This is the first part of a FIVE-part series, featuring chapter 2, “The Problem”, from my new book “Lean Scaleup”. In this book, I show a Best Practice framework that I have co-created along with 20+ leading companies that helps corporates to build new – in most cases, Digital – businesses from Innovation.

Chapter 2 nails down the “WHY” – why is so hard for companies to achieve business impact and corporate transformation from their corporate startups/ventures (short: EBOs for “emerging business opportunities”). You can reach me on The Digital Transformation people community directly via LinkedIn.

The Problem

Innovation certainly does not suffer from management attention. It has a high priority in almost any company – BCG and McKinsey found independently that 7 out of 10 CEOs consider innovation a top-3 priority.

One reason is that excellence in innovation correlates with business success. Many studies have shown that innovation leaders have higher revenue growth and margins than their peers. They also have a higher market capitalization. According to Forbes’ annual list of the most innovative companies, innovation leaders have a 70-90 percent “innovation premium.” This premium is the bonus that investors pay because they expect these companies to continue their innovation leadership.

Innovation, the insurance against irrelevance

There is a second reason why innovation is high on corporate priority lists. Excellence in innovation provides insurance against irrelevance and protection against commoditization. Statistical data[1] shows that the average lifespan of companies is decreasing:

- 89 percent of the companies on the 1955 Fortune 500 list are not on the current list.

- Companies in the 1965 S&P 500 stayed in the index for an average of 33 years. By 1990, this average was 20 years, and it is forecasted to shrink to 14 years by 2026.

- At the current churn rate, half of today’s S&P 500 firms will be replaced in the next ten years.

- It is reasonable to assume that in the 2080 Fortune 500 list, almost all of today’s companies will no longer exist.

Industry boundaries blur

A brilliant example of the speed and impact of industry convergence is the Southeast Asian Internet economy. Not everyone might be familiar with this business arena. A Google study[2] shows that in only four years, the industry landscape has completely changed. In 2015, companies from different industries were focused solely on their respective industries. Fast forward to 2019 – now, players from all sectors compete fiercely against each other in all industries.

Blurring industry boundaries do not reshape industries; they unshape them. Established players lose their positions, and new winners emerge who serve the customer base with new value propositions created and delivered in new value chains.

The blurring of industry boundaries does not necessarily require Digital. For example, a client of mine ponders how to react to Food and Healthcare’s converging to Functional Foods. But in most situations, Digital is the primary driver, such as Advanced Mobility, Smart Grids, Telemedicine – or Amazon moving into everything, from retail to movies to cloud services and logistics.

In this theme, corporate innovators need to insure the company against irrelevance in at least four ways by:

- Anticipating where industry boundaries blur and new value pools emerge

- Identifying emerging value chains and define pivotal positions

- Capturing the value via new offerings and business models

- Making new capabilities available

Future value pools emerge

Game-changing innovations open future value pools. These innovations fulfill a job-to-be-done much better as before, solve a problem that was never solved before or serve an entirely unaddressed customer base. Five examples may illustrate this point.

Improve the job-to-be-done: Procter & Gamble Swiffer. Swiffer is a line of cleaning products from Procter & Gamble. Its initial product was an electrostatic dust remover, which dramatically improved the job-to-be-done “cleaning floors in the home.”

Introduced in 1997, the brand uses the “razor-and-blades” business model. Consumers purchase the handle at a low price, but must continue to buy replacement refills over the product’s lifespan. To this day, Swiffer is one of Procter & Gamble’s most successful product launches, generating more than USD 500m in sales annually.

Solve an unsolved problem: Nestlé Nespresso. Before Nestlé introduced its capsule-based espresso system, consumers had to make a choice. Either they could get top-tasting, expensive coffee outside of their homes – or they could choose less tasty coffee at home.

Nestlé created a new category by combining convenience-at-home with top taste. It invented a new technical system and a new business model. The technical system consists of two parts: firstly, a coffee machine that generates immense pressure to draw out more flavor from coffee capsules; secondly, the only capsules that fit this machine come from Nestlé[3]. Nespresso bypasses traditional retail and instead relies on its outlets and online commerce/direct-to-consumer shipments. Today, Nespresso sells more than 14 billion capsules annually, and Nespresso brings in more than USD 10bn in revenues.

Solve an unsolved problem: Apple iPod and iTunes. When Steve Jobs introduced iTunes in 2001, he pointed out that current solutions to the job-to-be-done of “managing music for on-the-go” were too complicated and too technical for the average consumer.

Within two years, Apple launched the iPod (the hardware companion) and the iTunes Music Store. This combination offered consumers a convenient way to legally buy digital music assets and the music publishers the reassurance of a Digital Rights Management. With software, hardware, and an online store, Apple established itself as a new intermediary in the music value chain. Ten years after opening the iTunes store, Apple had sold more than 35 billion songs, with 30 percent of the revenue – on average USD 0.99 per piece – flowing into Apple’s pockets.

Serve an unaddressed customer base: Amazon Web Services. Amazon Web Services (AWS) is a subsidiary of Amazon. It provides an on-demand cloud computing platform to individuals, companies, and governments on a metered pay-as-you-go basis.

Amazon initially designed AWS as a standardized and automated platform for Amazon’s retail computing infrastructure. It then saw the opportunity to generate a new business and have the outside world finance AWS by opening defined platform layers. In 2004, Amazon launched the first public AWS service. In 2015, AWS became profitable with annual sales of USD 7.8bn. Another four years later, AWS had become a USD 35bn business, generating roughly 71 percent of Amazon’s overall operating profits.

Serve an unaddressed customer base: Netflix. In its 25-year history, Netflix – an American media services provider and production company – has transformed its business model several times. When founded in 1997, Netflix was a movie rental service relying on postal mail. Customers ordered DVD movies online and received them via postal mail. After watching the movie. they sent the DVDs back to Netflix.

In 1999, Netflix launched a subscription-based business model. Ten years after its foundation, Netflix innovated its business model again by introducing video streaming. Another four years later, Netflix produced its first original content series. With this step, Netflix moved from being a distribution channel for the major movie studios to a competitor. Today, Netflix has more than 200 million paid subscriptions worldwide.

Improve the job-to-be-done: Hilti Fleet Management. Hilti is a Liechtenstein-based machine supplier to the construction industry who successfully introduced a “power-tool-as-a-service” business model.

The basic fleet management idea at Hilti comes as a one-stop package. Customers can turn tool costs from capital expenditures into operating expenses and save administrative work. A fixed monthly fee covers all expenses related to financing, service/maintenance, and repair.

Some ten years after its introduction, Hilti had more than 1.2m tools under fleet management, representing a contract value of more than USD 1.4bn. As Hilti’s CTO stated, “Hilti developed many very innovative and successful products over the years. But they pale in comparison with the fleet management business model, which was the most important innovation in Hilti’s history.”

In this theme, corporate innovators need to insure the company against irrelevance in three regards by:

- Identifying emerging value pools

- Capturing the value in these pools via new offerings and business models

- Making new capabilities available

The existing business model is losing its relevance

Only one of the innovations mentioned above plays out in the company’s existing business model, Procter & Gamble’s Swiffer. All other ones were new-to-the-company, new-to-the industry, or even new-to-the-world business models.

The ongoing search for new business models should be on the management agenda. Companies that regularly rejuvenate their business model portfolio generate more shareholder returns than those who fixate on the business model that made the company great in the past[4]. Six of the world’s ten largest companies are serial business builders, having launched at least five new, significant businesses during the past 20 years.

However, not all companies understand the importance of the continuous search for new business models. One reason might be top management’s relentless focus on the day-to-day business – it almost seems that staff is not allowed to think outside the box. Another reason might be that there is something seductive about success. It lures people into thinking that the future will be equal to the past.

Especially for companies that have sustained success over many years, it is hard to imagine that the success might end. But it does stop at times, as we all know:

- Fortune Magazine wrote in March 1998 a story about “How Yahoo Won the Search Wars,” just six months before Google’s foundation.

- In 2017, the Guardian asked, “Will MySpace ever lose its monopoly?” In April 2018, Facebook took the lead in user numbers, and MySpace spiraled into oblivion.

- In November 2007, half a year after Apple introduced the iPhone, Forbes asked, “Nokia. One billion customers – Can anyone catch the cell phone king?” Six years later, Nokia sold off the remains of its col-lapsed cell phone handhelds business.

Disruption rarely comes from the known competitors, as these examples (and many more, e.g., Kodak, Blockbuster, Encyclopedia Britannica, Skype, and LED lighting) show. In some cases, disruption does not even come from a company, but from fundamental changes in customer preferences. For example, Nike tries hard to find answers to video gaming, and meat producers struggle to adjust to rapidly changing consumer preferences.

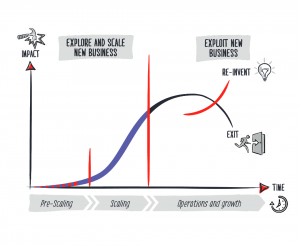

Even the most profitable business models have life cycles, like products. When they are just budding businesses, developed by a few whiz kids in a garage or a corporate innovation lab, their initial value is tiny. As the business model gains traction, the value grows steeply. Once the underlying technology ages or customer preferences shift over time, the value goes down. Hence the life cycle of a business model follows an s-curve.

Companies need to find a new, sustainable business model in due time. If they fail to do so, they become yet another more data point in the S&P 500 statistics (see above).

Figure 1: Life cycle of a business model

Once “the platform is burning,” it may be too late for the aircraft carrier to change its course and build the capabilities for success in a changing environment. Hence, starting the search for a new profitable business model needs to begin well before the existing one declines. It should be an ongoing process, which further helps prepare for unexpected strikes from unknown vectors.

Once “the platform is burning,” it may be too late for the aircraft carrier to change its course and build the capabilities for success in a changing environment. Hence, starting the search for a new profitable business model needs to begin well before the existing one declines. It should be an ongoing process, which further helps prepare for unexpected strikes from unknown vectors.

In this theme, corporate innovators need to insure the company against irrelevance in at least two regards by:

Identifying new business models that could become a sizable and sustainable business for the company

Leveraging corporate assets (see below) for an “unfair advantage” in building these new businesses and accelerate their journey

Service-centered business models gain in importance

A particular business model type has gained significant traction in the last years. In so-called service-centered business models, companies switch from selling products to providing customers with a convenient service that offers a practical, one-stop-shop solution to their jobs-to-be-done.

Service-centered business models have revenue models that significantly differ from product-based business models. Typically, services are charged via monthly subscriptions or metered usage. Hilti’s Fleet Management (see above) or aircraft engine maker Rolls-Royce’s “TotalCare” plan – in which airline customers pay per flying hour – are examples of service-centered business models and their revenue models.

Service-centered business models have a financial and a strategic rationale. The financial motivation is to provide a steady income stream for ongoing contracts, improve resilience during global crises, and increase product life cycles. The strategic rationale is to increase customer lock-in. When customers are satisfied with the service, they have only a few incentives to switch, and switching costs are high. In other words, service-centered business models increase the customer’s barrier to exit and the company’s competitive advantage.

Service-centered business models offer the company insurance against irrelevance. But they are hard to implement. Corporate innovators need to work hard to implement them:

- They build heavily on Digital for (a) connecting products and sub-services that make up the offer, (b) providing the base for predictive maintenance, and (c) using customer data to generate insights that help to anticipate customer needs and to provide a superior experience.

- They require deep domain expertise to understand the customer’s job-to-be-done and the customer journey profoundly – only then can an excellent solution be designed and implemented.

- They demand require extreme validation rigor and complete alignment of corporate functions and ecosystem capabilities.

Sustainability becomes as essential as financial viability

From a linear, profit-maximizing management thinking, when the daily pressures of generating cash flow guide every boardroom decision, it might be understandable that business leaders see environmental sustainability as a secondary priority.

However, the role of business in society has evolved. Investors, customers, employees, public authorities, and the public demand more. Business is more than just generating profits and jobs; it is also about environmental sustainability and ethical business practices. In other words, stakeholders expect companies to have a meaningful purpose that transcends business operations and purely financial results.

For example, several investors today use Environmental, Social, and Governance (ESG) metrics – such as a company’s carbon footprint, water usage, community development efforts, and board diversity – to evaluate a company. Research shows[5] that companies with high ESG ratings have a lower cost of debt and equity, and that sustainability initiatives can help improve financial performance while fostering public support.

Consequently, a growing number of firms integrate sustainability into their business strategy. They see that they can solve some growth problems while at the same time making a positive impact on the planet and can better meet their stakeholders’ expectations when sustainability and good ethics are closer to the Core.

In this theme, corporate innovators need to insure the company against irrelevance by launching new offerings and business models that are financially viable and – at the same time – environmentally sustainable.

[1] https://www.aei.org/

[2] https://www.blog.google/documents/47/SEA_Internet_Economy_Report_2019.pdf; the visual mentioned is on page 43

[3] This was the original concept. Since a few years, other companies can also sell caspules that fit the Nespresso coffee machines

[4] McKinsey Quarterly, July 2020: Why you’ve got to put your portfolio on the move

[5] Devalle, A. et al.: The Linkage between ESG Performance and Credit Ratings. International Journal of Business and Management. 12. 53. 10.5539/ijbm.v12n9p53.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: