Corporate innovators are turning their attention to creating innovation-led growth by creating high-potential corporate startups and to scale them to make a significant impact.

As series of short articles is a prelude to the Roadmap to Scaleup 2021 peer group.

Let’s think about the problem that we face in corporate innovation and we’ll start with some individuals you may be familiar with.

They have a different set of individual concerns but a common aim to play a part in corporate innovation and growth.

- Daniel as a CEO is looking for genuine transformation and wants to move the dial by looking for options for the organisation to deliver on.

- Claude, the Chief Technology Officer or Chief Innovation Officer is looking for options to leverage technology or placing the right bets on where technology should be developed in support of new value creation. He needs to articulate the investment cases behind building those capabilities at the bottom layer of the roadmap and creating buy-in for those new ideas.

- Anna sits in the corporate Innovation Centre and is looking for opportunities perhaps in the so-called white space where new platforms can be developed. As an innovation centre lead, she wants to engage the divisional heads of the company in these activities and to further the efforts of the centre towards achieving the overall corporate objective.

- And finally, Jamie in corporate venture capital has a portfolio of new businesses and wants to be more selective on the higher potential the highest impact use of capital. He wants a proven framework to scale those corporate investments.

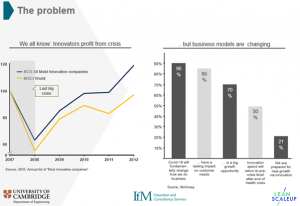

We all know: innovators profit from a crisis… but business models are changing

What about the question if a company should keep investing and innovating or to holding back that investment?

It’s a complicated picture at an individual firm level.

Several studies have shown that those companies that keep on innovating through a crisis outperform those who don’t. This data shows the performance through the financial crisis between the innovators and the index showing a clear spread between each.

It’s easier said than done; we need nuance.

A study McKinsey picks out from 800 executives, what their concerns are about the business environment emerging from the Covid-19 crisis.

It is changing how many companies are doing business and is fundamentally reorganising operations.

On one hand, 90% of execs believe the change forced by Covid-19 is important and will have a lasting impact but only 21% feel they are prepared to take advantage of the opportunities; to bounce forward out of the crisis.

There are shocks and jolts everywhere – 10 years eCommerce in 3 months

You sit in a business ecosystem with different actors – suppliers, partners upstream and customers downstream, each impacting one and other. You need to understand this business ecosystem to able to create innovative solutions.

In the area of eCommerce which has already been growing strongly, we see an astonishing catalytic effect experiencing 10 years of growth in only three months.

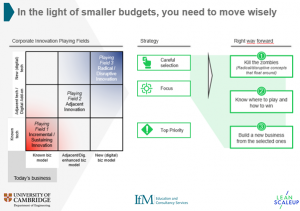

In Playing field 1, the red box playing field exhibits “red ocean” type activity and innovation is sustaining incremental innovation in the core business.

In Playing field 3, the blue area representing “blue ocean” options, companies are looking to stretch out with new technological opportunities and business models.

And in the playing field in the centre, there’s a big priority on companies supporting the core.

But how do you balance those different playing fields, how do you balance strategy? The answer is to actively select projects that you’re doing and to focus on the portfolio in the highest potential even though this can be hard to do.

Practically, this means releasing resources to focus on the portfolio you want with high potential top priorities. It requires actions to kill the zombies – projects going nowhere and drawing time, money and effort, to focus the limited resources that are available.

And we can only do so by stopping the wrong projects which allow focusing efforts to accelerate the right projects for growth. The right projects that allow you to play and win and to build new businesses from that selection of the opportunities.

Four decisive questions

So these four decisive questions conclude the problem definition.

- Where are those future value pools?

- How to build a strategic narrative for growth?

- How to scale up the selected corporate startups?

- What works to nurture those ideas through a process that increases the chance of a winner?

The next article will look at how we can seek and exploit new Value Pools. Read it HERE.

Want to Shift the Dial? Consider joining the Peer Group ’21.

Jointly delivered by myself, Frank Mattes, founder of LeanScaleup(TM) and experts from the Institute for Manufacturing at the University of Cambridge.

We are building up the Peer Group now. First companies are already on the “Yes, I am interested” list. Get your company on this list as well so that we can discuss details.

For more information, please Message me or register your details here

Article by channel:

Everything you need to know about Digital Transformation

The best articles, news and events direct to your inbox

Read more articles tagged: Innovation