necessary and must be consciously done.

- Branding: activity needs to be treated with careful attention. The challenge is when the venture promises a different value proposition than the core brand.

Orange, like Telefonica, need to innovate quickly to keep up as their industry is digitising fast.

Orange Intrapreneurs studio

Orange are a French Telecommunications company, operating in 28 countries with 260 million customers. Main operations are in Europe and Africa. In 2008 they initiated their innovation lab “Orange Vallée” to explore new ground in the digital ecosystem, quickly. From this initiative the Intrapreneurs studio emerged. The aim of the studio is to transform employees’ powerful ideas into an offering that would add to Orange’s portfolio. The studio was to help employees overcome 3 challenges:

- Legitimacy: the person might belong to the wrong area to develop the idea.

- Methodology: tools such as the Business Model Canvas or Lean Start up were not available to them.

- Network: the staff members often did not have a companywide network available to them.

There were other areas in Orange dealing with Ideation and Pre-Scale validation and so the decision was made to focus the studio on the scaling up stage of the end to end innovation process.

The work of the studio

The studio split its work into two phases; Qualification and Incubation. Qualification is a 3-week process that concludes with a “Pitch day” where the intrapreneurs present their idea to a cross company jury. Those ideas that successfully passed this hurdle go into a 6-month incubation phase. The Employee works full time on the idea and has access to expertise – CTO, coder, graphic design, marketing. They are hosted in the Orange innovation centre and take a lean start-up approach to validate their hypothesis in the product/service and underlying business model.

Lessons learned from the studio

Orange are on their 3rd cohort progressing through the studio. Here are the lessons learned from the first 2:

- Progression: Some ideas have turned into projects outside the studio program.

- Hands on the Qualification phase needs to be fully hands-on. This means skipping a lot of theory and using practical tools – value proposition canvas, MVP, business model canvas, MVP.

- Getting too close: the intrapreneurs tend to fall in love with the idea and this is dangerous as they will not see flaws.

- Class spirit: this is a real asset. Having a cohort of people/ideas progressing through the studio breaks down organisational silos and promotes collaboration.

- Incubation takes longer than you think: 6 months was not enough, and a 12-18-month timeframe is more realistic.

- Success attracts: second intake saw number of applicants and the audience watching intrapreneur pitches doubled.

- Diversity increased: the % female participants increased to 30% by the second intake.

- Sponsorship increased: all second intake ideas had BU sponsors.

- The first projects are ready for scale up: from the first cohort several of the ideas are now fully incubated and ready to go to the relevant BU for scale up.

TŰV serve industries that are being digitally transformed. They serve these industries and create service offerings that continue to offer value and stay relevant.

Spinoff effects of the program

Intrapreneurs learned a lot of skills from the program and have become an inspiration and energiser for others in the business with ideas. Managers have learned to adjust their mindset to being coaching leaders providing support to intrapreneurs and their projects. More broadly, the Business units have become more in tune with “Blue Ocean” innovation as projects emerge from the studio to go to the BU for scale up.

TŰV Rhineland are a leader in independent inspection services, they have been in business 145 years, have 20,000 employees and turnover of 2 Bn Euros (2017). Quality and safety are deeply ingrained into the corporate DNA, more than most companies as their core job is to inspect quality and safety. Their corporate slogan is “precisely right”. They operate in a fast-moving field; for example, vehicle inspections have moved from a mechanical test only to certification against prevention of automotive cyber-attacks. Digital Transformation brings 3 pressures to bear on TŰV:

- Stay on top of radical innovations. E.g. Automotive industry – networking cars.

- Find new value propositions to retain their position as trusted inspection partner. E.g. drone inspection of Solar farms.

- Fend off new competitors

TŰV Rhineland needed an innovation model

In this fast-moving environment, they set up a new department, Innovation and Digitalisation (I&D), reporting to the CEO and located outside their boardroom. It is there to steer innovations at a global level while enabling the 6 Business streams in the company to deliver non-incremental innovation. This enabling role is to prevent I&D becoming a corporate ivory tower function. There is an oversight committee made up of representatives from the business and IT. They are there to:

- Develop/Implement the I&D agenda.

- Support Digital Transformation of TŰV

- Develop/implement/launch innovative business models and solutions to market.

- Create conditions for collaboration and co-operation models for the business units to drive innovation/Digital within TŰV.

TŰV have learned great lessons about scale-up and their “XR training” product has emerged as a great innovative success.

TŰV learnings and challenges

- Big change = careful handover: The higher the degree of innovation the more the people in the operative functions need to change. Therefore, the higher the chance of failure on handover. If a core business salesperson must spend a significant time learning the new concept and then teach his customers before a sale, well would you waste your time or sell what you are used too? So, I&D have installed a monitoring/mentoring role for post-handover to a business unit (BU). This is to help the BU get past the scale up challenges of disruptive innovation.

- Digital/Non incremental innovation will play out in the ecosystems: there will be new partners to find in the new areas, as well as the traditional partners. Running a “future ecosystem” workshop linked to a concept with the potential partners can help here.

- Branding challenges: partners often were confusing validation work on innovation projects and the Corporate value proposition of TŰV in the market. They are taking more of a “white label” approach to avoid this.

- Cultural challenges: due to the nature of TŰV’s work in promoting excellence the Corporate slogan of “Precisely right” flies in the face of the experimental nature of non-incremental validation. They have partnered with HR to engage on cultural change, but it is slow work.

- Scarce resources: human resources are scarcer than financial resources. Ideators often have departmental work to do as well as the innovation work and this is still a challenge that TŰV are addressing.

- Changing the innovation mindset: this is important to enabling innovation to flourish. 3 steps TŰV took:

- Create an innovation space: TŰV set up a physical space outside their boardroom for the innovation teams with hangout and work spaces.

- Provide innovation tools: each participant in the innovation centre receive a “Blue Box”. This gives them guidance on how to advance an idea, a small idea validation budget. They also enter a program called the “Kickbox” program.

- Place champions in the business: these are alumni of the innovation program and have been trained in design thinking and rapid design. There are 25 alumni sprinkled now across and with Business units.

Success story from the Kickbox program

“XR training” is a new service being rolled out. It increases the speed of hard-to-explain training content. This is a product offering for TŰV and covers such items as Industry 4.0 scenarios, simulation training and instructional training. It blends holographic techniques (Microsoft HoloLens) with social learning.

SIX is Swiss and owned by the Swiss banks. As a financial services infrastructure provider, it must move fast as the industry digitises.

Six (Swiss Infrastructure and Exchange)

Six provide the infrastructure for Swiss banks, traders, merchants, investors and service providers worldwide, it is owned by its clients (130 banks) and have 4,000 employees. They handle 11 million credit card transactions and 5.4 Bn Swiss Francs traded on the Swiss stock exchange per day. They also find storage for 85 Terabytes of data per day. Financial services are being rapidly disrupted by Digitisation and Six redesigned their innovation management system in 2014/15. In 2017 Six reviewed how the innovation management system was going.

Following the 2017 review, Six consolidated non-incremental innovation into a new BU; Innovation and Digital (I&D). In parallel Six put 50m Swiss Francs into a venture fund to stimulate start-up innovation with its banking partners. They divided innovation into 3 playing fields – Incremental, Reshaping the core and Disruptive. For the reshaping the core they made this a joint responsibility of the BU’s and I&D. For the Disruptive innovation, they used a process called Pictures of the Future (POF) to enable visualisation of the concept. Six have seen traction, examples are:

- Six cybersecurity monitoring service: this security initiative has increased collaboration between the banks.

- F10 has run its 3rd accelerator cohort in 2018. Various start-ups have been identified from this cohort.

- Six Fintech venture fund has invested in several companies.

- I&D wove worked with internal and external stakeholders to broaden knowledge and the view of what financial markets will look like in 10 years. (They used POF as the process).

About the authors:

Frank Mattes Dr Ralph-Christian Ohr

Frank Mattes is founder and CEO of innovation-3, an international innovation agency focused on non-incremental innovation. He is also initiator of the ‘Peer Group Scaling-Up’. Frank holds two M.Sc. titles in Applied Mathematics from Germany and the US. His work in innovation management now spans for over 25 years, within specialized boutique consulting companies, the Boston Consulting Group and innovation-3. Frank has worked at Board level for several greenfield startups and is a Top-25-blogger in innovation. Frank’s LinkedIn profile is at https://www.linkedin.com/in/frankmattes/

Dr. Ralph-Christian Ohr is Founder of ‘Dual Innovation’, a specialized consultancy on modern dual corporate innovation management, Associate Partner at innovation-3 and co-initiator of the ‘Peer Group Scaling-Up’. He has held senior management positions in corporate innovation and development at various international companies across industries such as Thin Film/Semiconductor, Energy and Transportation. Together with Frank, he pioneered in 2012 how companies could use Organizational Ambidexterity to drive incremental and non-incremental innovation at the same time. Ralph is also a distinguished Top-10 innovation blogger and runs the awarded ‘Integrative Innovation’ blog. Ralphs’s LinkedIn profile is at https://www.linkedin.com/in/ralphchristianohr

Scaling-up Corporate Start-ups by Frank Mattes and Dr Ralph-Christian Ohr is available from Amazon

This Executive Summary has been brought to you by Neil Rainey of The Digital Transformation People. A writer of summaries, Neil’s mission is to tease the wisdom from books into a few pages.

Read more in our Executive Summary series here:

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured, Innovation