My last article summarized the positive (green shopper) digital consumer transformation trends from the latest edition of the “Disruptive Future of Retail” presentation.

As the audience from the recent keynote was primarily from loss prevention, in appreciation of their positive response and engagement, this post expands on the retail shrinkage industry data, including multiple new charts not presented due to time constraints.

The continued renaissance of the global retail industry will require increased innovation to protect employees, customers, and products. Traditional security solutions that typically increase friction to deter theft are counter to the new digitally empowered consumer that progressively wants to just scan and go.

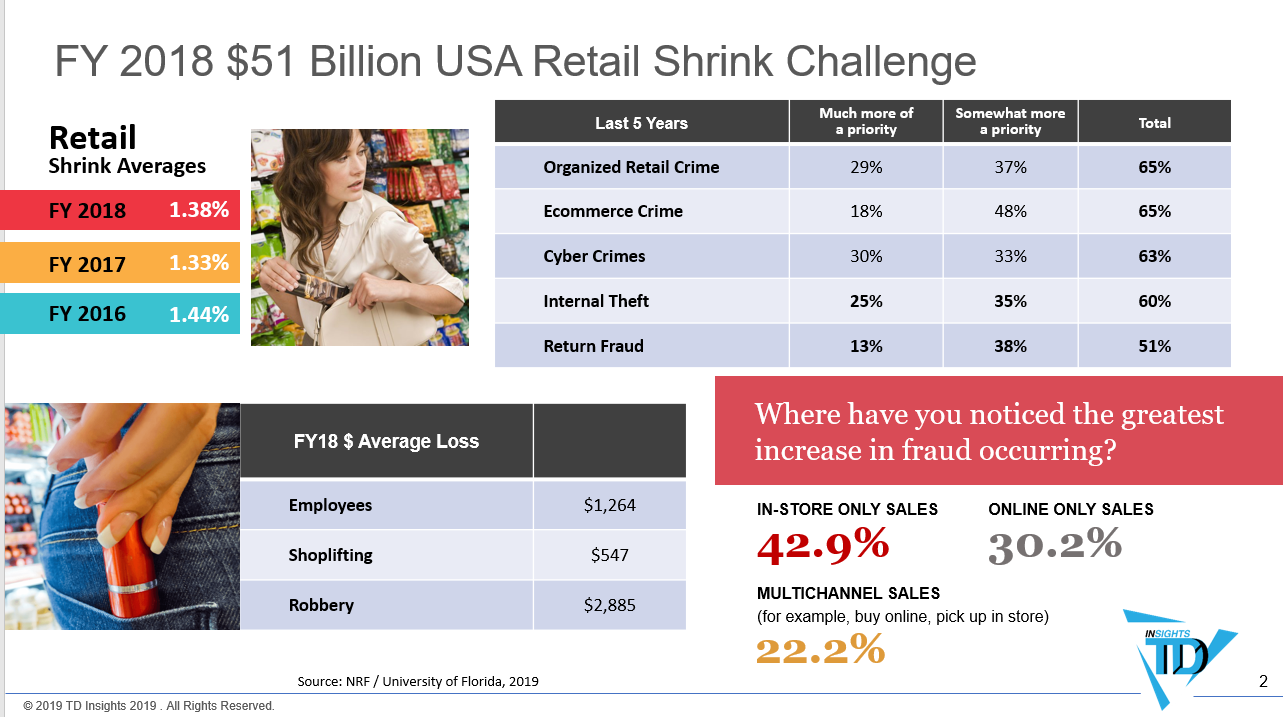

The $51 Billion USA Retail Challenge

The latest NRF national shrink survey, “tells a story of a dramatically changing retail risk landscape, with new threats and challenges being met at each turn with new loss prevention tools. Progress is being made, but LP teams continue to face setbacks and challenges with new and expanding areas of threat.”

Average shrink in latest survey was 1.38% of sales which is up from FY2017, but down from 1.44% in FY2016. Employees steal 2.3X more that shoplifters.

Greater focus is now on organized retail crime, e-commerce, and cyber. Over 8 in 10 respondents feel there’s increasing overlap between LP and cyber issues. Approaching retail shrink from an omnichannel point of view is a positive trend for the loss prevention function.

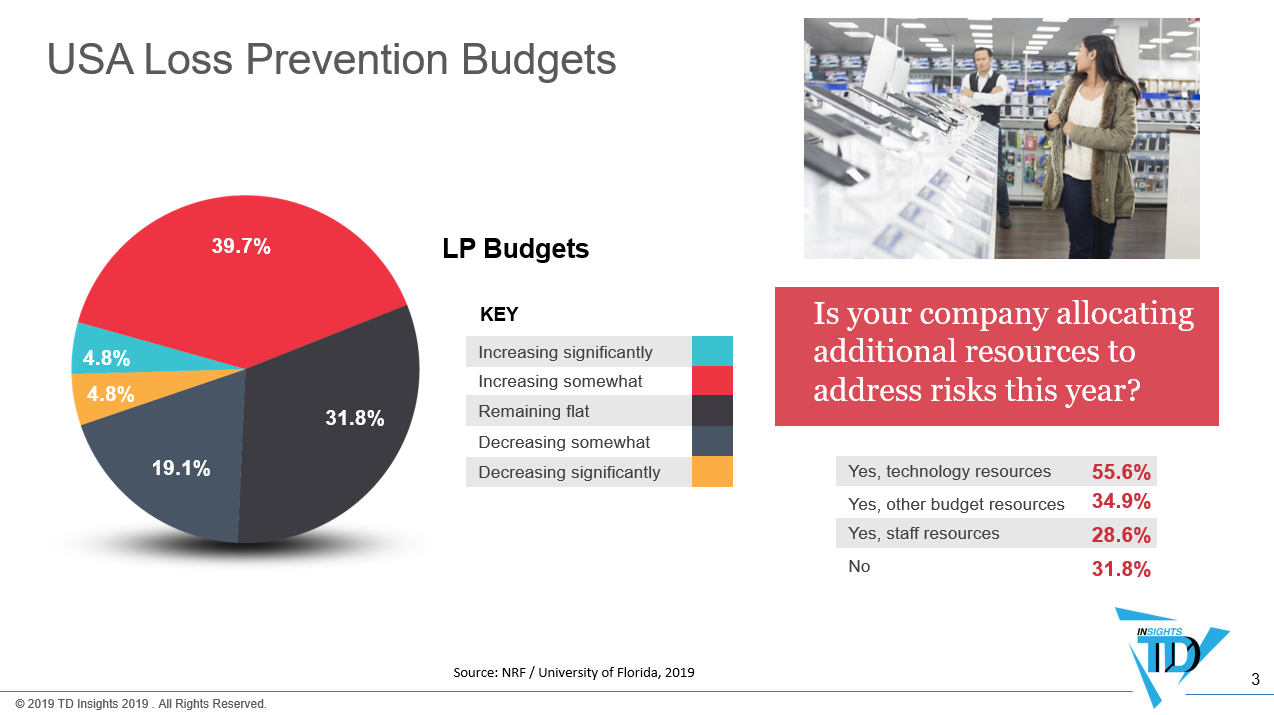

USA LP Technology Investments Increasing

“Surveyed LP professionals indicated their budgets for loss prevention efforts will be up for 44.5% of respondents and 68.2% say they’ll allocate additional resources, most of that in technology.”

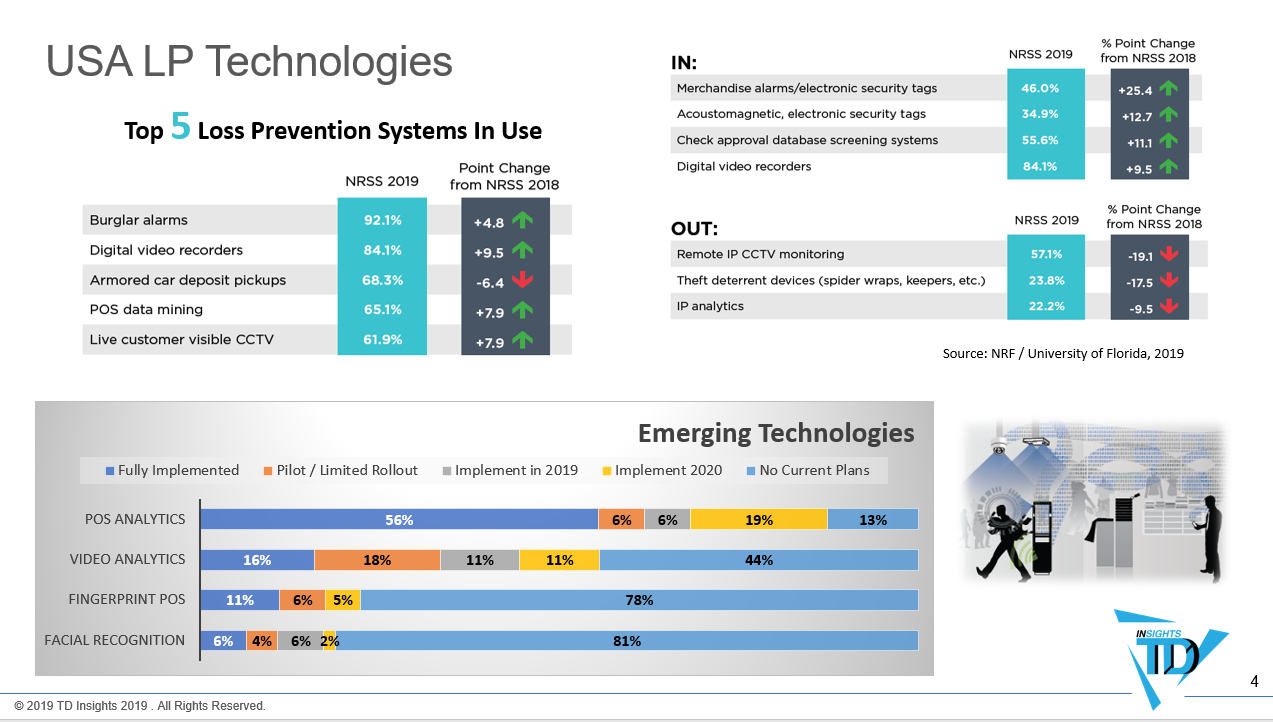

The top five LP technology focus areas below are very interesting. Note that EAS is missing from this list. All five areas are experiencing Year-on-Year growth except for armoured car deposit pickups.

Of particular interest are the technologies that are “in / out” for FY2018. Two versions of EAS tagging are “in” which is counter to what is reflected in the top 5.

In terms of emerging technologies, POS analytics is becoming ubiquitous with 87% planning to have it implemented by 2020. Video analytics which is counter to some of “out” technologies is increasing its presence along with biometrics (fingerprints & facial recognition).

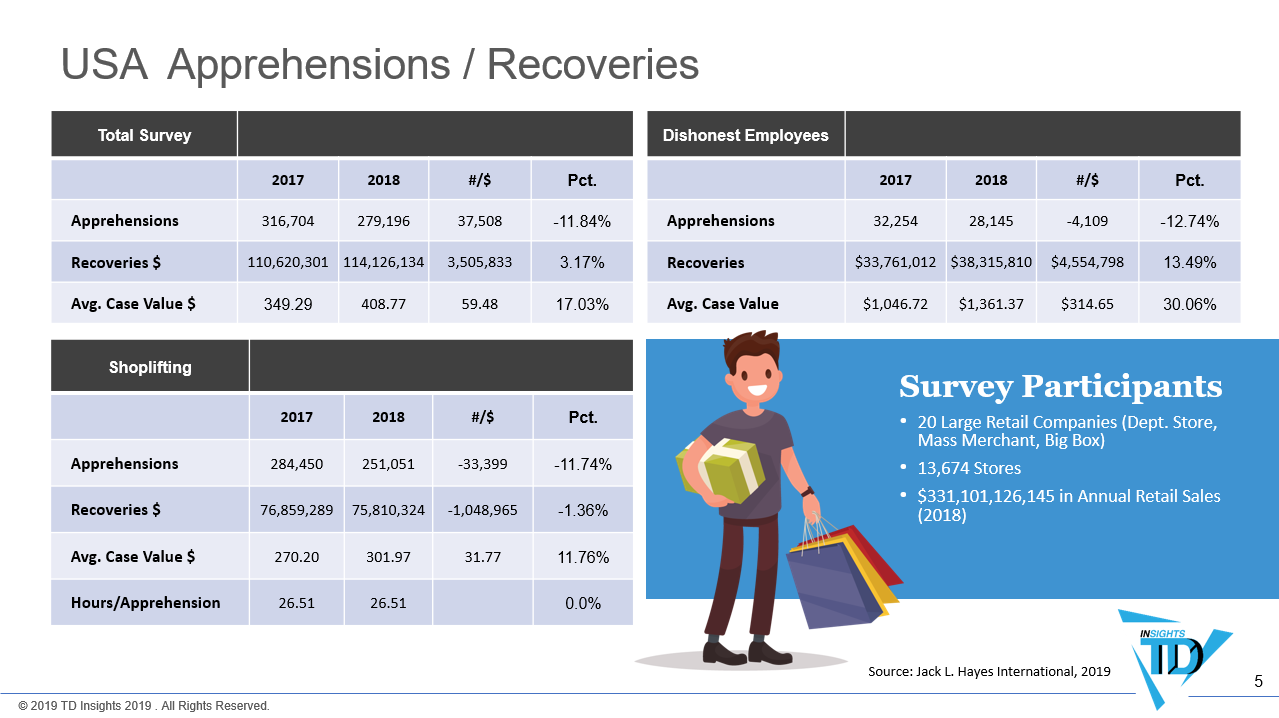

USA Shoplifter and Employees Case Values Soaring

A separate Jack L. Hayes International survey of 20 large USA retailers found that “theft case values soared in 2018 with the average shoplifting case value ($301.97) increasing 11.8%; the average dishonest employee case value ($1,361.37) increasing an amazing 30.1%; and the total average theft case value ($408.77) up 17.0%.”

The data points to a greater focus on quality shrink cases with overall apprehensions down, but dollar values up.

The 49 Billion Euro Challenge

Combining losses and solutions spend, retail shrinkage costs European retailers more than 49 billion Euros. The average of 1.4% of sales is similar to the United States.

The highest shrink sector in Europe is food. Total losses represent the 4th largest retailer in Europe and equates to 89 Euros per Capita.

The Future of Retail Loss Prevention

One of the key messages delivered to the large audience is that loss prevention has a bright future. Partially this is based on the fact that key legacy loss prevention technologies are disrupting the future of retail.

EAS was one of the first item level technologies and it is transitioning into smarter Internet-of-Things (IoT) connected consumer products solutions. Video, which had a rough start in security is becoming a very important overall retail visual intelligence solution through computer vision.

GPS inside stores, Artificial Intelligence (AI) / machine learning applied to video, and face recognition make an appearance in above chart because they are my current near-term focus. Working with progressive technology companies, private equity, and Silicon Valley startups, I see substantial growth in these solutions near to mid-term.

Key to a brighter future of loss prevention is ever increased focus on engagement for both green and red shoppers. For the green consumer, LP needs to decrease friction as new digital generations will quickly switch to alternative competitive shopping platforms.

For the red consumer that intends to steal, data and visual intelligence platforms will increase their presence. A futurist anti-shoplifting example shared with the audience is from a startup in Japan.

Retail crime patterns are changing, as are how consumers engage with brands. For loss prevention, this is the age to elevate the function through transformative brand integrated supportive security solutions to drive a mutually prosperous future of retail.

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox