Measuring your ROI is like using a map. Without it, you don’t know where you’re going and don’t know if you’re moving in the right direction. It’s key to any business initiative and should be a high priority for every entrepreneur.

Customer acquisition and customer retention are two metrics used mainly to determine the return on investment (ROI) for efforts to monetize consumers. Both are essential numbers to track since they will show shifts in the market or problems with a marketing plan. The numbers are different in a few ways.

Determining the cost of acquisition requires dividing all expenses dedicated to acquisition by the number of new customers acquired over the same period. Acquisition expenses include marketing, promotions like discounts, labour and any advertising targeted at non-existing customers. High customer acquisition numbers could indicate demographic shifts, ineffective marketing or problems with core products and services. Calculating retention costs is not easy. There is no commonly accepted formula. Retention figures can be calculated using total purchases over a period mitigated by retention expenditures, churn, acquisition costs and general overhead. Customer retention directly affects lifetime values (LTV). High retention costs lower margins and profits since each subsequent purchase is actually worth less overall.

“The key ingredient to a better content experience is relevance.”

What is more important, the acquisition of new clients, or the retention of existing ones?

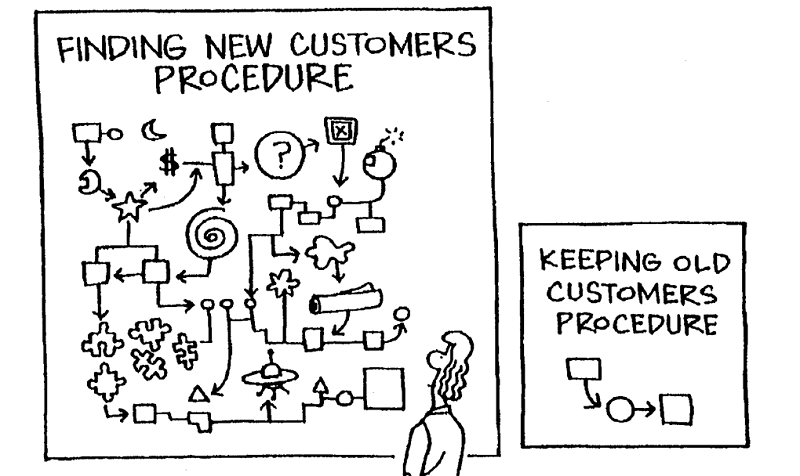

It’s a classic sales and marketing question and one that most CEOs would quickly answer with “both, of course.” But it’s not as simple as that. Resources are finite and when measuring your output you should be able to quantify what percentage of time and effort was put towards new clients vs. those you already have. Is 50-50 really the right number?

We’re stating the obvious here, but increasing your customer base is the fastest way to grow your business and the most obvious way to reach short-term revenue goals. Don’t assume it’s the only way, however, as up-selling to an existing customer can sometimes prove more lucrative than what you’ll make on a new client. And that’s before we get to “lifetime value.”

Is Customer Retention as Significant? Stepping aside from concerns of pure profitability, customer retention is one of the best ways to measure how reliably your company is providing its service. Put simply, companies with high retention rates are knocking it out of the park, and doing such good work their customers realize they would be worse off without them.

When it comes to revenue, customer retention is hugely important to consistent growth and financial planning. The more committed customers you have for the next financial quarter, the easier it is to make budgetary decisions. Another benefit of retained customers over acquired customers, is the fact they generally require less maintenance.

When we talk about “customer lifetime value,” what we’re referring to is a prediction of the total profit generated by a customer over a projected period of time. Calculating this number helps businesses see the long-term vision, in terms of how valuable a client would be if retained for a set cycle.

After all, onboarding new customers is getting difficult, as competition becomes fiercer and buyers become more discerning. What’s more, research has shown that existing customers boost bottom line growth in more ways than do new customers. Concentrating your efforts on building and nurturing relationships with your existing customer base is worth the investment. Below are three reasons you should confidently put budget into customer retention:

- Customer Retention Costs Significantly Less

- It Has a Positive Impact on Acquisition

- Loyal Customers Buy More

Most marketers know that it can be up to 5x more cost-effective to retain an existing customer than to acquire a new one, yet only 20% (approx.) of companies put their primary marketing focus on customer retention.

To be or not to be?” asks Shakespeare’s Hamlet.

For years business owners faced the same conundrum: “to buy or not to buy?” Knowing how to spend your marketing budget with confidence is always a challenge. Where do I allocate the money so it makes most impact? How do I allocate the money in a way that I can show tangible results?

Where to emphasize more? If your start-up days are behind you and your business is established, chances are that growing your business will be cheaper and faster if you retain and sell to your existing client base. This is not to suggest that you need to abandon acquisition efforts completely, but you need to shift the focus to your existing clients.If you are a start-up, then naturally your initial objectives should be to focus on new business acquisition and then as the customer base increases, start shifting the focus to retention.

“The first step in exceeding your customer’s expectations is to know those expectations.”

There are two things people want more than money… feedback and recognition.

Please add your “comments” below or tweet me your thoughts @refertoAnuj

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Featured