We can all too often forget, those of us working in programmatic, data, adtech and digital media (with the plethora of three letter acronyms, media metrics and performance indicators) that for all marketers, the ultimate aim of advertising is to increase sales revenue and market share.

This is the single objective of advertising. No brand launches and invests in social awareness campaigns or personalised dynamic ad creative or custom audience targeting or cross-device story telling simply for the sake of it, at some point that investment has to come back to real business outcomes, actual sales volume/revenue and market share growth.

The “Laws” of Marketing, Sales and Buyer Type

Going back to basics, we know that a business grows sales revenue in one of two ways (given a fixed price):

- Growth in net new customer acquisition (more people purchasing the good/service than before)

- Increased frequency of purchase via existing customers (same number of people purchasing, but they purchase more often)

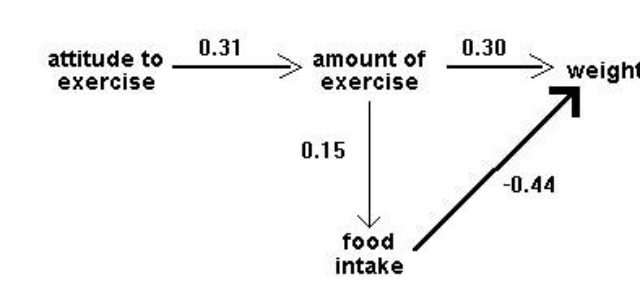

In Sharp’s study “How Brands Grow” [full write up here] the author reviews a series of empirical studies conducted over long periods of time, across industry verticals and product categories. The result of this study is that we begin to see the emergence of several laws which appear to govern the impact of marketing and advertising on a brands sales revenue and market share. Some of these laws of paraphrased below:

Double Jeopardy – Loyalty and retention are mostly natural results of market share and are not driven by efforts on the part of the brand. Larger brands tend to have more “loyal” customer bases, that is they tend to experience higher average purchase frequency than brands with a lower market share. It has proven to be much more difficult to influence avg. purchase frequency of existing customers than it is to acquire new customers and drive higher penetration.

Pareto 60/20 – A more accurate representation of the commonly used Pareto law of 80/20 (80% of purchases are derived from my top 20% most loyal customers), which states that the long-tail of less frequent buyers account for on average 30-40% of a brand’s sales and therefore should not be ignored by marketing efforts. This is particularly important when considering it is more difficult to influence the behaviour of a heavy buyer and their buying propensity is likely to be largely inelastic when compared to that of a light or non-buyer, reducing the effectiveness of advertising to this group.

The combination of these two laws lead to a natural conclusion that for a brand to grow its revenue and market share it must first focus on the acquisition of new customers and drive higher penetration, and it must secondly focus a greater amount of resource on marketing and advertising to light and non-buyers in order to generate more light (and medium) buyers, as these buyer groups have a higher elasticity and are therefore more influenced by advertising. These buyer types also represent on the whole a more significant proportion of a marketer’s sales revenue than has been suggested.

How can a DMP help?

Many believe that the DMP – a tool for audience segmentation and profile analysis – would not be suitable in delivering against the above laws. But a DMP is an incredibly powerful tool in driving high reach against non-buyers and light buyers of a brand, controlling exposure of existing heavy buyers, and managing global frequency to ensure media efficiency and maximum campaign scale.

A few executional strategies to consider for the DMP are provided below:

- Capture and Segment Buyer Type – By capturing data on buyer type a brand is able to better identify its “heavy buyers” and subsequently exclude these users from future media activity, or reduce total media exposure of this group if they seek to target non-buyers and light buyers exclusively to drive new customer acquisition.

- Manage Frequency and Weighting – The DMP allows a brand to track campaign delivery holistically across multiple platforms and devices. The marketer can use the DMP to control frequency of exposure of particular buying groups. For instance, a light buyer may require a periodic refresher or reinforcement message, low frequency and low budget weighting. A non-buyer on the other hand, who has not been exposed to the brand previously, may require a higher frequency in order to build awareness and consideration of the brand initially.

- Create Scaled Audiences – The DMP is an incredibly powerful tool in creating predictive models and look-a-like audiences based on machine learning and the depth and breadth of 3rd party data. We may not want to actively target heavy buyers, but we would certainly like to understand what makes up a heavy buyer and how we can find and convert more like-minded people. Look-a-like and propensity modelling allows us to do this with relative ease, in an automated fashion, with no limitation on the media execution or inventory acquisition.

- Control Device – By tracking campaign delivery across devices, a brand is better able to understand the consumer touch points and brand exposure across mobile, tablet and desktop, and take that into consideration when attributing new customer acquisition or establishing frequency capping. For instance, understanding that an exposure on a mobile device resulted in a conversion on desktop reduces the need to expose that same user on desktop, or vice versa.

- Offline/Online – Similar to cross device, many of a user’s touch points with a brand are offline, through Television, OOH advertising or through purchases/browsing in-store. Lotame has developed a series of partnerships which allow us to track these offline brand exposures and marry them with online audiences in order to reduce over exposure and brand saturation. For instance, understand “heavy offline purchasers” and exclude them from prospecting activity or cap all media exposure (whether that be TV, OOH, Digital, Search or Social) at a frequency of 3 per user.

If you are focussed on growing your revenue, acquiring new customers, and increasing market share, then reach out to Lotame

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured