I feel 2019 will be a make or break year for the platform providers for IIoT solutions. We are getting a real sense of clarity on who is leading the pack, who is struggling to keep up and some becoming real laggards, that need to change their game dramatically to stay in the platform hunt.

Clients need to come off their fence in where to invest and make some defining I(I)oT decisions. Yet to allow this to take place we need far greater clarity of the value and real positioning of the platform providers. We need to extract the real business value understanding and ditch all the “hype” that is drowning out the real understanding. Ditch the noise, increase the signal

When you look at this top fifteen provides you can break them out between those coming from the industrial solution providers (Siemens, Schneider Electric, Bosch, GE Digital, Hitachi) and those coming from a technology conglomerate positioning (AWS, Microsoft) those that are well known for specialised offering in technology solutions (IBM, SAP, Oracle, Cisco, Atos) and those that give perhaps greater specialised IoT focus in their business model (Software AG, PTC,C3 IoT)

How do you choose between these for your own solutions?

One thing enterprises struggling with is who to go with, that committing too, longer-term. Let us not forget, it is not one, it is a selection of those platform providers that when combined will offer you solutions to a significant part of your solution need. Partly, the decisions considers does depend on which industry you are in, the type of solutions you are looking towards to solve, so as resolve your biggest problems in your digital transformation.

Also, you have to consider the technology providers you have built a history with, often equally caught up in legacy issues, or those you determine will be best at managing your cloud and edge issues (management, storage, analysis, remote connections) going forward.

We can break it further down by recognizing we are seeing “Edge, Operating Platform and Cloud” as needing specific solutions. For example, Cisco is for me a real edge provider, AWS and Microsoft are cloud providers but what about the middle part the platform? The needs of your operating platform. This is the battle point that needs resolving and here this needs to consider what you want from your platforms, such as data assessments, collaborations, analytics, learning, innovation engagement and belief you get the type of cybersecurity needed, the best and leading practice into artificial intelligence, machine learning, a collaborative environment etc.

Then you really need to look at the granularity within all the reciprocating arrangements going on between these players. What constitutes the partnership agreements? Are they specific or general? Having a sales and marketing arrangement been made only, for their push into securing customers or are these because of shortfalls and where one strategic partner bridges that significant gap for underpinning the data issues or accelerating solutions into digital connections.

Do the combinations being offered, benefit you, until further clarity emerges on winners and losers? So do you hold off decisions, explore, experiment and stay in perpetual evaluation mode until this becomes clearer? In many ways, this decision is not the best for anyone, no decision really holds you back, stops you learning, exploring and figuring out your digital strategy needs in more practical ways.

Something needs to give in this platform, requiring a general market approach to consolidate and give that greater depth of focus to raise the confidence of the majority still yet to commit, to make a clear, lasting, deep commitment,. The business case digital transformation does offer really lasting value from all that IIoT can provide, solutions in a connected world that takes you closer to a reality of the promises that Industrial Revolution 4.0 ‘hype’and predictions on benefits being suggested can be realized.

Then you have to ask the real strategic question: what is the core need of each of the Platform providers?

Not all platforms are the same, they have all been racing to cover off all the “appealing parts” of platforms but we need to look and question what is actually core to each of them, the end need? All we know not one platform can offer all the services and solutions, they need alliances for sales and lead generation, for design competence or technology, industry or machine and factory understanding for example.

Let’s take an opening view on this. I want to look a little closer around this in a future post but here are my initial thoughts. These need a little more thinking but let me provide my designated need each is looking to achieve as a core. There is duplication but this might be not the actual case once you dig a little deeper.

We have those that really want to manage your data (Microsoft, AWS), provide ‘greater data management services (IBM, Microsoft, AWS through Amazon), intelligence services (SAP, Oracle, IBM). Those that want to capture the design, visualization and simulation market (PTC, Siemens, GE), those that can play into PLM and offer platforms to build a digital platform for this (PTC, Siemens), those that have “generic” capability for digital twins (PTC, Microsoft, Cisco) and those with highly specific digital twin capacity (Siemens and GE). Then you have the ones who want to protect connections and extend the edge (Cisco, Bosch, Schneider Electrics), offer (robust) machine learning and CyberSecurity built from their existing solutions in the market (SAP, Oracle, IBM, Microsoft, Amazon).

So we have partnerships and clients need to understand these partnerships or ecosystems of providers

I think you can break down the fifteen into these core activities and those linked into partnerships, you recognize no one has all solutions and often they lack the capabilities to bridge this into their offering. We have enterprises comes from deep technology domain knowledge and those coming from a deep industrial domain and machine performance knowledge.

We have the ones positioning as more neutral in their positioning, appealing to smaller and medium-sized clients (Schneider Electrics, Bosch, PTC) as they seem to offer the impression or actual fact they are less expensive and focus on specific needs and outsource very specifically and openly to others within these platforms (we know machines, others know data)

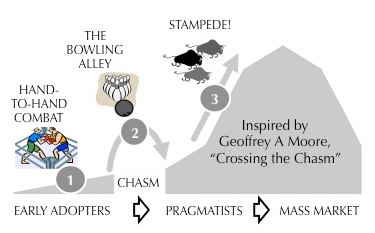

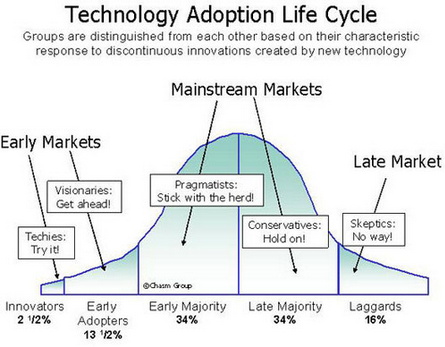

We have been in a real scrabble to build comprehensive platform offerings. I would say we are entering the bloodbath period of the Crossing the Chasm as depicted here, where all platform providers are desperately seeking to get into the bowling alley to “hit home runs”. Then we have a different type of stampede towards sub-sector optimization to be best in class.

My view or 2019 prediction is this “gaggle” of fifteen providers will consolidate. They will realize the realities you alone cannot be master of the platform universe, They will increasingly re-orientate their offering into specialized areas. This settling into very specific offerings will create the clarity of the stack offering that clients do need to invest fully into.

They are seeking answers to different questions. “Who do I use for the edge”? Who do I use for the platform? (specialist or generalist) and who do I use for cloud and technology leading applications (AI, Machine Learning)? This market definition breaks out will allow for some breakthrough in clarity, and give a more compelling argument of where to invest.

As the different submarkets or segments become defined and those within each of the parts starts to really focus in on their specific part, the jump across the chasm will happen at an accelerating rate. We do need clarity of positioning and the assessment of platforms for real delivery of a claimed position (Cyber, AI, market leading, digital twins etc)

The ability to cross the chasm and get the majority for adoption still needs to happen

A really important tipping point will arrive in 2019

Let me give you a stack selection, adding to the above thoughts to begin to segment these different platform providers as examples.

- Cisco or Schneider Electrics (or both) becomes you edge partner

- Siemens and Bosch become your specialized platform partners as well as C3IoT and or PTC as more generalized

- Amazon AWS or Microsoft Azure becomes you cloud and leading technology partners.

- SAP, Oracle or IBM become your interface to the existing application (ERP or specialized Intelligence Service Providers)

** So you end up with anything between 4 to 6 actual IIoT partners

The likes of Hitachi need to break out of their limited geographical sphere (Asia). Then two players not currently within platform providers that will give incredible insights on what is happing in the B2C space that is missing in this industrial space are Alibaba and Google. They are entering this IIoT market and will become attractive alternatives. Both have incredibly strong platforms from different perspectives that need watching and learning from.

The B2C platform building you will also require will have these two alongside Amazon AWS, Microsoft Azure, IBM, Oracle and SAP to be thought through as well in any comprehensive platform evaluation for many companies that operate with both the B2B (IIoT world) and B2C (the IoT world)

So I feel we are not yet at the point of “the platform providers really still do not know their market positions“? They are racing to cover off all options and that is wrong in the next stages of market maturity. As I explain in future posts

Do platform providers believe they can survive in this “race” and thrive? What happens if they still find the present offering concept of early adopters does not translate into the majority of industrial clients? What is holding clients back? Why are they not making commitments to move platforms across the chasm into full adoption? I believe most are convinced there is a pending shakeout time and who wants to be caught in the ones that become the losers?

For the platform market to finally explode it needs bolder leadership and influencing

New investments require leadership, those bold decision makers who evaluate the market today and since the shifts taking place, or barriers still to be broken down and make some bold decisions. We are at that “inflection point” for platforms. The current experiments, assessments need to be converted into clear, long-term decision commitment so the real momentum of technology, partnerships and “fusion” can take place. We are getting to that point. Platform investments have been made, now there needs a shift in building platforms into building clear, distinct value proposition platforms that clients can fully believe in to commit their future towards.

Research providers need to become more embolden themselves to help clients understand Platforms

Now the evaluation that knowledge providers like ZD net, IIoT_World, Gardners, Forresters, IoT Analytics should be providing is the market structure format and not lean heavily on the supply side and contractors for their understanding and giving “lagging” or “breaking” understanding in research or news. I sometimes feel these research providers are a little too much wedded at the hip to the providers of knowledge (understandably so) but need to continue to build out their evaluations into more of an independent and insightful, shaping for client understanding. Yes, even Gardner and Forresters who do very helpful evaluations but in static reports, that can go out of date very fast.

These research providers should take on a more shaping role to help their clients far, far more in future structures and defined matrix work to give us all a greater understanding of the future (possible) shape. I know they partly do this but it should be having a higher emphasis to help decision making by placing greater structure from their knowledge into a segmentation analysis that would better serve the client that needs to buy solutions

These knowledge providers need to switch to the demand side, the clients side and begin to shape and influence this confusing space into this stack need and explore from this the solution suggestions that clients need and suppliers can robustly provide. Note that word robustly as there is so much hype and claim, often with poor use cases or highly specialized to that one company featured or a real lack of “APP” solutions

Summary

So I believe 2019 we will see segmentation, consolidation and some of the beginnings of necessary stack definitions

We will see that the platform providers have all been supported by other parts of their business. Be this cloud services (AWS and Azure), PLM (Siemens and PTC), IBM, SAP, Oracle ( the need to support there intelligence and invested solutions like ERP, SAP HANA and IBM Watson) or the need of their industrial solutions requiring the digital element (Schneider Electrics, Hitachi, Siemens, GE, Cisco and Bosch).

Then Atos, IBM, Software AG, C3 IoT coming from their consulting or software supporting practice). Knowing the real profit from platform offerings would perhaps be an uncomfortable position today as they are all investing in the future.

There are a few things that can determine the eventual winners. These are openness, transparency, type of revenue model, the ability and capacity to fund their platform development and the ability to solve customers problems to give them returns on investment all need to feel is worth the decisions, investments and commit too. To get to this point of client identification we need to see the greater emergence of the specialized core role the platform can undertake.

We know we can (simply) connect up other platform providers but there needs to be a higher, more compelling reason why one platform makes sense over another. The current appealing to all, in the race to similarity, is a bad race to be involved in. You get into those races of over promising, under delivering.

Finally, It is hard to know the staying power of all those involved in platforms (burn rates must be high) but as more alliances form we will see combinations emerge that, once evaluated and analyzed well move potential clients off the fence as the solution “set” becomes clearer.

Platform providers will show there value and worth and investments will accelerate in the core competencies and that is a very healthy notion of where innovation becomes highly distinctive and valuable to the platform provider. Today they are all chasing the same “generic model” in my view and that over time does not make sense.

In 2019 this shift in platform thinking I believe does need to happen, Who is going to shape platform providers into client solution offering that are specific and provide real value?

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured, Internet of Things