Corporate innovation teams have always been challenged to focus on projects that will have the highest returns. Sometimes, our enthusiasm for new ideas can cause us to over inflate the innovation pipeline. COVID-19 presents a new pressure, one that is focusing attention on speed and accuracy of innovation portfolio decision-making. At Change Logic, we find our clients asking how to dynamically reset their innovation aspirations to match today’s highly uncertain, rapidly changing marketplace.

Portfolio management is a fundamental element of the innovation system that provides leaders with the insight, data, and visibility to make decisions to fund the right mix of projects across all growth horizons. Individual projects are evaluated using criteria that measures value, risk, and alignment to strategic objectives. When performing well, decision makers optimize resource loading for priority projects to maximize value creation. Companies striving for growth through innovation realize they cannot do everything they want to do. Leaders must confront core business and new-growth tension and set priorities. Since resource capacity is the primary constraint in most organizations, decision makers must be comfortable saying no to many promising projects to ensure the success of higher value projects.

Resource management goes hand in hand with portfolio management. It is the discipline that governs the way resources are deployed to ensure projects prioritized by the portfolio management process are staffed for success. It provides portfolio decision makers with the information necessary to optimize new product growth, productivity and project throughput by:

– Choosing the right number of projects (resource demand) relative to capacity (resource supply)

– Determining the capacity and cadence for new project initiation

– Understanding skill-set gaps

– Matching resource allocation to portfolio objectives in both core and new-growth portfolios

Early Stage Portfolio Management Maturity

As companies improve their portfolio management practices, they progress through distinct stages of capability maturity. Early stage portfolio management is characterized by periodic reviews where project data is gathered manually from individual project spreadsheets and customer experiment logs, reports are created and analyzed, projects are prioritized, capacity is determined, and funding decisions are made. Unfortunately, this stage is fraught with problems.

– Data collection is time consuming, taking weeks for some companies

– Project data is not kept up to date

– There are inconsistencies in project financial and learning metric calculations

– Project teams use different forecast approaches

This results in portfolio managers spending valuable time chasing down missing information and correcting irregularities in proforma estimates. And worse, portfolio decisions are based on stale information and questionable data that is out of synch with changes in project plans or changes in the marketplace.

Dynamic Portfolio Management

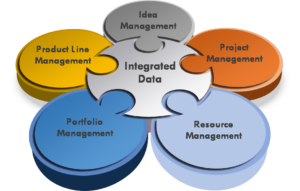

The next stage of portfolio management capability, dynamic portfolio management, brings step-change performance improvement to companies looking to accelerate growth from innovation. Dynamic portfolio management is characterized by continuous, real-time decision making using up-to-date data that is available for analysis whenever and wherever it is needed. Instead of being captured manually on disconnected spreadsheets, project data from across the organization is captured in a common portfolio management system that integrates a consistent set of strategic portfolio management, resource management, idea management, product line management, and project management reporting and analysis tools.

Figure 1. Decision data captured in a common system

When project data is captured in an integrated enterprise system it becomes possible to pre-configure standard portfolio views that represent the mix of dimensions needed to inform decision making. Leaders have up to date visibility into portfolio balance, value, strategy alignment, and resource supply and demand. Instead of waiting weeks to collect suspect data, decision makers have the information as needed, allowing them to identify projects or groups of projects for potential action and to manage constraints and unproductive tension proactively.

When consolidated project information is centrally housed in one system, individual managers can quickly and easily customize their portfolio analysis. A portfolio manager might start out with a standard, high-level view that displays monthly resource capacity versus aggregate project demand to help identify potential “red flags” such as downstream constraints. Once a constraint is identified, he or she can take a “deep dive” into a specific bottleneck function, role, over-allocated resource, or skillset, analyze alternative staffing scenarios, and determine corrective action. Portfolios can easily be “sliced and diced” in multiple ways over multiple time frames with different project data sets. Analysis that used to takes weeks pulling data from separate spreadsheets becomes instantaneous.

The benefits of dynamic portfolio management extend to other business processes as well. Individual project funding decisions, such as approvals at phase gates or new venture reviews, are made with knowledge of how go/no-go funding decisions align with portfolio objectives. Decision makers can make portfolio alignment and resource availability a pre-condition for receiving funding approval. Project Leaders are held accountable for working out staffing conflicts with business unit or functional resource “owners” in advance of the project funding decision. Teams come to the funding review with a staffing recommendation supported by the data and “what-if” analysis needed to ensure there are no major constraints or staffing issues ahead.

Dynamic portfolio management also helps remove the administrative burden and data inconsistencies inherent in cross-business unit analysis and decision making. As I pointed out in a previous article, ‘Innovation Portfolio Management: The Link Between Strategy and Execution’, it is important to distinguish between corporate portfolios (collections of business units and new-growth innovation initiatives), business unit portfolios (collections of core business innovation projects), and product lines (platform, brand, or franchise derivatives and line extensions). Each tier in this corporate hierarchy has its own unique governance mechanisms with different decision objectives and decision-makers. Operating at this scale is complex, but manageable when enabled by an integrated portfolio management system. Business unit portfolios, corporate portfolios, core product line portfolios, and new-growth portfolios can be viewed separately or combined. Using a common database, standard or custom portfolio views and performance dashboards are created on-demand for decision makers at any level in the corporate hierarchy.

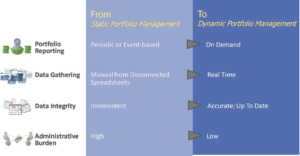

Figure 2. Moving from static to dynamic portfolio decision making

The benefits of dynamic portfolio management are amplified in times of high uncertainty and rapid change. The COVID-19 crisis has accelerated the need for real time decision making as companies evaluate and re-evaluate market scenarios, innovation strategy, project priorities, value chain disruptions, and customer buying behavior changes, all in the face of reduced capacity and reduced workplace productivity.

Dynamic Portfolio Management Illustrated

The following system dashboard summarizes the results of a “what-if” scenario where a change to the strategic category mix, priority, and number of projects results in an improved 5-year projected outcome despite lower overall investment (thanks to Sopheon for providing these screen shots from their Accolade Enterprise Innovation Management solution).

Dynamic Portfolio Management Software Systems

The landscape for dynamic portfolio management software systems is a crowded one consisting of highly integrated systems that support multiple innovation process elements, point solutions, highly configurable systems, on-premises, and cloud-based SAAS solutions. Project Portfolio Management (PPM) systems, the most common in the integrated category, include functionality that enables strategic portfolio management, resource management, project management, and idea management capabilities. In recent years, the leading PPM vendors have added functionality to support additional business processes, including product roadmapping, team collaboration, and Agile project management. In many cases, these additional capabilities have been added through acquisition of smaller, niche solution providers. The tools market has come a long way expanding functionality and improving ease-of-use with leading vendors looking to differentiate with an integrated set of unique capabilities.

Some well-established PPM solution vendors that offer a broad set of capabilities include Planisware, Planview, Sopheon, Changepoint, Clarity PPM (Broadcom), and Microsoft. Planview and Clarity have their roots in IT portfolio management and have successfully made the transition to innovation portfolio management. Both have expanded into Agile project management by way of acquisition. Planview acquired LeanKit in 2017 and Clarity bought Rally in 2015. Planisware was built to support innovation from its beginnings and is the dominant solution in the biopharmaceutical industry where advanced resource management algorithms are essential. Sopheon and Changepoint were also built from their start to support innovation and score high among users for ease of use. Microsoft benefits from its long history supplying project management tools and its MS Project solution is well entrenched in many organizations as the de facto standard for project management. Microsoft uses a certified network of third-party vendors to help its customers build out integrated PPM functionality (e.g., Edison 365, UMT 360, Cognizant).

Not to be confused with PPM systems, there is a large market of innovation point solutions – software solutions that enable one or two of the functions described (e.g., idea management, resource management, project management). Examples include Brightidea, Hypershift, PDWare, Ideascale, Hype, and Workfront.

Some of these solutions, with their narrow focus, offer robust capability in their area of expertise. However, they lack the benefits of a fully integrated system and may not scale to support interdependent capabilities as your company matures its innovation processes. This drawback has led to recent industry consolidation with point solutions being acquired by larger PPM vendors looking to expand functionality. For example, Planview acquired Spigit (idea management), the aforementioned LeanKit (lean and Agile project management), and Projectplace (project collaboration); PlanBox acquired Imaginatik (idea management); Sopheon acquired Alignent (product line management).

A word of caution about enterprise software systems. Buying a software system and expecting it to improve your innovation portfolio management performance is like buying an exercise bicycle and expecting to lose weight. You still need to do the hard work establishing a disciplined portfolio and resource management process, setting up a governance approach with project investment and decision making ground rules across core and new-growth portfolios, ensuring reliable data, and defining portfolio scope, project evaluation criteria, resource pools, review cadence, and investment allocation targets. Without these critical elements working in a synchronized, systematic way, software tools have limited utility and usually get the blame when performance expectations are not met.

Advanced PPM System Capabilities

Once a company is operating with discipline and consistency in the dynamic portfolio stage of maturity, it can consider layering in advanced portfolio management capabilities. For example:

– Fully integrating project financial data with functional budgets so bottoms-up project financials tie to top down functional plans

– Integrating product line strategies with project financials and resource plans so portfolio charts automatically update when product line roadmaps, business models, or ecosystem maps are modified

– Rolling out functionality to support management of linear, gated development side-by-side with iterative, lean innovation (Agile) approaches so leaders can simultaneously manage core and new-growth engines

– Tracking lean customer experiments and customer evidence metrics such as user engagement, retention rate, sign ups, website visits, and referral rates

– Applying artificial intelligence and predictive analytics to portfolio optimization, resource management, demand forecasting, project scheduling, and cost projections (e.g., “smart” resource planning algorithms and project schedule templates tied to historic data and project complexity parameters)

– Embedding voice-enabled chat bot functionality to quickly access and update PPM information (e.g., ‘show me budget to actual for project X’; ‘move backlog item 6 to done’)

– Integrating PPM with video conferencing platforms (e.g., Zoom)

Conclusion

The pace of change has accelerated with new digital technologies, emerging market growth, new business models, and competition from well-funded start-ups. At the current churn rate, half of today’s S&P 500 will be replaced over the next ten years. This was the environment we found ourselves in prior to the COVID-19 pandemic. The pandemic has accelerated change and has brought unprecedented uncertainty to markets. Annual or semi-annual evaluations of investment allocation and portfolio priorities are no longer enough. Companies need an “always on” process enabled by enterprise tools that allow them to continuously monitor, analyze, and make real time modifications to their innovation pipelines.

Dynamic portfolio management enables an entirely new set of capabilities that addresses the limitations of previous approaches. Real time portfolio analysis, made possible with up to date data captured in a common system, allows timely decision making that keeps up with a volatile marketplace. Greater visibility and accessibility to current project information allows better decision making and innovation portfolios that are optimized for maximum value creation and return on R&D investment.

This is the fourth in a series of five articles on innovation portfolio management. If you found this article helpful, I invite you to take a look at:

Innovation Portfolio Management: The Link Between Strategy and Execution

Innovation Portfolio Rationalization in the Face of a Downturn

The Big Hairy Challenge with Separating Innovation from the Core Business

For more practical tips, templates, and tools to enable innovation portfolio management, please send an InMail or direct message me here on LinkedIn.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: