For the last couple of months during the lockdown, I have been extremely busy continuing to speak with retailers, working several board opportunities, setting up an in-house studio, opening a new YouTube Channel, hiring research resources, and participating in a plethora of podcasts and webinars. Because of COVID-19, my primary focus has shifted to providing intensive data-backed analysis to the “new normal” ahead.

This article summarizes the latest data from multiple leadership sources on the near term economic and retail challenges from COVID-19. All the trends confirm a post-pandemic “New Normal”.

What will be the 2020 GDP impact to key economies? Which consumer categories are positive? Which continent will lead the recovery? How many USA stores have reopened? Will it be a V, U, or L shaped retail recovery? How long will it take for key USA retail sectors to recover? Is online retail permanently eating the consumer world? Where do we go from here?

Worldwide COVID-19 GDP / Consumer Expenditures Impact

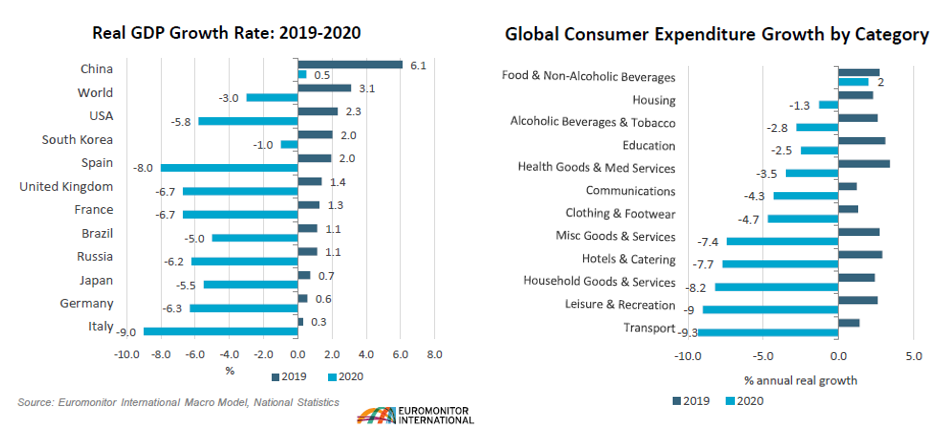

Euromonitor this past week shared an insightful summary on the projected 2020 global economic outlook. My two favorite charts focused on Real GDP Growth Rates / Consumer Expenditures comparisons between 2019 and 2020.

Not surprised by the Euromonitor data. Countries that were severely impacted such as Spain and Italy and had longer shutdowns, will have the biggest negative GDP growth. Interesting to see that China will still grow in 2020 and this can be attributed to their more draconian response to the health crisis.

Essential versus non-essential spending is reflected in the consumer trends. The data confirms that tourisms and travel have a long recovery road ahead.

World Looking Forward to 2021

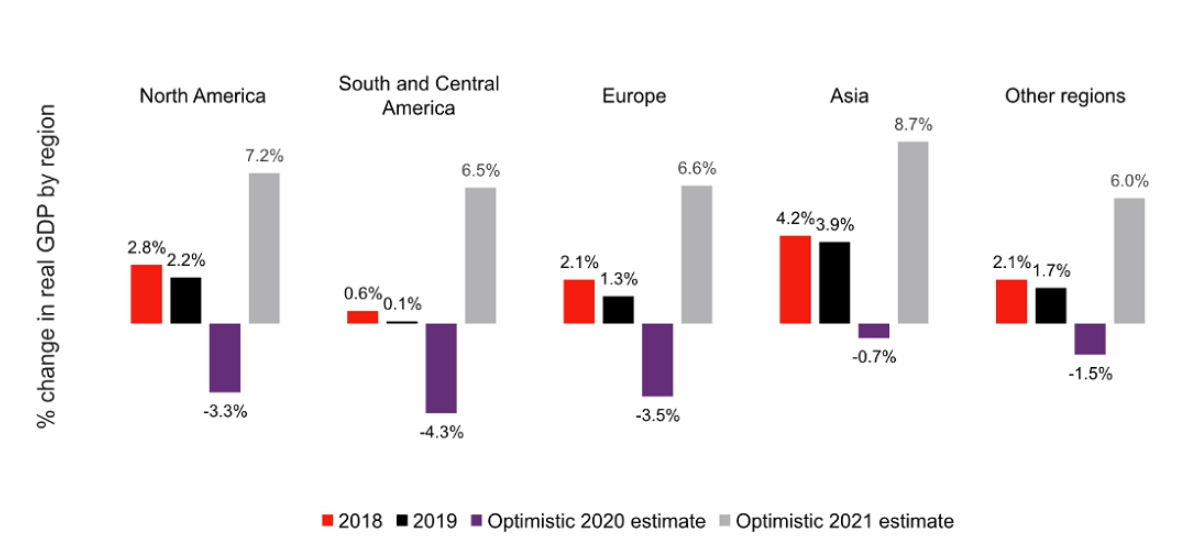

Forrester in a JLL Webinar the last week shared similar negative 2020 projections with their optimistic GDP forecasts.

Of great interest in the Forrester data are the incredible 2021 GDP growth numbers in all regions. Again, Asia leads the world both with less impact from COVID-19 in 2020 and faster growth that the rest of the world in 2021.

The Uneven USA Retail Recovery Journey

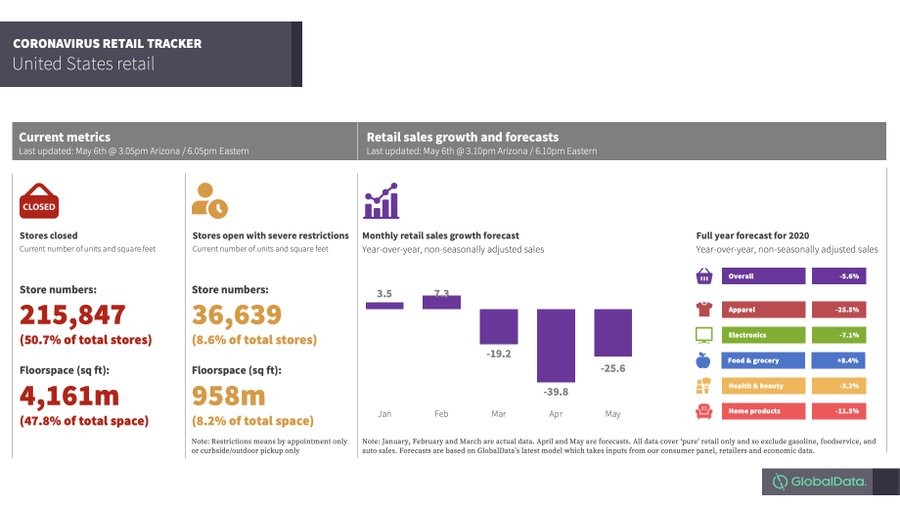

Weekly Neil Saunders from GlobalData.com has been sharing an insightful chart on the status of USA retail operations.

As of May 6th, nearly 51% of USA stores are still closed. Note the negative monthly forecasts, especially in April. The hardest negatively impacted sector for 2020 is apparel with -25.5% growth. The only positive sector is Food and Grocery, up 8.4%.

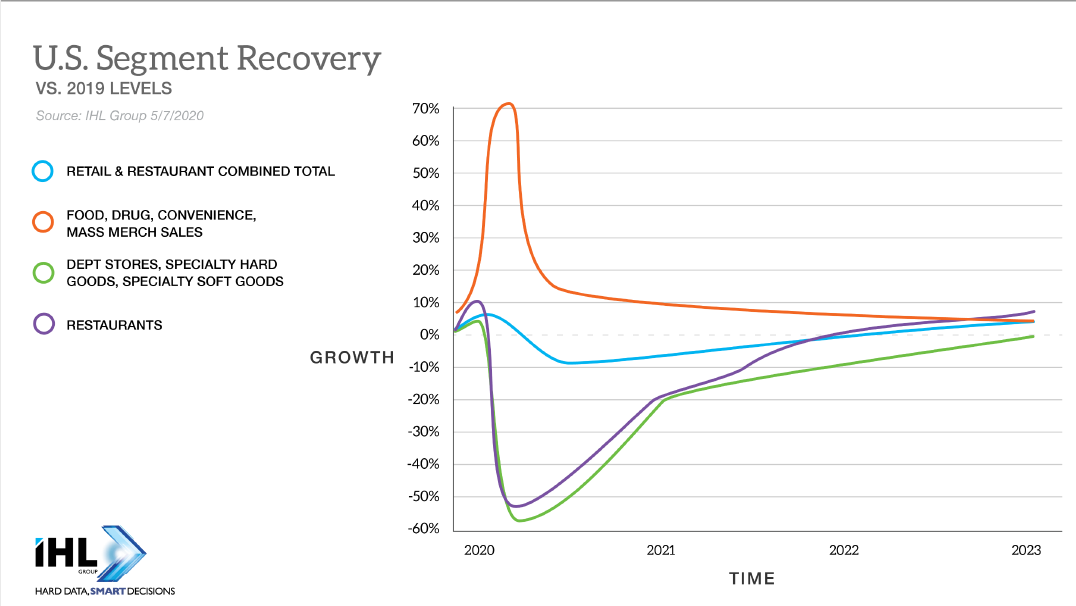

USA retail will have an uneven return to growth as demonstrated by this latest forecast from the IHL Group.

Overall retail recovery to 2019 levels will not be reached until December 2022. Food, drug, convenience and mass merchandisers will stay positive, but their growth rates will substantially decline from the current spikes. Department stores and specialty stores including apparel will not recover until 2023 at best. Restaurants will recover in 2022.

Will the Online Tsunami Last?

The pandemic has accelerated multiple digital trends, especially e-commerce. Even my ninety-year old father in Italy has been ordering groceries remotely and having them delivered.

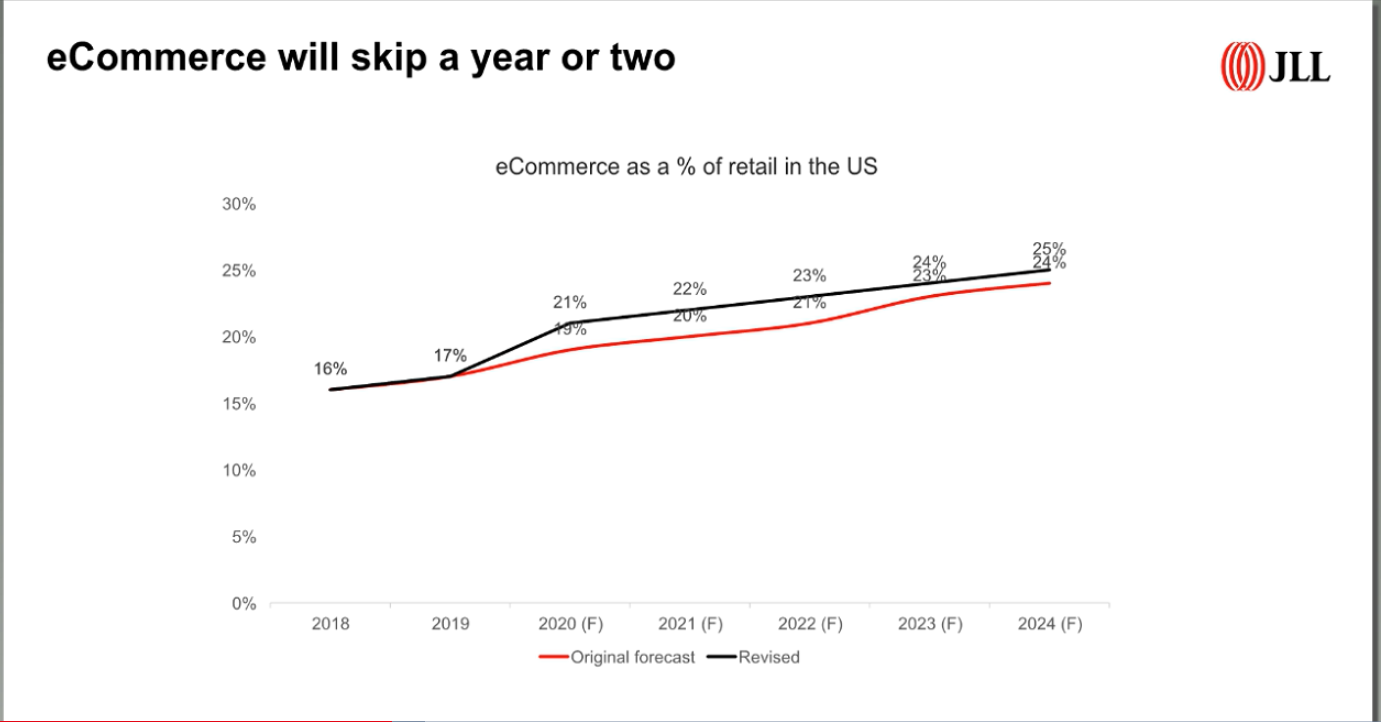

The growth of e-commerce will continue, but the current spike will subside with many of us returning to physical stores. Forrester in a JLL Webinar revised their USA E-commerce forecast for 2020 to 21% of total retail sales, up from previously projected 19%. By 2024, E-commerce will be 25% of sales.

The analyst from Forrester cited three reasons why e-commerce growth will not be exponential: current digital experiences are still mediocre (which I fully agree with, especially in grocery); there no such thing as a single channel shopper and physical experiences will get better; e-commerce delivers lower margins for retailers.

The Post COVID-19 “New Normal” Future of Retail

The current pandemic is not the first health issue that the world has faced. Many of us have read about the Spanish Flu in 1918-1919 which killed 40 to 50 million people. As it was then and today, loss of life is painful, but remember that the Spanish Flu was followed by the “Roaring ’20”.

COVID-19 has become a brutal accelerator agent of digital transformation trends that were already underway. Research indicates that it takes 66 days or roughly two months for a behavior to become an automatic habit. That is roughly how long most countries have been in various stages of lockdowns.

On a global scale, everything is being disrupted in a very short amount of time. The new habits being created during our surreal social distancing phases will very negatively impact the boring middle of retail models that failed to innovate and keep up with ever-increasing digitally empowered consumers.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox