This is the second part of a FIVE-part series, featuring chapter 2, “The Problem”, of my upcoming book “Lean Scaleup”. In this book, I share a Best Practice framework that has been co-created with 20+ leading companies that helps corporates to build new – in most cases, Digital – businesses from Innovation.

Chapter 2 nails down the “WHY” – why it is so hard for companies to achieve business impact and corporate transformation from their corporate startups/ventures (short: EBOs for “emerging business opportunities”). The book is scheduled for May 2021. You can reach me on LinkedIn and also on The Digital Transformation People Community platform where I’ll be sharing parts 3-5 of this series.

In the first part of this article series, I highlighted that a company’s innovation activities need to insure it against irrelevance. Statistical data shows that the average life span of companies has been decreasing steadily. Five forces accelerate this trend.

This second part will highlight the corporate business-building problem.

Here comes the business-building problem

These five themes put two fundamental questions to companies and corporate innovators on the table:

- What new businesses should the company create?

- What should the company do to create these businesses with a good level of certainty?

At a high flight altitude, there are three potential solutions. Firstly, corporate innovation could work with external startups or integrate the technology and talent from a startup acquisition. This strategy is not easy. Only 1 out of 12 companies consider their relationships with startups to be very satisfying[1]. Weaving acquired external startups into the corporate fabric is also not an easy task. Statistically, 50 percent of an acquired startup’s top talent has left the company after two years[2].

The second option is that the company could acquire innovative, established businesses. After the acquisition, corporate innovation would use the acquired business’ technology and talent to deliver the innovation agenda. This approach is a risky business. M&A failure rates are between 70-90 percent[3], and studies show[4] that organic growth generates more value than acquisitions.

Thirdly, the company could build business-building capabilities. Success in this option builds on corporate innovation’s ability to implement a robust validation and scaling framework and create a supportive environment for EBOs – for which the Lean Scaleup provides the playbook. Statistically, this is the best of organic growth options – and organic growth creates more value than M&A (see above).

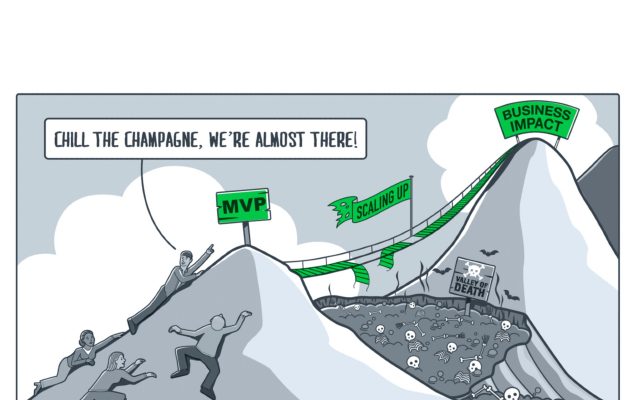

However, companies struggle dramatically in creating new businesses from innovation.

Theoretically, there is an unfair advantage

Established companies in many industries are fighting against VC-backed greenfield startups. While the chances for an individual “greenfield startup” to build a sizable business are low, the VCs that back them have large portfolios and deep pockets. So how should companies with a limited portfolio and a limited budget win this competition?

The answer is to move fast and smart, by leveraging corporate assets. Large, established companies have a broad base of assets that a VC-backed “greenfield startup” can only dream of. Some of these assets are tangible (physical) assets, such as production facilities and owned points-of-sales. Others are intangible assets (i.e., assets that do not show up on the balance sheet) which could be highly relevant for innovation.

Operational and functional capabilities such as Sales, Supply Chain Management, Procurement, Production and Quality Management, Financial Controlling, IT, Legal, Intellectual Property, Recruiting, HR, and Regulatory Affairs provide functional expertise.

Advanced expertise and know-how such as market insights, models for risk and fraud detection, Artificial Intelligence and Machine Learning models, and cybersecurity enable cutting-edge Digital solutions.

Growth-enabling capabilities such as large-scale contracts to source licenses, resources, raw materials, components, interim human resources, online and offline marketing expertise, growth hacking capabilities, access to influencers, opinion leaders, and regulators accelerate the Scaling-Up journey.

Privileged assets such as brand and reputation, access to customers, channel partners and ecosystems, initial customer base (in business-to-consumer plays: employees as customers), and Intellectual Property (including patents and trade secrets) provide differentiation options and accelerate the journey.

Technology and IT comprising individual technologies, technology platforms, and technology toolkits (such as Volkswagen’s MQB toolkit for e-vehicles), IT for transactional purposes (such as existing SAP systems), safety and security systems, and Machine Learning / Artificial Intelligence platforms reduce investments and unit costs during Scaling-Up.

Transactional data enables fast and effective statistical analysis and training of Artificial Intelligence models.

Some of these intangible assets should be in every innovation, as when none of these assets are used in an innovation, the company effectively builds a venture in the wild. In this case, corporate innovators will not have a convincing answer to the question, “why should our company do this innovation and not someone else?”

For an individual innovation, these corporate assets might be real game-changers, leveraged without significant considerations (“no brainers”), or might be used with careful consideration (“trade-offs”).

But companies do not materialize the unfair advantage

There is probably no business area that has absorbed more attention, books, blogs, and conferences over the last few years than innovation. But there is perhaps no business area where the gap between ambition and results is more massive.

Here are some statistics that highlight the disappointing situation:

- Only 1 of 8 corporate startups achieve scale[5].

- Only 1 of 20 business innovations are successful[6].

- 84 percent of executives say that innovation is critical for their business, but only 6 percent are satisfied with the outcome[7].

- Only 10 percent of companies with Digital Innovation units have successfully scaled their ideas up into a launched product[8].

- 54 percent of executives believe that getting ideas to market quickly and at scale is the number one innovation problem[9].

- Only 20 percent of Chief Strategy Officers see their company prepared for disruption[10] .

These statistics spell disaster for many companies. When they cannot build new business, they will fall prey to the five forces shown at the beginning of this article. They will become another company that “did not make it.”

The business-building problem is not a problem that only large corporates face – it also applies to medium-sized companies. Conventional wisdom suggests that smaller companies are better in innovation because they are faster and more agile in their decision-making, and their organization is less bureaucratic. They are supposed to be closer to the customer, and are less tied to existing technology and infrastructure. Furthermore, since they are more often privately owned, they have a longer time horizon and do not have to eye the quarterly analyst calls. However, a study found[11] that company size is not a differentiator. In other words, smaller companies are not significantly better at building new businesses than large corporates.

[1] https://www.bcg.com/de-de/publications/2019/corporate-startup-relationships-work-after-honeymoon-ends

[2] https://mitsloan.mit.edu/ideas-made-to-matter/your-acquired-hires-are-leaving-heres-why

[3] https://hbr.org/2011/03/the-big-idea-the-new-ma-playbook

[4] https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-value-premium-of-organic-growth

[5] https://hbr.org/2016/12/when-large-companies-are-better-at-entrepreneurship-than-startups

[6] https://www.bcg.com/de-de/publications/collections/most-innovative-companies-2018

[7] https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/how-we-help-clients/growth-and-innovation

[8] https://www.strategyand.pwc.com/gx/en/insights/2019/strategists-guide-to-digital-innovation.html

[9] https://www.capgemini.com/de-de/wp-content/uploads/sites/5/2020/09/Final-Web-Report-Scaling-innovation.pdf

[10] https://www2.deloitte.com/us/en/insights/topics/leadership/chief-strategy-officer-survey.html

[11] https://www.bcg.com/en-ca/publications/2020/most-innovative-companies/overview

To connect with Frank and learn more about the book Lean Scaleup and when it will be available here are some events to which you are cordially invited:

Speaking Events

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: