Throughout the COVID-19 lockdown phase, I have been following very closely the global economic and retail growth trends in anticipation of the reopening phases which are now underway in many parts of the world. Good signs from key markets such as USA which saw the biggest historical increase in retail sales in May.

The threat of multiple other waves of COVID-19 is still present, but key lessons have already emerged to guide countries during the reopening phase. Continuing to do well are most of the essential retailers, e.g. food and drug stores. Their growth spike will slow as more of the retail industry reopens. Best positioned are those essential retailers that had fully scaled services such as Buy-on-Line-Pick-Up-in-Store (BOPIS) prior to the pandemic lockdown.

Non-essential retailers, especially apparel and department stores have a longer road to recovery and some projections have them returning to 2019 level in the distant year 2023. To survive these sectors have already accelerated discounting, a recipe which will trains consumers to expect more and further delay profitability.

As Neil Saunders pointed out in his June 12 Webinar, in May 2019 just over 21% of apparel items were discounted and the average discount was nearly 18%. For May 2020, nearly 70% of the items are discounted and the average discount rate is more than double at just over 44%.

The lockdown online shopping spike is subsiding with various forecasts having 2020 reach 20% to 21% of total USA retail sales. Prior to the pandemic, USA ecommerce was expected to reach anywhere from 15% to 19% of total retail sales as projected by multiple industry analysts.

COVID-19 has become a brutal accelerator of digital transformation trends that were already underway.

Ecommerce has leaped two to three years ahead of previous growth patterns. There will be a substantial number of physical stores in the boring middle that failed to keep up with consumer engagement and innovation that will close.

Proactively managing uncertainty by analyzing the latest economic and retail forecasts is paramount to returning retail to prosperous growth.

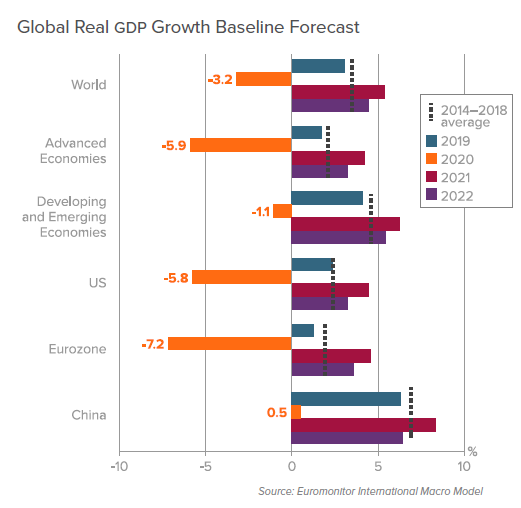

China Leads the World in GDP Recovery

Latest June 2020 Euromonitor report points to China as the only major economy that will still grow in 2020. Globally Gross Domestic Product (GDP) will be down -3.2% in 2020. USA will be down -5.8%. Hardest hit is the Eurozone which will be down -7.2%.

In 2021, the strongest growth is again expected in China, up 8.3%. Other key economies in 2021: USA +4.5%; Eurozone +4.6%; Germany +4.5%; Italy +4.6%; Spain +4.7%, UK +4.2%. Slowest 2021 GDP growth countries include: Japan 2.8%; Mexico +3.0%; South Korea +3.2%.

The latest 2020 forecast from the World Bank is more pessimistic than Euromonitor. According to the World Bank forecast, GDP 2020 growth will be: world -5.2%; USA -7%; and Eurozone -6.1%. World Bank also not as optimistic for 2021 with USA +4.0%; Eurozone +4.5%, and China +6.9%.

Uncertainty about the path of the pandemic will keep the forecasts fluid. Retail reopening plays a key factor on the road to the recovery.

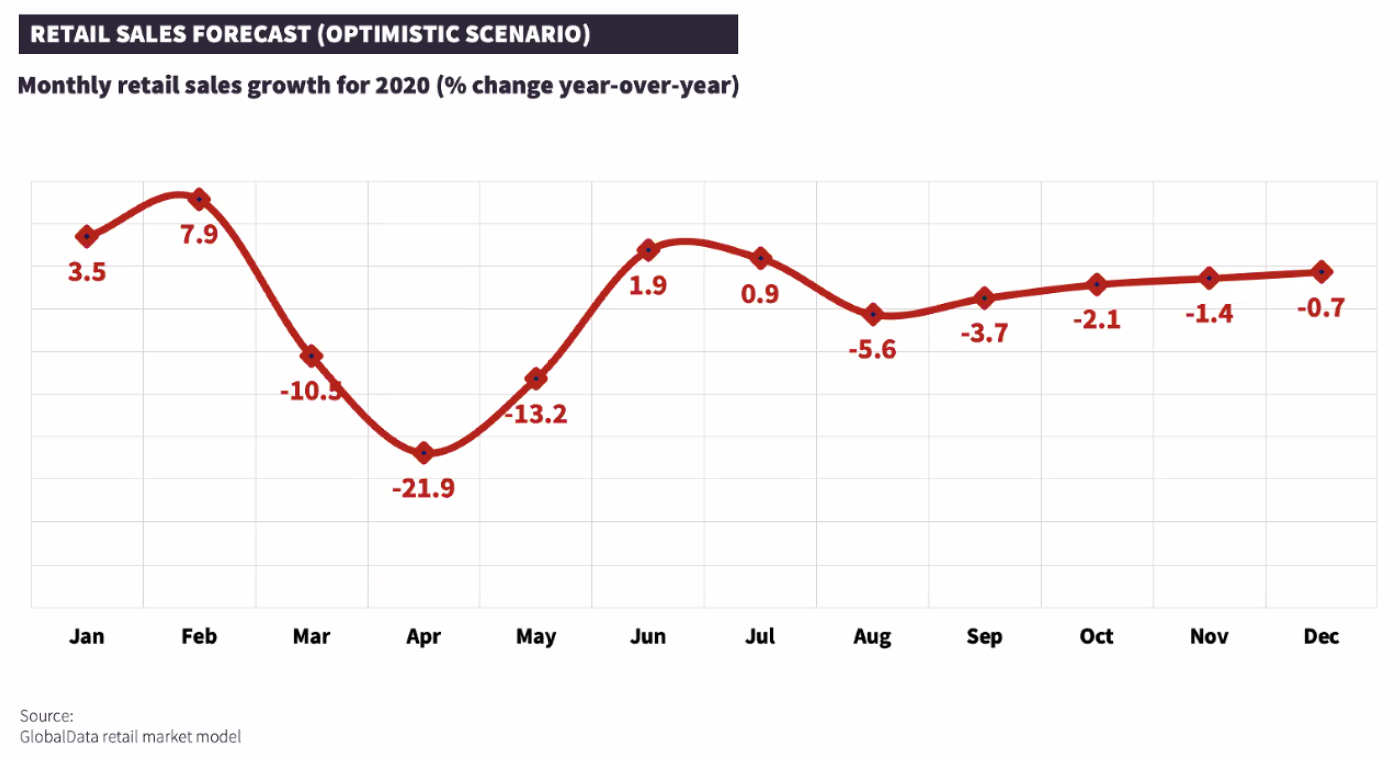

The Patchy USA Retail Recovery is Underway

The latest USA forecast from Global Data paints a patch recovery for retail through the rest of this year. June / July growth are pent-up demand, but overall growth remains negative for the year.

For the USA holidays, Global Data forecasts that sales will be down 1.1%. This forecast is subject to the progression of a second wave, legislation around the stimulus and unemployment benefits.

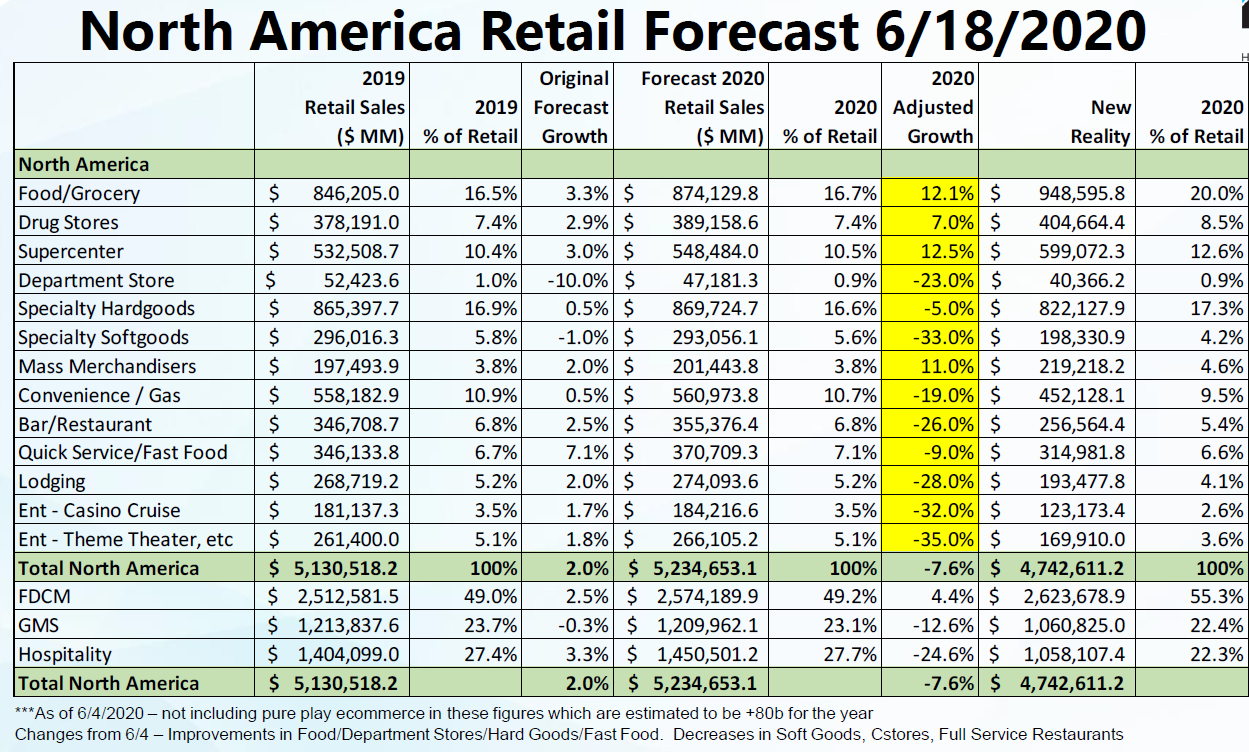

The Haves and the Haves Not Retail Sectors

The IHL Group just updated their 2020 forecast for North America retail sectors. Overall retail sales will be down -7.6%. The winners in 2020 are food/grocery, drug stores, supercenters, and mass merchandisers Three of out of these four will experience double digit growth in 2020.

Entertainment sectors will be down -30% plus with specialty softgoods down -33% and department stores down -23%. It’s a very tough year for non-essential considered sectors.

There will be a substantial number of closures in 2020, but stores are not going away. As economies reopen worldwide, Covid-19 is reinforcing the importance of the physical store, but is also exposing that just being a brick and mortar destination is not enough to thrive in the future.

Progressive retailers should be exploring and adding more convenience services that engage consumers across channels. Listen to the pain points of your customer base. Stop being boring. Invent more and expand the service linkages to increase the value of your physical store asset for a brighter 2021 and beyond.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox