Forward by Michael Tushman, Baker Foundation Professor, Harvard Business School Chairman, Change Logic

“Most companies find it challenging to simultaneously manage both core and exploratory innovation portfolios. Successful ambidexterity requires a clear strategy that justifies the need for both core and exploratory innovation, sufficient separation of exploratory innovation to allow different, more entrepreneurial operating processes to thrive, an ambition that motivates the organization around a common purpose, and leadership commitment with the courage to act in the face of uncertainty.

Portfolio management is one of the key linking mechanisms that can enable a firm to pursue an ambidextrous strategy. It connects strategy to execution through investment decisions, project prioritization, and resource allocation. The most successful growth firms have these mechanisms for balancing investment and resource allocation across core and exploratory innovation portfolios without trading off one for the other.

That means that when short-term conditions in markets, customers, or internal operations change, these leaders have the courage to stick to investment allocation targets established by the company’s longer-term growth strategy. It is less likely that explore gets cut by accident or without clearly understanding the implications. They can see whether it is better to delay a core product line extension in favor of accelerating an uncertain innovation even if the financial payo is several years out. These sorts of evidence-based decisions help prevent cuts in explore budgets to make an annual budget but kill the firm in the long-run

I am thrilled that Change Logic is shining a light on these practices so that we can learn how more firms can deploy successful portfolio management to enable them to be truly ambidextrous.”

Table of Contents

SUMMARY FINDINGS

- Common Portfolio Management Challenges

- General Observations on Industry Leaders 6

STUDY RESULTS & INSIGHTS

- Practices of Industry Leaders – Leadership’s Role

- Investment Allocation

- Leading for Ambidexterity

- Practices of Industry Leaders – Portfolio Structure & Governance

- Portfolio Governance

- Portfolio Structure – Core and Explore

- Practices of Industry Leaders – Portfolio Reviews

- Portfolio Review Purpose

- Portfolio Review Frequency

- Project Evaluation & Prioritization

- Practices of Industry Leaders – Portfolio Management Tools

- Portfolio Tools

- Portfolio Data

ABOUT THE STUDY

- Study Objectives

- Study Scope

- Study Approach

- Study Participants

SUMMARY FINDINGS

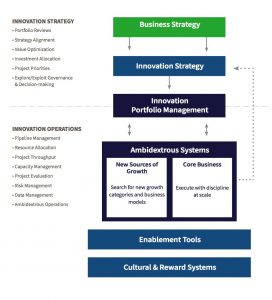

Innovation portfolio management is a fundamental business capability for planning, aligning, and optimizing R&D investment. It serves as the primary link between innovation strategy and project execution, providing corporate and business unit leaders with the insight, analytics, and visibility to improve decision-making for funding the right mix of projects across all growth horizons.

The discipline has both strategic and operational elements. Leaders allocate investment according to strategic priorities to maximize value creation, while balancing overall resource needs versus availability to maximize project throughput.

Common Portfolio Management Challenges

Strategic and operational challenges most frequently cited by study participants

The results of this year’s Change Logic portfolio management study exposed common strategic and operational portfolio management challenges. The strategic challenge most frequently cited by study participants was a mismatch between investment mix and company ambition. Most of the companies we studied felt they had clear growth goals. However, in many cases, the current mix of funded projects had a disproportionate number of incremental investments that did not match the scale of the growth ambition. In other cases, it was unclear what proportion of growth would come from organic innovation. Other strategic challenges cited include differing points of view on how to evaluate projects, corporate politics as an impediment to portfolio decision-making (portfolio decisions that cut across functional management objectives, threatening power and control), and an inability to make or follow through on tough decisions when market conditions are uncertain.

The strategic challenge most frequently cited by study participants was a mismatch between investment mix and company ambition.

The operational portfolio management challenges most frequently cited include an overloaded pipeline, too much late-stage firefighting, inconsistent data (not kept up-to-date or taking too much time and effort to collect and analyze), complex cross-project or business unit interdependencies, and ineffective portfolio reviews.

There is clear separation in performance between high performing industry leaders who have overcome these challenges and those in the early stages of building portfolio management capability.

General Observations on Industry Leaders

The study revealed some significant gaps between average performers and leading companies (those in the top ten percent of their industry). Top performers were interviewed to identify specific practices that correlate to excellence in portfolio management.

Top performers have established clear investment allocation criteria that facilitates objective decision-making. They go beyond financial metrics and look to customer experiment data and insights to validate critical market and project business case assumptions. Their portfolios are continuously monitored for balance and strategic alignment and they can rapidly change investment priorities as external and internal conditions change.

Leading companies also mentioned the importance of a disciplined portfolio review process. Quarterly reviews that are decision-oriented and produce clear outcomes. The effectiveness of the review process and reliability of the data are under continuous improvement with clearly defined decision-making responsibilities for corporate, business unit, and product line leaders. Top performers also pay close attention to resource allocation. The mix and number of projects in development is tightly managed based on priorities and resource availability.

Perhaps most important of all, industry leaders view portfolio management as a key business capability that must be executed consistently and continuously improved.

STUDY RESULTS & INSIGHTS

Practices of Industry Leaders – Leadership’s Role

The study revealed several common characteristics among leaders from high performing companies. Leaders for top performers clearly define and communicate a growth strategy with strategy objectives that cascades to business unit leaders, functional managers, and project teams.

They exhibit the courage to follow through on their growth ambition, even when market uncertainty is high, by maintaining investment in longer-term, higher risk/reward innovation. They recognize that new product ideas from multiple sources can inform strategy from the bottom- up and periodically rationalize portfolios to eliminate low value or dormant projects.

Leaders in high performing companies recognize that core and exploratory innovations require different capabilities, processes, and reward systems. They set up separate operating models for each, confront the core-explore tensions that inevitably arise, and prudently leverage core resources and capabilities when scaling new businesses.

When managing exploratory new venture portfolios, leaders understand that their role is different from that of leaders who manage execution-oriented core portfolios. They establish areas of focus, set opportunity size guidelines, and provide a “safe space” for exploratory innovation teams. They are mentors, not micromanagers, who promote a culture where failure is reframed as learning and back it up with incentive systems that reward rapid learning.

Effective exploratory portfolio leaders accept that decisions must be made under uncertain conditions. Exploratory project funding is closer to a venture capital model where projects are funded in stages to manage risk (i.e., metered funding). Traditional ROI metrics are replaced with customer evidence and validated learning. When presented with customer evidence that demonstrates progress, exploratory portfolio leaders make fact-based investment allocation decisions, ratcheting up funding for projects that show promise, quickly cancelling those that do not, and rebalancing priorities accordingly.

Investment Allocation

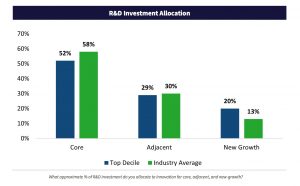

Leadership allocates R&D investment across core, medium-term, and long- term growth horizons based on growth objectives with top performers investing an average of 7 percent more in new-growth, exploratory innovation.

When performing well, the portfolio management discipline ensures alignment between strategy and funded projects. Leaders that seek more aggressive, organic growth must invest a higher percentage in higher risk/reward exploratory innovation. They also realize they must monitor investment throughout the year and periodically prune low value projects to free up capacity to accelerate higher value investment opportunities.

The pace of change in most industries has accelerated well beyond the point where an annual evaluation of investment allocation and project priorities is enough. Companies with advanced portfolio management capability and centrally housed project data can quickly model or simulate alternative investment scenarios and make trade-off decisions in real-time.

Leading for Ambidexterity

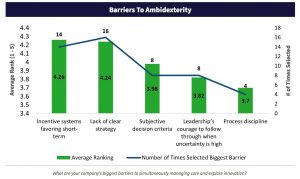

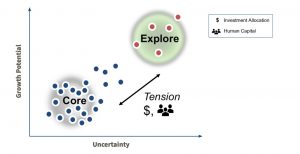

Most companies find it challenging to simultaneously manage both core and explore innovation portfolios. The biggest barriers cited include incentive systems that favor the near term and lack of a clear ambidextrous strategy.

Successful ambidexterity requires a clear strategy that justifies the need for both core and explore innovation, sufficient separation of explore innovation to allow different, more entrepreneurial operating processes to thrive, an ambition that motivates the organization around a common purpose, and leadership commitment with the courage to act in the face of uncertainty.

Leading companies have learned to balance investment and resource allocation across core and explore innovation without trading off one for the other.

Portfolio management enables ambidexterity by connecting strategy to execution through investment decisions, project prioritization, and resource allocation. Leading companies have learned to balance investment and resource allocation across core and explore innovation without trading off one for the other. And when short-term conditions in markets, customers, or internal operations change, these leaders have the courage to stick to investment allocation targets established by the company’s longer-term growth strategy. They have the restraint to say “no,” or to delay a core product line extension in favor of accelerating an uncertain innovation even if the financial payo is several years out.

Practices of Industry Leaders – Portfolio Structure & Governance

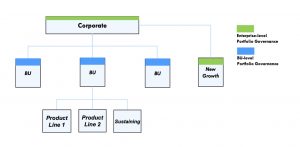

Large companies with a traditional business unit organizational structure distinguish between corporate portfolios (collections of business units), business unit portfolios (collections of core business projects), and product lines (platform, brand, or franchise derivatives or line extensions). Each tier in this corporate hierarchy has its own unique governance mechanisms with different portfolio decision objectives and decision-makers. At the corporate level, leaders are responsible for managing innovation across a portfolio of business units and, for those with a centralized, corporate-funded exploratory innovation model, overseeing new growth initiatives, cross-business platform development, and acquisitions.

The corporate governance team establishes company-wide strategy, tracks and monitors business unit performance, and ensures that each business unit is playing its proper role in the execution of business strategy. Business unit leaders establish business unit strategy, determine investment allocation, manage resources, and prioritize projects. Product line managers determine the type, sequence, and timing of new products.

Exploratory innovation projects are managed and prioritized in a separate portfolio. However, core and explore resource demand is typically rolled up in one portfolio view for shared resource constraint visibility.

Most of the leading companies we studied manage the project portfolio at the level in which project resource allocation decisions are made. This is typically at the business unit level for large companies and at the corporate level for small companies (less than 1000 employees).

We discovered a wide variety of investment allocation methods, each based on how the senior team translates strategy into investment choices. The most common were by product line, product type (new platform, new product, line extension, maintenance), growth horizon, and market segment. One leading materials company splits investment according to technology type before sorting by market segment.

The importance of a well-defined portfolio structure with clear governance cannot be overstated. Strategy needs to be translated into decision-making mechanisms at each level in the corporate hierarchy so leaders can determine the right investment mix. At the same time, the most attractive project opportunities that meet strategic criteria need to be funded. Portfolio management is the linkage between top-down strategy and bottom-up execution

Portfolio Governance

Most large companies govern core project portfolios at the business unit level and have reporting mechanisms in place to ensure that each business unit plays its proper role executing corporate strategy.

In large companies, it is important to distinguish between corporate portfolios (collections of business units and new-growth initiatives), business unit portfolios (collections of core business projects), and product lines (platform, brand, franchise derivatives, or line extensions). Each tier in the corporate hierarchy has its own unique governance mechanisms with different decision objectives and decision-makers. When operating at this scale, leading companies manage core project portfolios at the level in which project resource allocation decisions are made. This is typically at the business unit level.

For those with a centralized exploratory innovation model, a venture-style governance team establishes areas of focus (hunting zones), sets opportunity size guidelines, and provides a “safe space” for innovation teams. Cross-business unit platforms, those that benefit multiple BUs, are also governed at the corporate level.

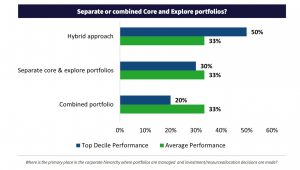

Portfolio Structure – Core and Explore

Managing high uncertainty, exploratory innovation in a separate portfolio is quickly becoming common practice. However, companies still need visibility to shared resources (hybrid approach).

Leading companies have learned to run exploratory projects in a separate portfolio with distinct funding criteria, lean processes, and venture-style governance mechanisms. These high uncertainty projects are evaluated and prioritized independently from core projects. However, as risk and uncertainty are reduced and projects move closer to launch and scale-up, teams get significantly larger. Innovation teams need to tap deeper into functions like manufacturing, supply chain, procurement, marketing, quality, regulatory affairs, and customer service. When this happens, core and explore teams end up competing for the same resources. Portfolio decision-makers must compare the relative value of all investment alternatives and make tough resource trade-off decisions between core and explore projects.

Portfolio analysts and resource managers aggregate resource availability for both core and emerging new businesses, identify downstream constraints, and align plans with strategic priorities. Armed with this information, portfolio decision-makers can anticipate bottlenecks, reprioritize, and flex capacity where needed to avoid delays and other late-stage surprises.

Practices of Industry Leaders – Portfolio Reviews

The portfolio review, when effective, is a decision-making forum designed to confirm adherence to portfolio objectives while making periodic corrections or adjustments based on changing market conditions, project variances, strategic pivots, or other significant new information gained between annual planning cycles. Leading companies utilize their portfolio review process to align investment to strategy, to optimize innovation pipeline value, and to prioritize projects. They establish a consistent agenda with clear review outcomes that are different from individual project funding or status reviews and are conducted at a frequency that is appropriate for the business. Most industry leaders have established a quarterly portfolio review cadence at the business unit level with semi-annual review at the corporate level.

The industry leaders allocate review time to evaluate the latest customer and competitor data, to proactively address resource constraints, to discuss platform, project, and technology lifecycles, and to address white space opportunities no less than twice per year.

A consumer-packaged goods company we spoke with relies on their portfolio review process to help them identify and rectify variances in their planned growth trajectory. They shared an example from a recent mid-year portfolio review that exposed a disproportionate investment in incremental renovation and maintenance projects. Company leaders realized they needed to rebalance their portfolio and increase investment in new, high-growth categories. They modified their investment mix, re- prioritized projects, cancelled several low value renovation projects to free up capacity, and raised their opportunity size guidelines for new project approvals. These changes helped get them back on track.

Another company, in the industrial products sector, told us how their quarterly portfolio reviews have helped them improve development productivity. They explained how they regularly analyze a standard set of resource capacity views to identify downstream constraints that can inhibit the flow of projects. With this information in hand, decision-makers proactively reallocate resources or flex capacity to avoid costly project delays and improve overall project throughput.

The output from the portfolio review includes documented, actionable decisions that clarify linkages between innovation investment allocation and the execution activity needed to produce results.

Leading companies recognize the importance of a disciplined portfolio review process. They have learned that they need to periodically monitor and rebalance their innovation portfolios, pruning low value projects in favor of accelerating the most promising. The pace of change has accelerated well beyond the point where an annual evaluation of investment allocation and project priorities is enough.

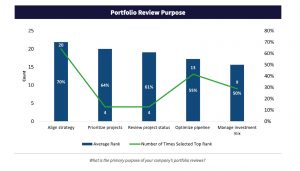

Portfolio Review Purpose

Portfolio reviews serve multiple purposes—strategy alignment, pipeline value optimization, and investment mix management were selected most frequently as the primary purpose by survey participants.

The portfolio review, when operating effectively, is a decision-making forum designed to confirm adherence to strategy objectives while making periodic corrections or adjustments based on changing market conditions, project variances, strategic pivots, or other significant new information gained between annual planning cycles. Unfortunately, in many companies, portfolio review are used to review project status. Project teams are paraded in front of senior leaders, providing schedule updates and presenting red/yellow/green issue logs while executives pepper project teams with questions and tinker with tactical project details.

Study participants highlighted a few techniques that help to keep their portfolio reviews productive and focused on their intended purpose. 1) Establish a portfolio analysis team to separate data capture and analysis “pre-work” from the portfolio review. This team formulates a set of recommendations in advance of the review, 2) Utilize the gated development process, functional sta meetings, and project dashboards to keep leaders informed of project status, 3) Start the portfolio review with a discussion of meeting objectives to reinforce the portfolio reviews intended purpose.

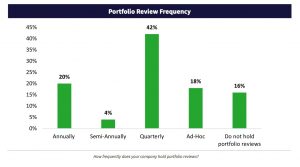

Portfolio Review Frequency

While most leading companies hold quarterly reviews, over 50% of companies surveyed still conduct portfolio reviews annually, on an ad-hoc basis, or not at all.

The portfolio review, when operating effectively, is a decision-making forum designed to confirm adherence to portfolio objectives while making periodic corrections or adjustments based on changing market conditions, project variances, strategic pivots, or other significant new information gained between annual planning cycles. In other words, portfolio management is a dynamic process. Unfortunately, many companies still use their annual budgeting process to fund and prioritize development projects. Annual planning is not a substitute for portfolio management. Markets, technologies, customer buying behaviors, and competitors change too quickly. In most industries, a quarterly review cycle is needed to revisit investment priorities and reallocate resources.

Key factors in determining portfolio review cadence include 1) market pace of change – companies in fast changing, dynamic markets need to revisit project and aggregate portfolio assumptions more frequently, 2) number of concurrent projects (more projects typically brings increased portfolio complexity and the need to continuously re-allocate/optimize investments), 3) dedicated vs. shared resources (when scarce resources are shared across multiple projects, clear and up-to-date project prioritization becomes critical), and 4) product development cycle time (companies with shorter development cycle times need to react more frequently to plan or market changes, e.g., cell phones vs. aircraft engines).

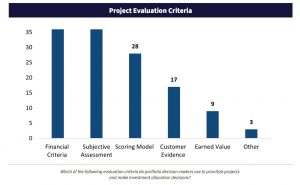

Project Evaluation & Prioritization

Financial projections and subjective assessment are the evaluation criteria used most frequently for investment allocation and project prioritization decisions.

Surprisingly, despite their desire for objectivity, many companies fall back on subjective criteria or executive opinions when making project prioritization decisions. This can sap development productivity with scarce resources being spent on questionable projects— incremental improvement projects that don’t move the needle, pet projects, dormant projects that languish, and science projects with no link to product line strategy.

Scoring models are a useful way to incorporate qualitative criteria into the decision process, capturing intangibles such as strategic fit, market and technology risk, and operational leverage. However, they are best used as a starting point for an informed discussion.

As you move away from the core business to evaluate projects meant to drive growth in new categories, traditional criteria become less and less reliable. Projecting an ROI in the early stages of an exploratory innovation is guesswork at best. This is where customer evidence needs to take priority as an input to portfolio decision-making.

Practices of Industry Leaders – Portfolio Management Tools

There is a correlation between the use of enterprise so ware tools and excellence in portfolio management at large companies. Portfolio Managers from large companies revealed that, as their companies scaled and their product portfolios became more complex, they outgrew the utility of spreadsheets. There came a point when the administrative burden attached to manual data collection, cleansing, and analysis became too high.

Most of the industry leaders in our study use an integrated system that houses project information centrally and supports multiple capability areas (e.g., portfolio management, resource management, project management, idea management). This class of enterprise so ware supports continuous, real-time decision-making with pre-configured portfolio views available on demand with “what-if” analysis capability.

One common practice among these high performers is to define and preconfigure a standard set of “go to” portfolio views that represent a mix of the most important portfolio dimensions. One leading medical device company we spoke with boiled their analysis down to 6 standard views that inform decision-makers on portfolio mix, value, strategy alignment, risk, pipeline cadence, and resource supply/demand.

Another common practice is to develop and maintain a library of standard resource and cycle-time profiles tied to project type or complexity parameters. Project teams reference this data and use it as a starting point for planning. These planning algorithms become more accurate over time, resulting in improved resource management, reduced time-to- market, and improved schedule predictability.

Enterprise portfolio and resource management tools enable an entirely new set of capabilities that address the limitations of manual approaches. Real-time portfolio analysis allows timely decisions that keep up with an increasingly volatile marketplace. Greater visibility and accessibility to current project information allows better, more informed portfolio management.

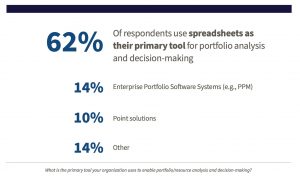

Portfolio Tools

Most companies surveyed still use spreadsheets as their primary tool for portfolio analysis and decision-making.

Spreadsheets are still the de facto standard tool used for portfolio planning and analysis. However, as companies scale and mature their portfolio management practices, there comes a point when they outgrow the utility that comes from disconnected spreadsheets. As companies scale and increase the number and complexity of their offerings, data collection and analysis become more and more time-consuming and can lead to portfolio decisions based on stale information or questionable data that is out of synch with changes in project plans or changes in the marketplace.

Today’s enterprise portfolio management systems enable continuous, real-time decision- making using up-to-date data that is available for analysis whenever and wherever it is needed. Instead of being captured manually on disconnected spreadsheets, project data from across the organization is captured in a common database that integrates portfolio management, resource management, idea management, product line management, and project management reporting and analysis tools.

When project data is captured in an integrated enterprise system it becomes possible to pre- configure standard portfolio views that represent the mix of dimensions needed to inform decision- makers. Leaders have up-to-date visibility into portfolio balance, value, strategy alignment, and resource supply and demand. Instead of waiting weeks to collect suspect data, decision-makers have information as needed, allowing them to identify projects or groups of projects for potential action and to manage constraints and unproductive tensions proactively.

The landscape for dynamic portfolio management software systems is a crowded one consisting of highly integrated systems that support multiple innovation process elements, point solutions, highly configurable systems, on-premises and cloud-based SAAS solutions.

The landscape for dynamic portfolio management so ware systems is a crowded one consisting of highly integrated systems that support multiple innovation process elements, point solutions, highly configurable systems, on-premises, and cloud-based SAAS solutions. Project Portfolio Management (PPM) systems, the most common in the integrated category, include functionality that enables strategic portfolio management, resource management, project management, and idea management capabilities. In recent years, leading PPM vendors have added functionality to support additional business processes, including product road-mapping, team collaboration, and Agile project management. The tools market has come a long way in expanding functionality and improving ease-of-use with leading vendors looking to differentiate with an integrated set of unique capabilities.

Not to be confused with PPM systems, there is a large market of innovation point solutions – so ware solutions that enable one or two of the functions described (e.g., idea management, resource management, and project management).

Some of these solutions, with their narrow focus, offer robust capability in their area of expertise. However, they lack the benefits of a fully integrated system and may not scale to support interdependent capabilities as your company matures its innovation processes. This drawback has led to recent industry consolidation with point solutions being acquired by larger PPM vendors looking to expand functionality.

Portfolio Data

Top performing companies ranked the integrity of project data used to make portfolio decisions 1.5X higher than average performers.

Companies in the early stages of portfolio management capability highlighted challenges with data integrity. Common problems include data that is not kept up-to-date, inconsistent project financial calculations, and project teams that use different volume forecasting approaches. This results in portfolio managers spending valuable time chasing down missing information and correcting irregularities in pro forma estimates. And worse, portfolio decisions are based on stale information and questionable data that is out of synch with changes in project plans or changes in the marketplace.

Leading companies are starting to apply artificial intelligence and predictive analytics to portfolio optimization, resource management, demand forecasting, project scheduling, and cost projections (e.g., “smart” resource planning algorithms and project schedule templates tied to historic data and project complexity parameters). These companies are also incorporating customer evidence into project portfolio decision-making, replacing uncertain financial projections and opinions with facts. When using evidence of value from customer experiments, portfolio decision-makers focus on the viability of the most critical assumptions that drive the numbers in the project’s business case.

About the Author

Noel Sobelman is a Principal and Portfolio Management Practice lead in the San Diego office of Change Logic.

Noel works with corporate leaders to accelerate core business vitality while simultaneously building new-growth businesses. For the past 25 years, he has worked extensively in the areasof growth strategy, innovation capability building, portfolio management, organization design, ecosystem development, and digital enablement. He is widely recognized for bringing a practical and applicable approach to companies looking to ignite change.

Acknowledgements

The author thanks Lucas Wall for superb data analysis for this year’s report. He is also thankful to Andrew Binns, Kristin von Donop, Christine Gri in, Aaron Leopold, Eugene Ivanov, Nishi Gupta, and Vanessa Ceia for their thought partnership and writing assistance. Special thanks to Ember Harker for graphic design. In addition, he thanks Jo-Ann Sabatini and Alina Cowden for their assistance helping to edit, design, and plan the report launch

For Further Contact

STUDY RESULTS & INSIGHTS

ABOUT THE STUDY

Study Objectives

- To raise awareness of portfolio management as a key innovation capability

- Increase the performance of the portfolio management discipline by:

- Defining a common set of portfolio management performance characteristics

- Establishing process benchmarks and performance levels for this set of characteristics

- Identifying key correlations for excellence in portfolio management

- Linking good practices to best-in-class performance

- Defining a common set of portfolio management performance characteristics

- Identify gaps between average and leading companies

- Position results with companies as a preamble to action

Study Scope

Our definition of portfolio management considers both strategic and operational elements.

- The research focuses on four areas of the innovation portfolio management discipline

- Overall portfolio management performance

- Leadership’s role

- Portfolio structure and governance

- Portfolio review effectiveness

- Portfolio data and tools

- Interviews included the above topics with emphasis on practices that separate the performance leaders from average or lagging performers

– Participants were asked to self-select performance within their industry based on innovation growth and operational metrics over the previous 2 years. Metrics included revenue from new core products, revenue from new growth categories launched (beyond the core), return on R&D spend, time-to-market, and schedule predictability.

Top Decile Performer:

– Performance in the top 10% of the company’s industry. Inclusive of Industry Leader and Industry Best-in-Class cohorts.

Average Performer:

– Companies outside of the top decile. Inclusive of Industry Average and Industry Laggard cohorts.

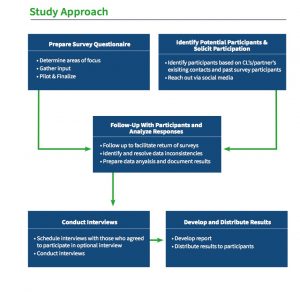

Study Approach

Study Participants

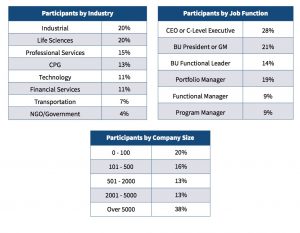

There were 65 survey responses and interviews captured for the study.

Change Logic research is conducted by Change Logic, Inc.; whenever there is input from outside entities, including our clients, we make that clear and will only use client names when we have permission. We ask that you not publish or post this report in its entirety; if you quote from it or reference it, kindly credit Change Logic.

To get data from this report in presentation form, visit changelogic.com/contact or email Noel Sobelman directly at noel.sobelman@changelogic.com.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: