In my constant quest for Digital Transformation stories and innovation insights, I had the pleasure of interviewing Dr. David Knott about his 30-year career leading enterprise level innovation.

From automating fax machines and putting print newspapers online, to building Blockchains and in-house expertise in AI, David’s experiences in technology are wide-reaching and have led to profound conclusions about the value of real Digital Transformation and the right (and wrong) ways to approach it.

Lindsay Herbert: What does your role as Chief Architect entail and how do you approach it?

David Knott: The short-form of my job description is to say I’m accountable for all the technology design decisions across the organization. The way I do my job is I lead a small core team (small in terms of HSBC small) of about 120 people. They are the most senior technology architects in the bank, and they do things like look after the architecture of the retail bank, the commercial bank, the private bank, our infrastructure, and the state of our security.

I also run a practice of 1,200 people who do solution technology architecture and design across HSBC. This means I look after career framework, training and development, and talent management for that community. They also participate in design working groups and governance structures, which helps guide us to make good design choices.

Lindsay Herbert: Tell me about your career path. What experiences have brought you here?

David Knott: I’ve been at HSBC for about three and a half years, but I’ve been doing this a long time. I started just over 30 years ago, and I’ve worked in enterprise technology my entire career. I’m one of those people who enjoy figuring out interesting ways to put the right technologies together with a relatively small number of smart people working with me.

I’ve also worked in many different companies, about 12 in total. In that time, I’ve done pretty much every job you can do in an IT function – I’ve been a CIO, CTO, I’ve run operations, I’ve been a developer and a Project Manager. Probably 60 to 70 per cent of my time has been in financial services, but the other 30 per cent has been a variety of industries like consulting, media, and utilities. This has been really helpful because it’s given me the perspective of being both on the supply side and the client side. The other useful perspective came from working in industries that manage physical assets, rather than virtual ones.

Lindsay Herbert: What are the proudest innovation moments from your career?

David Knott: Three examples come to mind. The first was in the early nineties when I was working for a credit insurance company. Credit insurance companies insure the audit books of other companies, and one of the key parts of that business is to issue ‘limits’, which determine how much a company can trade with another and still be covered by their insurance policy. It was a massively paper-based exercise, and the company would be waiting on a letter to arrive in order to choose whether they could actually do a deal with a potential customer or not. Time was crucial.

Today it sounds incredibly old fashioned, but the innovation was to convert this critical mail-based process into a fax-based process. It collapsed the time taken to advise a customer of a business-critical choice from days to minutes – a real transformation when you consider the number of business deals between companies and across industries that would have been impacted.

My second proud innovation moment is from the early 2000s when I was working for a media company in the newspaper business. When I joined the company, all their print titles were all completely non-digitised, and their online presence was literally a scan of the front page of the newspaper put up on the internet as a GIF. The challenge was to convert the newspaper’s print titles to 24/7 online rolling news – and we were given a 6-week period to do it.

The best innovation thrives under conditions of adversity.

We had an internet facing Content Management System, and we had a system that built the print copy of the newspaper, so we connected the two systems together. It allowed content to be converted from a static print title to a dynamic digital title, which journalists could use to write stories in a really short time frame. It wasn’t about inventing new technology, we just stuck together things that already existed.

Then the final proud moment is actually here at HSBC. One of the major challenges banks always have is finding the right combination between security and customer experience. Since the earliest days, one of the bank’s job has been to put barriers between money and unauthorised access to that money. In the old days, it used to be vaults and chests, keys and locks, and walls with iron bars. Now it’s digital barriers.

Back in the early part of this century, our response to that challenge was to put a lot of barriers in the way of our customers. HSBC would own up to the fact that we made our customer experience too clunky. We put things like half-tokens and too many passwords and PIN numbers in the way of our customers. In the last couple of years, we’ve really embraced biometrics.

We’ve basically exploited the fact that these days, everybody carries a high-end computer with a lot of sensors built into it in the form of their smartphone.

Today’s smartphones have very good authentication authorisation mechanisms, so we put together our online banking experience with the authentication mechanisms available on smartphones, like voice ID, face ID and touch ID. This made it possible for people to at least access the ‘front page’ of their banking account, so they can do the things they do most often without having to go through lots of complicated PIN numbers and hard tokens.

If I put together those three examples, the thing that made a difference was putting together existing capabilities in new ways to collapse time and remove barriers between the end customer and the technology capabilities we provide. This is the most important style of innovation, so that’s what I call out as my proudest moments.

Lindsay Herbert: What is your most painful innovation lesson?

David Knott: The biggest lesson in innovation comes back to the question of ‘how do we go about this stuff?’. In large organizations people tend to talk about procedural pain – approvals, contracts, legal, and that kind of stuff – and yes it is painful, but I don’t think it’s the biggest pain.

I think the biggest pain is maintaining clarity of purpose and execution discipline when doing something new and innovative. People often get distracted by the newness of a technology, and they lose some of the execution disciplines they’d bring to something much more routine. We know how to do normal projects, but people often think that to do innovation you’ve got to abandon all the discipline that you’d normally have. In my experience, you actually need to follow project disciplines even more closely.

My belief is that innovation learns its strongest lessons from the scientific method.

Innovation works best when you can frame a hypothesis, figure out how you’re going to test the hypothesis, execute that test method in as rapid and as precise a way as possible, form your conclusions and then figure out what you can do next.

I think where innovation feels painful in a large organization is when those things are lacking because people aren’t necessarily clear and focused on what we’re trying to achieve with this current cycle. Every time I’ve worked on innovation initiatives that have gone a bit wrong, the answer has always been anchoring ourselves back on the question of what are we trying to achieve in the first place? How can the thing we’re working on now help us to achieve that thing? If not, let’s stop and recalibrate and readjust our methods, and not get distracted.

Lindsay Herbert: What are the key challenges facing the financial sector that innovation could help address?

David Knott: There are four challenges for the finance sector that are still unsolved. The first one is finding the right marriage between customer experience and security. The second one is a variant of the first, which is that every company in the world today has to be conscious of the risks of cyberattack. Because we look after the money, we have to be even more conscious of that than anyone – the rewards of breaching us are higher than the rewards of breaching other people.

The cyber frontier is a continuously moving and evolving space, so it’s key for us to figure out not just what the attackers are doing, but what partners and other opportunities we have to innovate in that space and improve our defences.

The third challenge is the classic banking challenge, which is rooted in the fact that banking is about taking risk in an intelligent fashion. We have increasingly large volumes of data that can inform our decisions about risk, but innovation in technologies that can put data to work and derive meaningful insight is extremely hard. Finding ways to use the data we have to make sensible decisions about the risks we’re running is very important us.

The final big unsolved problem is that, like every large organization that’s been around for a while, we run multiple layers of technology of varying vintages. Our challenge there is always trying to figure out how we can make the old core behave in a way that is responsive to the needs of today.

Responding to digital demands, responding to the ever-increasing customer expectation, there are various ways we can address that, including completely re-platforming our core. But my personal view is that very large re-platforming projects are often distractions, and there are emerging technologies that should help us manage the core better without having to fully re-platform. That will help us manage a heterogeneous layered system with multiple vintages of technology, and manage the risks inherent in that, and also be responsive to customer needs. It’s a really hard problem, but it’s one of the things I’m looking into at the moment.

Lindsay Herbert: What other innovation challenges are you currently working on?

David Knott: The thing that will always be front of mind for us will be the marriage of customer experience and security. The second one is a challenge and an opportunity for us and can be put under the broad banner of Open Banking.

Many countries, including the UK and Europe, are leading by implementing initiatives to get banks to open up their core capabilities and their data through a set of open APIs, offered to the market. The motivation is to increase competition in the banking sector, which we think is good, and we engage in Open Banking schemes that are implemented on a country-by-country basis more often than anybody just because of our global footprint. One of the opportunities and challenges in doing do so is making sure we make the most of that Open Banking ecosystem, while also bringing our experience of what we see as good or challenging from previous countries to each new country.

The third big innovation challenge is the shift in our retail customers telling us they want to interact with us through mobile apps, and increasingly, our corporate customers telling us they want to interact with us through APIs. It’s partly driven by the Open Banking movement, and increasingly the channel will be a set of APIs that we open up to third parties, including our customers, and try to offer them a secure direct machine-to-machine interaction.

Another innovation challenge is figuring out how to strike the right balance in Customer Experience. The majority of our customers just want it to work right now. The other part is security — they absolutely want to be able to trust the customer experience. But the third is understanding and advice — those times in the customer’s life, both corporate customers and retail customers, when they actually value high engagement and thought, over efficiency and speed. Thinking about retail customers, it’s when they’re taking out a mortgage, thinking about retirement, planning an investment, all these kinds of things. It’s a challenge because they want that advice, and we have to find a way to deliver it in the right way and at the right time.

The other big opportunity that we’re working on is figuring out how we put AI to work in a thoughtful way that is consistent with our values.

Like every company you speak to, we view AI as an enormous opportunity.

There are insights that have traditionally been just beyond the reach of traditional procedural programming that with enough data and with enough training, AI solutions can address. As you can probably tell by that description though, I try to be quite grounded in my understanding of what the current generation of AI means because it’s a very overly hyped area of the market. We’ve built enough expertise in-house to understand what the current generation of AI really means to us, so we have plenty of opportunities to put that to work.

Lindsay Herbert: What new innovations and emerging technologies are you paying attention to right now?

David Knott: I’m fortunate in that my role gives me exposure to a whole host of interesting innovations. We see interesting things coming from three sources in the AI sphere. One is the big global Cloud providers, and we are in partnership with all three of the big Cloud providers. It’s interesting to see those companies developing AI to run their own businesses and then bring it to the market in ways people like us can consume it.

The second thing I take with a pinch of salt, but it would be impossible to talk about financial services innovation without mentioning Blockchain. My style is always to try and ground myself in the realities of the technology, and Blockchain is a set of technologies that enable sharing of data between multiple parties who have an interest in a trustworthy and useable sort of truth. We think that may be of interest to us, particularly Trade Finance which is a global multi-party business, so we are engaging and innovating in that space.

Blockchain is a space we feel we should be playing, and we should be playing a lead role. I think the jury is still out and will remain out for some time in exactly what form that will take in reality going forward.

An area where we probably could do more engagement is in the range of companies that have started to innovate on top of the Open Banking ecosystem. Open APIs schemes launched in the UK last year, but the number of companies that have genuinely built scaled businesses on top of that is still pretty low. It’s an area we see as interesting innovation, but I think the bright ideas have not quite yet come to the fore.

Another area is the continuous innovation in customer experience. FinTech companies excel at bringing a great customer experience to their customers, and it’s interesting to us because it really keeps us on our toes. FinTechs are the new entrants to the financial services market who are trying to bring financial services directly to customers, rather than just sell to technology people like us. They’ll have a great UX and UI offering, they tend to have weaker back-ends, and often they have no back-ends at all – more often they back off their credit or actual products to an established incumbent. They are great at bringing in and anticipating customer experience, and that’s something for us to learn about by partnering with those guys to figure out how better to innovate in customer experience.

Lastly, there are really edge innovations. We keep an eye on Quantum Computing because cryptography is obviously a huge deal for us, and everyone who trades on the internet, but particularly for us. The potential for quantum to undo the viability of existing cryptography methods is a worry to us, so we keep an eye on that and we also keep an eye on other cryptographic approaches that might be needed in the post-quantum world. But that’s very much us keeping an eye on the far horizon, rather than us doing anything really deep and meaningful about that part of the sector right now.

Lindsay Herbert: How do you prioritise which innovations to go ahead with and when to scale?

David Knott: We try to be structured and thoughtful. We define a set of both strategic themes and innovation themes. It’s not watertight and it shouldn’t be watertight because we can’t anticipate everything. But we pick themes, we focus on those themes, we try to be disciplined about them, we do revise them on a regular basis because otherwise, they can go stale quite quickly.

I’m fortunate in my innovation role in that I get attention from the CEOs of each of the businesses within the bank to review and revise that set of innovation themes. The thought goes into figuring out what the themes are, and after that, it helps us to focus.

Lindsay Herbert: How important are partnerships for furthering innovation, and what are the challenges?

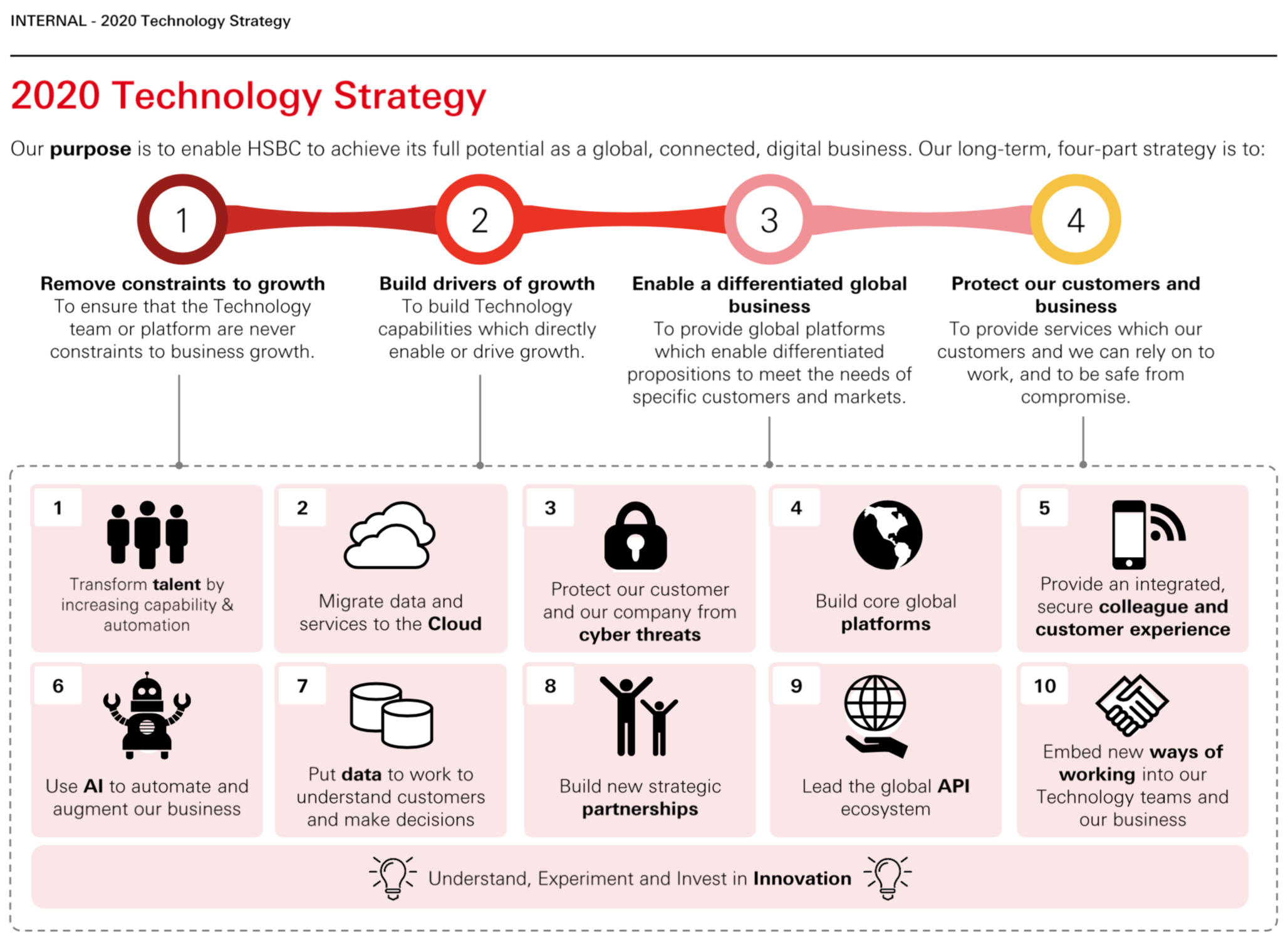

David Knott: Partnerships are very important. Our Technology Strategy has 10 themes, and one of them is partnerships. Our belief is we can’t do this alone, we must partner. Enterprise technology functions always have partners in the sense we always have suppliers, but now we are looking at two types of more interesting and strategic partnerships.

There are challenges in partnering with all types of companies. With the smaller companies, one challenge is just the mechanics. When you put a company like us together with a company that’s just started, we come in at completely the other end of the spectrum. We have a giant procurement team, lots of paperwork, lots of lawyers, and a very firm point of view over what a contract with us should look like.

A very new start-up quite often doesn’t even have a legal team. They have absolutely no idea how to contract at all.

Our approach there is both within our procurement team and within our technology team, we have dedicated people whose job it is to basically help manage those kinds of companies through beginning a relationship with us. They’ll do things like have a standard set of short-form paperwork and guidance so that when the start-up hires lawyers, they’ll have something to start with. That’s only one of the things we do to just help those people through the process so we don’t swamp them with our demands.

The other thing we’re trying to be really disciplined about is reminding ourselves that quite often for these smaller companies, a ‘no’ is as helpful as a ‘yes’. We can be quite a big polite organization. It can take a long while for a big enterprise to make its mind up that they don’t want to work with a company, and when a company is small, that can be a huge opportunity lost in that company. We try to be thoughtful and respectful of the limited time these small companies have and not waste their time if actually, we’re going to say ‘no’ in the end. Part of my job is to help people get to ‘no’ quicker as often as we get to ‘yes’ quicker.

At the other end of the spectrum, what we find working with the big global Cloud providers is we have the normal legal dance of what we’ll give on and what they’ll give on. But the good news is for the big Cloud providers, we have been through that process and we have Master Services Agreements in place with all of them. But that was a long, drawn-out process.

Lindsay Herbert: And now for the question I ask everyone. How do you define the term Digital Transformation?

David Knott: I’ll give you the cynical definition first. I get pitched to a lot, and most Management Consulting firms and technology vendors will stick the label ‘Digital Transformation’ on whatever they’re pitching because they see it as a door opener. From that perspective, Digital Transformation is a marketing term.

If I think slightly less cynically and more profoundly from my enterprise technology roots, Digital Transformation is the steady transformation of manual processes done by human beings, to digital processes done by machines. You then couple that with all the benefits you get from digitisation other than just costs, which is speed, accuracy, and vast quantities of data. In that way, Digital Transformation is a new term for a thing we have been doing for a very long time – it has been accelerating, but it’s not new.

But that definition comes from a very ‘inside-out’ perspective. My third definition of Digital Transformation comes from an ‘outside-in’ view. The advent of internet and mobile has created a world in which our customers, both corporate and retail, expect to interact with us fully and through a digitally enabled channel. This has driven us to change the way we present ourselves to the world, and because we come from a world of paper cheques and bank statements, it has engendered a massive transformation.

Digital Transformation in that sense is the acceleration and impetus given to change itself, via the fact that technology is now the primary customer interface.

This increases the urgency with which companies need to transform the way they operate in order to present the experience their customers actually want.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured, Innovation